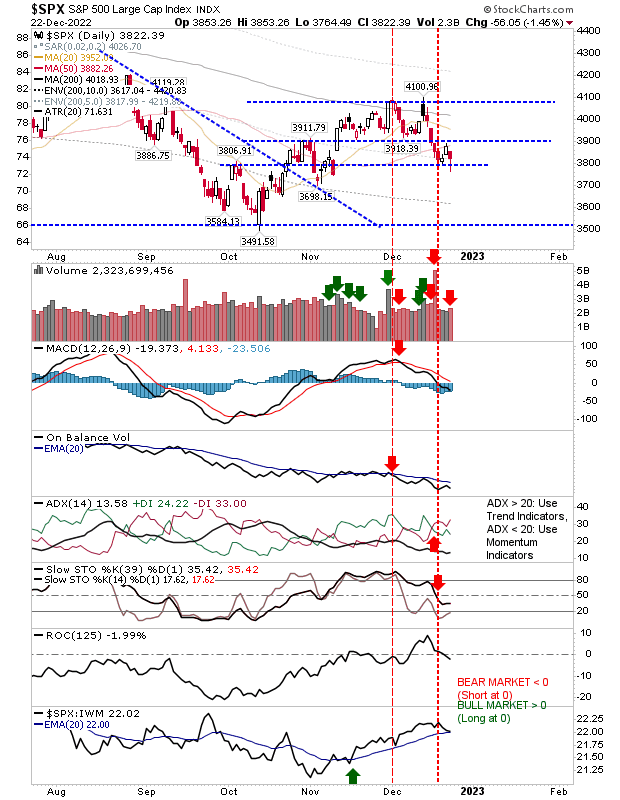

It has taken a while, but the 8-day decline has finally flashed reversal candlesticks across indices. Lead indices finished with 'bullish' hammers, with spike lows indicating increased demand. Indices are at or near support, strengthening the potential of the reversal.

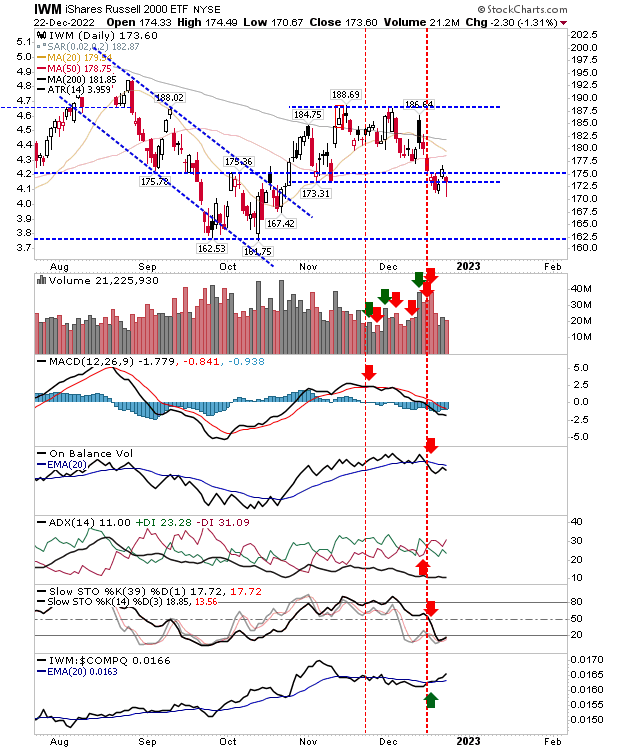

The Russell 2000 (IWM) had the longest spike low on oversold technicals. The index has the additional benefit of outperforming the Nasdaq 100 and gaining ground on the S&P 500. Traders can measure risk to reward ratio using a stop at the loss of today's low with a target of November's highs.

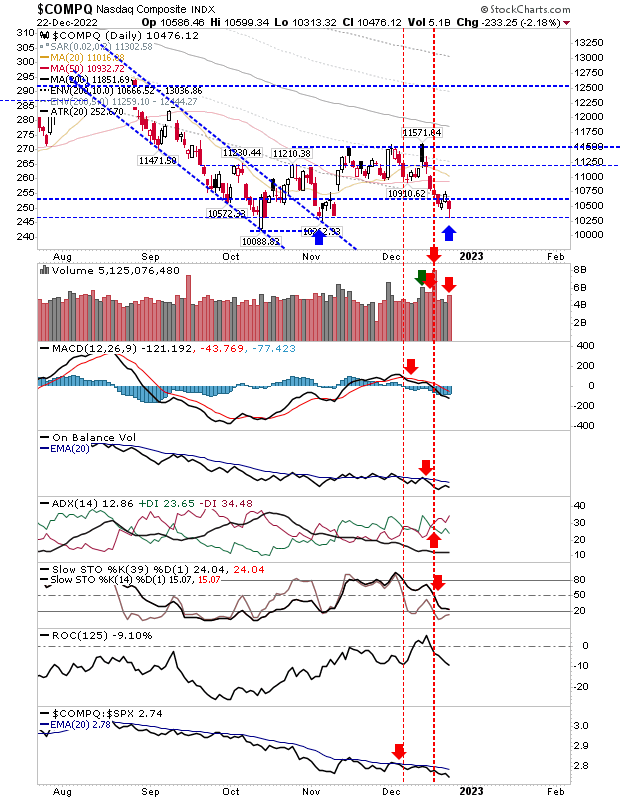

The Nasdaq is underperforming relative to the S&P 500 and Russell 2000. It finished the day losing one level of support but found another - although it's running out of supports to defend. Volume spiked, indicating confirmed distribution and increased validity of the candlestick (as a launching point for a possible reversal).

The S&P 500 also closed with a bullish 'hammer' on higher volume distribution, with the spike low of the 'hammer' cutting through support. The index is struggling at its 50-day MA but not enough to override the bullish potential of today's action.

If we are going to see a Santa rally, then Friday would be a good day to start it. An end-of-day close into yesterday's spike lows would negate the reversal potential of the hammer. But an intraday violation would be nothing to worry about.