Leading off articles with a question sets the readers up for an expected answer which involves a prediction for the future.

The fact is no one knows what will happen, and all clients can ask of advisors is that an advisor make probabilistic decisions regarding portfolio construction and asset allocation, that allows the client portfolio to participate in secular bull markets but also preserves capital in secular bear markets.

The period from 2000 to 2009 was a unprecedented decade for US stock returns. Before Morningstar was swallowed up Ibbotson, I always studiously analyzed the annual Ibbotson return data from “Stocks, Bonds, Bills & Inflation.” Ibbotson—when calculating the “average, annual return” for the decade from 2000 to 2009—concluded that the S&P 500 returned approximately 1.25% (I can’t remember the exact figure) per year for the decade, with the benchmark basically earning the dividend for the decade.

Looking at the historical decades beginning with the 1930’s, the decade from 2000 to 2009 was the worst average, annual, return for the S&P 500 since the 1930’s, although the 1930’s was far more negative. In other words, the S&P 500’s decade return was the worst since the 1930’s, albeit positive.

Two weeks into the 2022, the bond market returns are almost universally negative (here’s the postfrom this weekend showing the Treasury yield curve and how the bond funds tracked weekly), with rising Treasury yields, which preceded the October ’87 stock market crash and the events of 2001–2002. In the spring of ’87, the 30-year Treasury bond lost 9 points in a month, and investors often forget that Alan Greenspan raised rates in 1999, which contributed to the 80% 2000–2002 NASDAQ bear market, although if you’d ask me about “attribution” for the 2000–2002, 50% bear market in the S&P 500, I’d say it was primarily the collapse of the tech and large-cap growth bubble, which also included 50% declines in stalwart names like Home Depot (NYSE:HD) and Walmart (NYSE:WMT).

Alpine Macro, which is a macro research firm that (I think) does good work out of Canada, sent this missive along this weekend, which properly sums up what a lot of buy-side investors are thinking right now.

In July, 2020, this post was written, posing the same question I'm addressing now, “Planning for a March, 2000, Moment” (the NASDAQ and S&P 500 both peaked in March, 2000) just so readers and investors remain conscious of history and its important lessons.

I remember March, 2000 to October, 2002, like it was yesterday. Let’s recap the main events:

- March, 2000, the NASDAQ and S&P 500 put in secular bull market tops with the S&P 500 peaking around 1,550 and the NASDAQ peaking around 5,000–5,100;

- A 30% drop in the NASDAQ occurred between mid-March ’00 and mid-May ’00;

- Intel (NASDAQ:INTC) warned in late September ’00, being the first major large-cap tech giant to warn about slowing revenue;

- Cisco (NASDAQ:CSCO) reported early November ’00 with John Chambers raising guidance on the call;

- November–December ’00 was the contested Presidential election between Bush 43 and Al Gore;

- January ’01: Alan Greenspan reduces the fed funds rate to start the new year and the markets rally for about 1 month;

- February ’01, Cisco reports around February 7, ’01 and lowers guidance for fiscal ’01, after raising guidance just 90 days earlier.

- The NASDAQ Composite falls 25% in Q1 2001;

- 9/11: not much else to say about that date. Wall Street closed for 4 days (?) as the US economy comes to a screeching halt;

- The Fed cuts rates immediately after 9/11, sparking a rally that lasted till the end of 2001;

- Enron begins to be a problem as the stock price peaked at a high of $90 in mid-2000, but fell to zero by late 2001;

- In mid-2002, around May–June ’02, I believe it was David Faber of CNBC that broke the story of massive fraud at Worldcom. The CEO Bernie Sullivan was later imprisoned, after blaming his CFO.

- Around this time the Sarbanes–Oxley law was passed protecting investors from fraudulent account practices by publicly-listed companies. The law also made company executives sign off on the financials, since many CEO’s were blaming their CFO’s for the corrupt practices and claiming innocence about the fraud.

- After bottoming in late July–October ’02, the S&P 500 500 later put in a triple-bottom just prior to mid-March ’03, which was the ultimate bottom for the stock market, coinciding with the start of Gulf War II in mid-March ’03.

- The entire peak-to-trough correction for the S&P 500 from March, 2000 to October, 2002, was 50%, the first 50% correction for the S&P 500 since 1973–1974, and only the second 50% correction in the post WW II period.

- The NASDAQ Composite low 1,000–1,100, was an 80% peak-to-trough correction for the over-the-counter index, taking out the September–October ’98 LongTerm Capital Management lows of 1,475.

Writing for Jim Cramer’s TheStreet,com at the time kept me sane. There was another kid who wrote for the site at the time, Jeff Bagley, who was very sharp, went to Fordham b-school, made very good calls, good writer, good analyst, etc. who shot me an AOL instant message at the time, saying, "I come into the office and just lay my head on the desk and hope this goes away.”

What made the bear market tougher to stomach was the actual “real economy,” i.e. home and auto sales and general business activity, was white hot, thanks to the Fed having to cut rates after 9/11 and really injecting a lot of liquidity into the US financial system.

Summary / conclusion: Per the Bespoke Report published every Friday afternoon, sentiment has reached a low (depending on the survey) with AAII not being this bearish since mid-September ’01, while some of the other surveys are now as bearish as they’ve been in the last month. Readers probably only care about how bad any correction will be, and the fact is nobody knows.

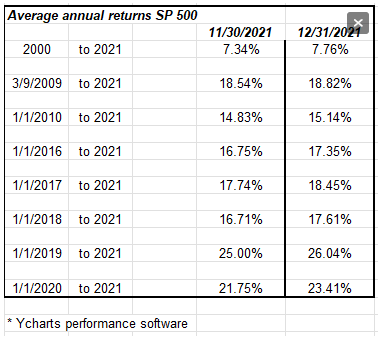

This post that was written in early December ’21 for a client dinner where I had to explain that many of the winners of their portfolios for the last 6 years were going to have be trimmed, and this graph / table was shown to the clients to try and crystallize for them how good the recent returns have been over the past 5 years and maybe some capital gain harvesting was warranted. This following table updates the “average, annual, returns” as of 12/31/21:

Put simply, these returns cannot last, and like the growth stocks in 2000–2002, the underlying companies might be fine, might continue to grow at the same rates they have the last few years, but if the “macro” changes, and right now that’s the Fed, then PE’s can compress and popular companies could find a lot of air underneath their stocks quickly. And the fact is, for the Russell 1000 growth stocks, that’s already happened. The Top 10 stocks in the S&P 500 continue to hold, but you have to wonder how long that lasts.

Clients are seeing their value positions increased in weighting, along with International (Oakmark International) and the Emerging Markets ex-China ETF (iShares MSCI Emerging Markets ex China Fund (NASDAQ:EMXC).

The UK looks like it is poised to break out. One client owns the iShares MSCI United Kingdom ETF (NYSE:EWU) and the Invesco CurrencyShares® British Pound Sterling Trust (NYSE:FXB) together. If the EWU can power through $35 on volume, which is the 200-month moving average on the monthly chart, that would be a big plus. Gold has been churning for a while in this $160–$180 area via the SPDR® Gold Shares ETF (NYSE:GLD). The 10-year return on the precious metal as of 12/31/21 was +1.18% per year; contrast that with the above table and the S&P 500’s return since 1/1/2010.

Josh Brown, the noted CNBC commentator who is featured prominently on the network noted in the last 18 months that the average, annual return of the iShares MSCI Emerging Markets ETF (NYSE:EEM) since June 30, 2006 is 5%, versus the S&P 500’s 11%—less than half.

Over on Seeking Alpha, where I occasionally do my company analysis and bottom-up research, a series of articles have been run over the last 5 years called “Surveilling the Laggards” where articles are written for companies and stocks, like Coca-Cola (NYSE:KO) which last made a meaningful all-time-high in July, 1998, around $48 per share and has risen just $12 in the ensuing 13 years. IBM (NYSE:IBM), peaked in 2013 at $215–$217 per share and has lagged badly since. Bank of America (NYSE:BAC) hasn’t yet traded up to its December, 2006 peak price of $55 per share.

Cisco and Intel, are two other tech giants that have spent the last 21 years trying to reformulate their business models to capture the late 1990’s growth, with little success. Cisco is probably a better bet than Intel, although Intel’s new CEO might work some magic.

Intel’s Achilles heel is its $10 billion capex nut every year, and I don’t know that that is going to be diminished anytime soon. Intel’s capex consumes 50% of its cash-from-operations, making it more akin to a 1960’s steel mill than a cutting-edge technology company.

The old large-cap pharmaceuticals complex like Pfizer (NYSE:PFE), Merck (NYSE:MRK), Eli Lill (NYSE:LLY) are reinvigorated with the COVID-19 outbreak. Pfizer has broken out of a 20-year malaise when it traded above $48 on it’s widening efficacy of the COVID vaccine. More PFE is being bought on pullbacks.

Personally I don’t think investors will see a 50% peak-to-trough correction in the S&P 500 like we did in 2000 to 2002, simply because I don’t think the probability of seeing the add-on events that followed, like 9/11 and two major companies going into bankruptcy thanks to massive fraud, is likely today. But I could be wrong.

I do think there is a good chance we see a 20%–25% correction in calendar, 2022, at least partially based on interest rates and the always-inevitable adjustment period following a policy shock like March ’20.

Take all this with substantial skepticism and remember, past performance doesn’t guarantee future results. The above positions can change quickly too.

The key word for the next year or two is “uncorrelated.” The only constant in the capital markets is change, and the longer the trend the stronger the likelihood that it will change at some point