Are stocks “cheap,” or is this just another bullish “rationalization.” Such was the suggestion by the consistently bullish Brian Wesbury of First Trust in a research note entitled “Yes, Stocks Are Cheap.” To wit:

“The Fed remains highly accommodative, there are trillions of dollars of cash on the sidelines, vaccines have reached over 50% of Americans, and the economy is expanding rapidly. Some valuations have been stretched, but the market as a whole remains undervalued. As a result, we remain bullish and are lifting our targets.”

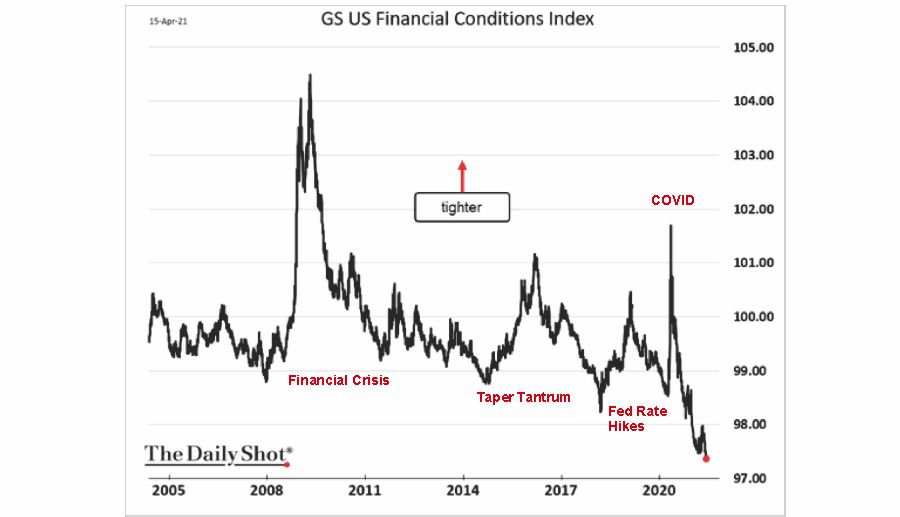

Yes, it is true the Fed remains highly accommodative, which has undoubtedly pushed asset prices higher. In fact, financial conditions recently reached a historic low, which suggests elevated asset valuations ironically.

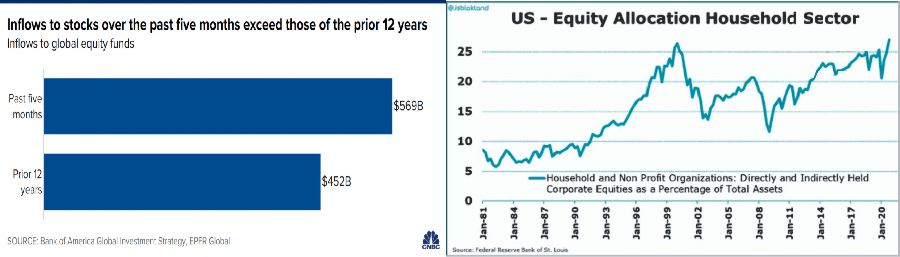

We have busted the “myth of cash on the sidelines” previously, but this is a “rationalization” that won’t seem to die.

“‘There are no sidelines. Those saying this seem to envision a seller of stocks moving money to cash and awaiting a chance to return. But they always ignore that this seller sold to somebody, who presumably moved a precisely equal amount of cash off the sidelines.’ – Cliff Asness

Every transaction in the market requires both a buyer and a seller, with the only differentiating factor being at what PRICE the transaction occurs. Since this is necessary for there to be equilibrium in the markets, there can be no ‘sidelines.’”

In the last 5-months, more money flowed into equities than in the past 12-years combined. That flow pushed investor allocations to historic extremes suggesting there is little “on the sidelines.”

Difference Between Expansion And Recovery

With vaccines reaching more Americans, the economy is indeed recovering. However, there is a difference between an economic “recovery” and an “expansion,” as noted recently.

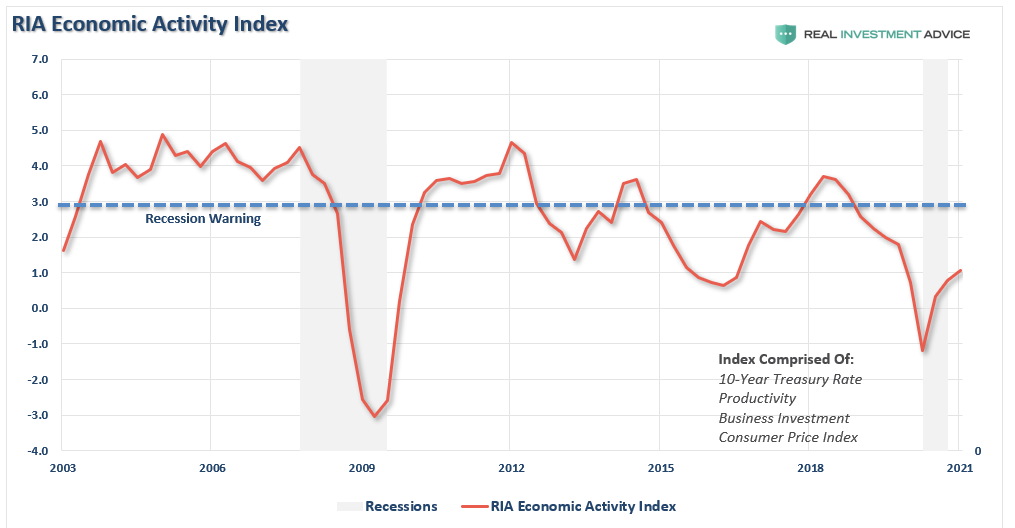

“The “Economic Activity Index” is an average of the 4-most essential components of organic economic activity. Interest rates have a long historical correlation to economic activity, along with inflationary pressures. Without productivity and business investment, jobs do not get created to support consumption which is ~70% of the GDP calculation.”

However, I want to focus on the valuation component of his thesis and whether stocks are actually “cheap.”

Through the first quarter of 2021, the expected economic recovery runs well ahead of what the “economic activity index” approximates. Furthermore, given the market’s advance is based on optimistic expectations, there is potential for disappointment.

Such is where fundamentals become extremely important. When expectations of the recovery are disappointed, the market will begin to reprice itself for its intrinsic value. With the market is trading more than twice the level of underlying economic growth, such suggests a significant risk.

Growth Versus Recovery

“With real GDP growth of 6%+ this year and S&P 500 earnings expected to grow by 27%, or more. We think stocks

will easily bust through our original target by year-end, so we are raising our year-end target to 4,500. That is 7.5% higher than the Friday close.” – Wesbury

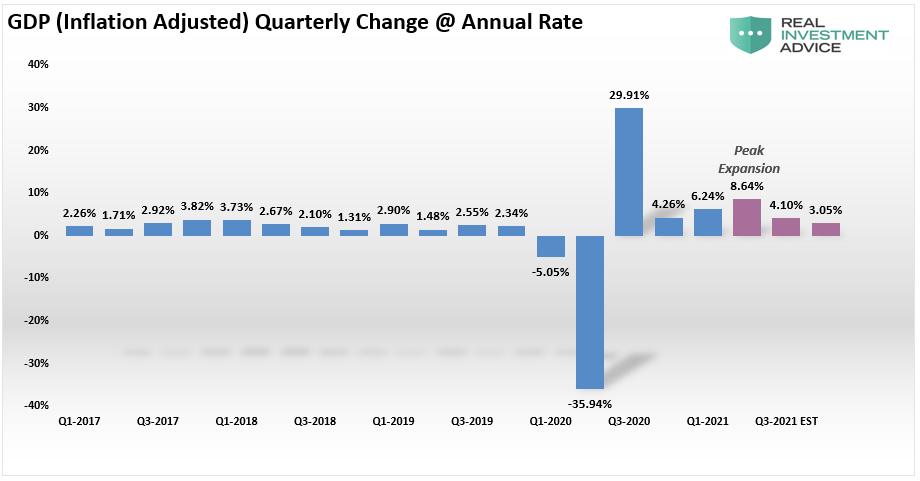

The story would have merit IF the economy were expanding at 6% annually, every year. Notably, 2021 economic growth is primarily a function of annual comparisons recessionary growth. Unfortunately, once the initial recovery is complete, both economic and earnings growth will revert to historical norms.

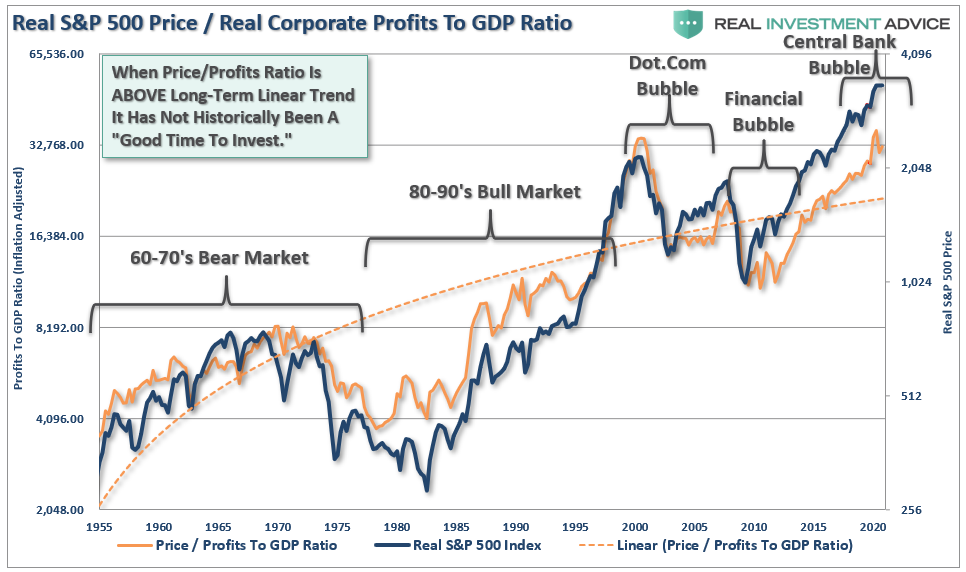

Since corporate profit growth is a function of economic growth, the relationship is also a cause of concern. With the price to profits ratio elevated well above the long-term trend, there is little to suggest that markets haven’t already priced in the expected recovery.

While the U.S. economy will indeed exit the recession in 2021, it may be a statistical result rather than an economic recovery leading to broader prosperity. The most significant risk, which Wesbury overlooks, is a surge in inflationary pressures, undermining more optimistic projections. That concern will manifest itself as a stagflationary environment where wages remain suppressed while costs of living rise. Such will hurt earnings and profitability in an already overvalued market.

Value Isn’t Cheap

“Some investors and analysts are skittish about further gains in equities. The price-to earnings (P/E) ratio on the S&P 500 is 32.6 (based on trailing earnings) is high by historical standards. And the total market capitalization of the S&P 500 has reached about 175% of GDP.” – Wesbury

While Wesbury suggests that valuations are cheap, there is little evidence that such is the case. Most of the assumption is that earnings and the economy will “catch up” with prices. Such would suggest that prices remain stagnant during that process, yet Wesbury assumes prices will surge to 4500 in 2021, eclipsing the benefit of assumed growth.

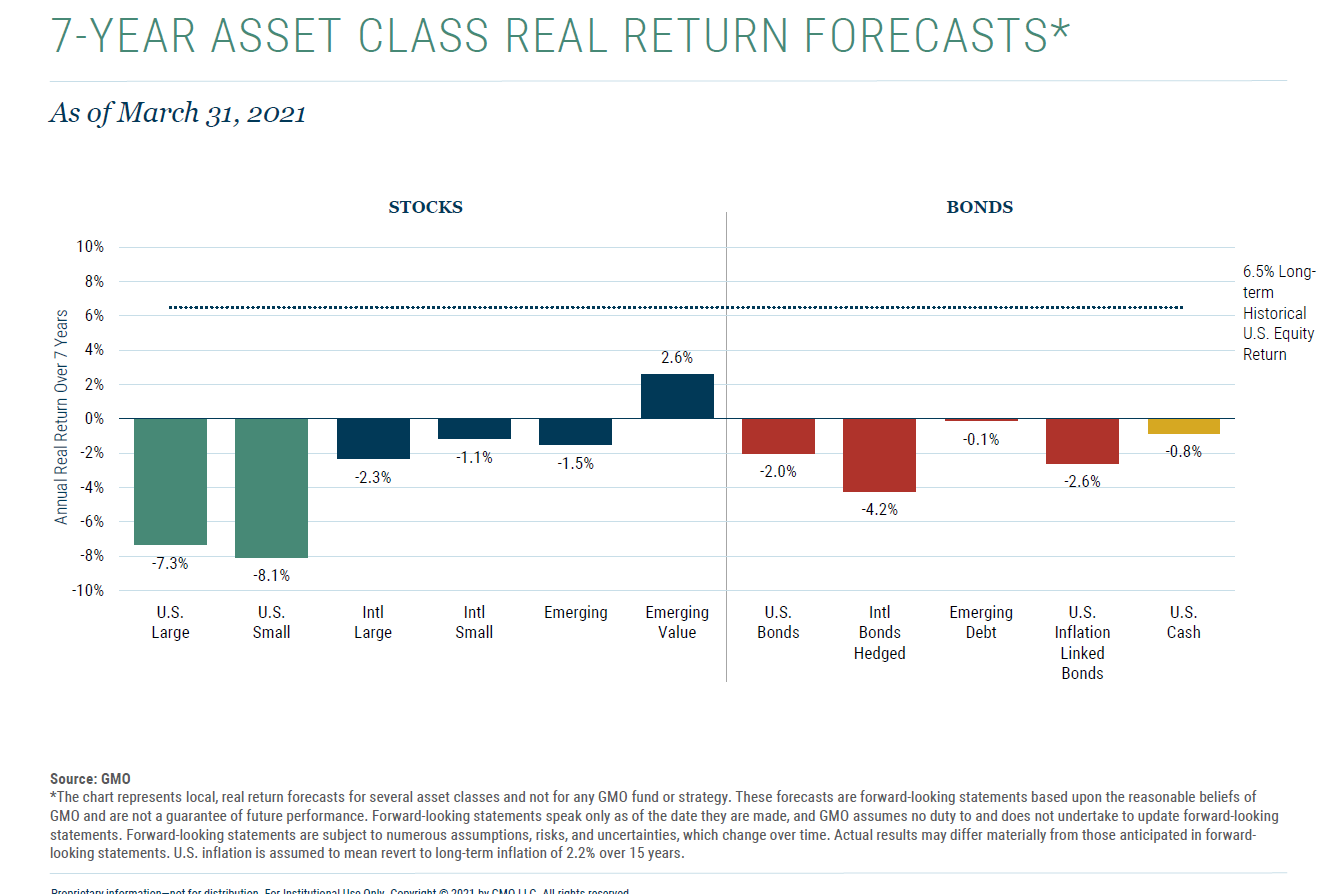

Therefore, valuations are not only high by historical standards now but will remain high in the future as prices rise along with economic and earnings growth. The consequence of over-paying for valuations today is substantially lower long-term returns from asset classes in the future. The eponymous GMO noted such in their most recent 7-year forecasts.

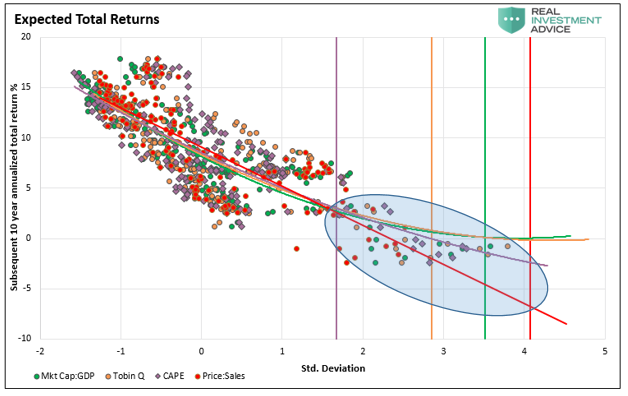

However, as we showed previously, such is also proven out by the historical correlations between a majority of the most relevant valuations models: Tobin’s Q, Price/Sales, Market Cap/GDP, and CAPE:

The Fed will continue to supply liquidity, which will help the market ignore the reality of the barometers shown above. As we saw in March, that does not preclude hair-raising volatility and significant declines, but it does support prices on the margin regardless of the environment.

The average of the 10-year expected returns from the four gauges is -0.75%. Whether by design or due to inflation, slower economic growth, or massive debt levels, rich valuations will matter whenever the Fed backs off.

Rationalizing Valuations

“Also, persistently low-interest rates make higher P/E ratios more sustainable as future profit growth is worth more with a lower discount rate.” – Wesbury

The view that low interest rates justify high valuations has little historical evidence to support such a claim. As I discussed recently:

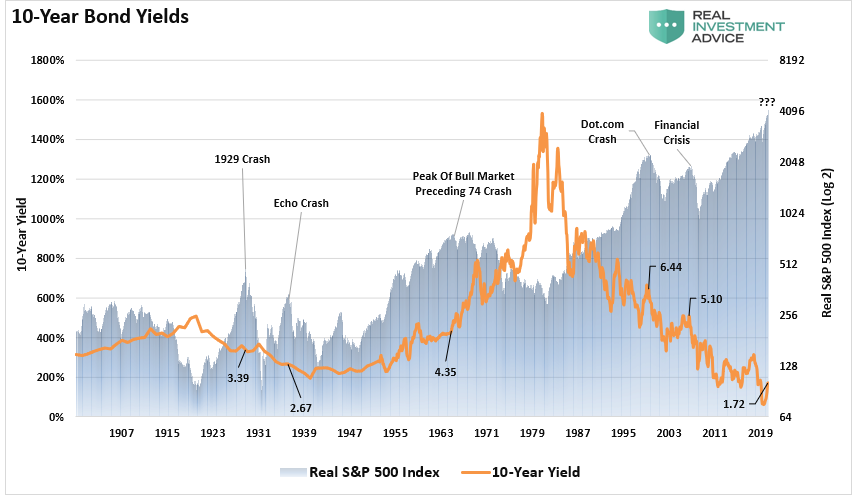

- Exceptionally high interest rates, which have occurred twice, coincided with low stock market valuations.

- Exceptionally low interest rates, which have occurred twice, have coincided with high stock market valuations only once; today.

- Only once (1/3 probability historically) did high stock valuations coincide with low-interest rates; today.

- If extremely low interest rates do not cause high stock market valuations, then a rise in rates should not necessarily cause a decline in stocks.

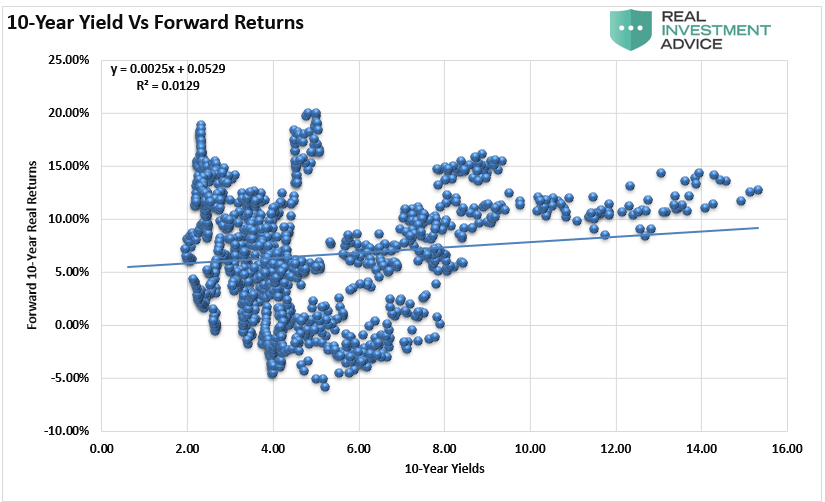

Furthermore, if we run a correlation between 10-year yields and forward returns, as suspected, we find there is virtually no correlation to support Wesbury’s claim.

Notably, in studying if low rates justified high valuations, we quoted Cliff Asness of AQR:

“Instead of regarding stocks as a fixed-rate bond with known nominal coupons, one must think of stocks as a floating-rate bond whose coupons will float with nominal earnings growth. In this analogy, the stock market’s P/E is like the price of a floating-rate bond. In most cases, despite moves in interest rates, the price of a floating-rate bond changes little, and likewise the rational P/E for the stock market moves little.”

Simply, if you are going to discount the “P” due to low rates, you also have to discount the “E” as well.

Not Today, But Eventually

While it is “bullish” to come up with reasons to justify overpaying for assets in the short-term, outcomes are quite different long-term.

If this wasn’t the case, then “riddle me this.”

If investing works like the media suggests, then why are 80% of Americans living paycheck-to-paycheck? Why is it just the top 10% of income earners own 88% of the stock market?

The reality is that investing long-term is hard. Short-term exuberance tends to lead to poor long-term returns.

Let me conclude with this crucial quote from Vitaliy Katsenelson, which sums up our investing view:

“Our goal is to win a war, and we may need to lose a few battles in the interim.

Yes, we want to make money, but it is even more important not to lose it. If the market continues to mount even higher, we will likely lag. The stocks we own will become fully valued, and we’ll sell them. If our cash balances continue to rise, then they will. We are not going to sacrifice our standards and thus let our portfolio be a byproduct of forced or irrational decisions.

We are willing to lose a few battles, but those losses will be necessary to win the war. Timing the market is an impossible endeavor. We don’t know anyone who has done it successfully on a consistent and repeated basis. In the short run, stock market movements are completely random – as random as you’re trying to guess the next card at the blackjack table.”

Rationalizing high valuations today will likely lead to ultimately “losing the war.”