- The Montney formation, spanning parts of British Columbia and Alberta, was discovered 55 years ago

- But only recently has horizontal fracturing delineated just how big it is

- Improved infrastructure made it easier to get the product to market

- As in all energy plays, there will be winners and losers in this area

The first well in what we now know to be the Montney formation was drilled by The Texas Company way back in 1962, a couple of years after they changed their name to Texaco. After Texaco was acquired by Chevron (NYSE:CVX), primarily for its refineries, their gas stations were mostly sold to Shell (NYSE:RDSa), though its Canadian operations were acquired by Imperial Oil (NYSE:IMO), which is now 70%-owned by Exxon (NYSE:XOM). “Oh what a tangled web we weave…”

For those unfamiliar with the Montney, here is the geographic area we are looking at:

That’s a very big chunk of two very big provinces. (B.C. alone is bigger than all of Texas.)

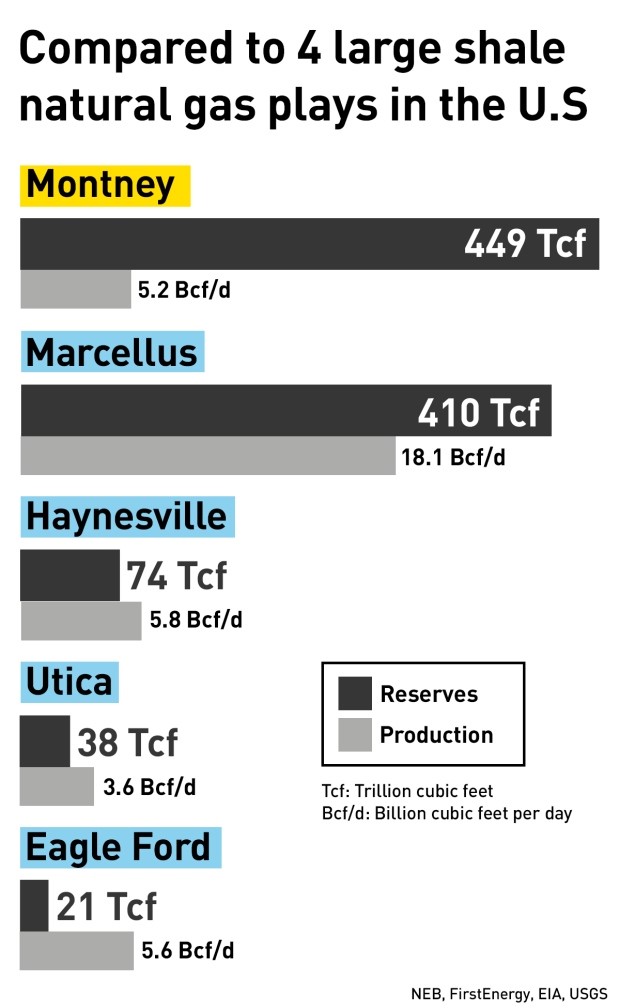

And here is what the reserves in the Montney are estimated to be:

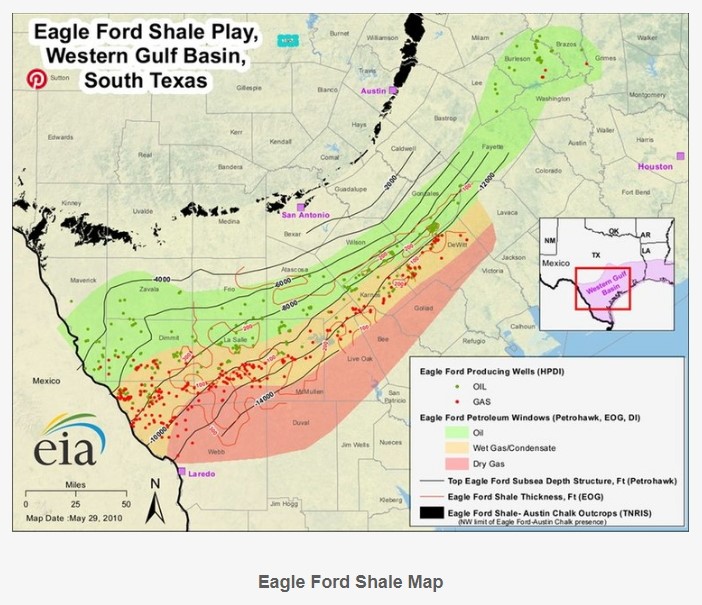

Of course, having the reserves and getting them to market are two different things. Clearly it is cheaper to move gas, liquid gas/condensate and oil from the Eagle Ford through the well-established pipeline system to nearby cities like San Antonio, Austin, Dallas and Houston than it is to move product through a markedly less-developed pipeline system in the Montney. (With Juneau, Alaska the closest city to the Montney known to most American investors!)

Let me add that there are additional stumbling blocks to overcome besides the lesser infrastructure footprint in the Montney formation areas of Alberta and British Columbia.

The “green” movement is quite strong in Canada and there are those who are not satisfied to move from coal to natural gas on a logical path to solar and wind. Some are willing to accept only all or nothing: 100% solar and wind now.

Never mind that sunshine in winter, precisely when needed most in the colder regions of the northern hemisphere and especially above the 49th parallel that (mostly) marks the US-Canadian border, might last just 6 hours or less on the few days it is shining. Or that wind is by its very nature intermittent.

No utility is going to risk its continued existence to switch from coal to gas, a very expensive undertaking, unless they believe they can make back the money spent within some reasonable time. And they certainly aren’t going to face freezing-in-winter consumer backlash until they know that some combination of solar, wind and hydro are going to be available in enough quantity to protect customers. So far, even realizing that clean natural gas would be significantly better than the dirty tar sand oil extraction currently providing much of Canada’s power, the greens haven’t budged.

Neither have some First Nation tribes whose concerns are both environmental and cultural/religious. Even if Canadians as a whole decide they want cleaner-burning natural gas, an alliance of these tribes and environmentalists don’t want to see the pipelines built that would transport the gas and condensates to the utilities and the markets that would send them further as national exports.

I hope I’ve made it clear that there are risks in being investors in energy companies. There are political, cultural, religious, environmental, infrastructure, weather and other potential roadblocks.

On the other hand, the world is growing, emerging markets are emerging, and people around the globe are going from bicycles to motor scooters to automobiles. Whether those autos are gasoline-powered, natural gas-powered or electricity-powered, someone somewhere has to refine the raw product or turn some turbines to generate the electricity. The more electric and electronic “things” the world uses the more power, either fossil (Nature’s batteries) or renewable (solar, wind, hydro, biomass, etc.) must be generated.

Unlike the tar sands or offshore oil drilling, both of which demand huge capital investments and a long payback period (and are considerably less environment-friendly) tight oil and gas plays like those in the Montney, Eagle Ford, et al provide fast returns on investment with a considerably smaller environmental footprint.

The most realistic next step therefore is the conversion of power providers to natural gas and liquefied natural gas (LNG.) And as you can see in the chart up above, only the Marcellus shale natural gas play in the USA comes close to the Montney in natural gas reserves. The Hainesville, Utica and Eagle Ford combined don’t even come close. I’m betting the Montney will be in the forefront of production.

I want to invest in companies that hold large acreage positions in proven, profitable North American horizontal oil plays. But too many have risen beyond what their likely long-term value is even in a time when energy stocks, by and large, still reflect surplus rather than demand. I think they’ve gotten ahead of themselves.

But the horizontal natural gas firms with big acreage and established production and transportation of product corridors are going to be sitting in the catbird seat. Notice I didn’t focus solely on large acreage positions. Too many investors do. I don’t want some under-capitalized “next big player” that is touted this week just because they picked up some land on the periphery of a big play. I want the guys producing now, companies that have already encountered all the problems and circumvented them.

I’ll stop here for the moment. In part 2, which will be published later today, I'll discuss in greater detail my favorite established company in the Montney Formation, a firm that is well-known to my subscribers and clients, but which I have avoided while they went through a tough period. Indeed, I recently sold 2 other energy companies in our Model Portfolio to make room for two from the Montney. This first company has successfully navigated those rough seas and are now, I believe, going to come back even stronger.

DISCLAIMER: Do your due diligence! What's right for me may not be right for you; what's right for you may not be right for me.

Past performance is no guarantee of future results. Rather an obvious statement, but too many people look only at past performance instead of seeking the alpha that comes from solid research and due diligence.