Value stocks of the S&P 500 have been leading the way higher lately, but the charts tell us that it may soon be time to start buying leading tech stocks once again. Read our simple, “no-nonsense” analysis here to find out why…

The tech-heavy NASDAQ Composite has been in consolidation mode since forming a top in February, digesting last year’s massive gains among leading growth stocks.

Meanwhile, clear institutional rotation into value stocks and other sectors has enabled the broad-based S&P 500 to assume leadership and rally to new highs during the same period.

However, the S&P 500 has recently flashed a reliable technical signal that warns a significant price correction may be just around the corner.

This is potentially good news for the Nasdaq, as weakness in the S&P could spark sector rotation back into tech stocks.

Continue reading to learn how to spot this valuable market warning signal, and how it may lead to a bullish rotation back into leading tech growth stocks.

The Hanging Man of the S&P 500 Index

Two weeks ago, the benchmark S&P 500 Index concluded a three-month rally off its 20-week moving average by forming a “hanging man” candlestick pattern on its weekly chart.

A hanging man is a bearish candlestick pattern that often precedes a significant reversal within a strong uprend.

The hanging man pattern occurs when the wick (tail) of the daily candlestick is at least two times greater than the width of the candlestick body (which should be small).

This bearish pattern should be confirmed by further weakness, such as a lower close the following day/week (depending on chart timeframe).

In order to be valied, the hanging man must also occur near the top of an uptrend, rather than the middle of the range.

Like all chart patterns, the hanging man pattern is merely a visual way to represent the psychology behind the price action that is occurring.

Specifically, the hanging man indicates the bulls were able to control the session by the close, but there was a considerable amount of intraday/intraweek selling that caused the long wick to be formed.

Overall, this candlestick pattern tells us the strong uptrend is beginning to show signs of losing steam and may be setting up for a price correction lower.

On the weekly chart of the benchmark S&P 500 Index below, we have annotated the hanging man pattern that formed two weeks ago:

As mentioned above, the hanging man pattern should be confirmed by lower closing prices in the following session.

On the chart above, notice the S&P 500 Index indeed closed lower in the following week.

Also, notice that last week’s price action mostly traded below the closing price of the previous week that produced the hanging man pattern.

This provides additional confirmation of the bearish signal that was formed.

While this certainly does not mean the S&P 500 uptrend is over, it does provide high likelihood of at least a few weeks of sideways to lower price action in the index.

Sector Rotation – Follow the money flow

Mutual funds, hedge funds, and other institutions are responsible for managing billions of dollars under management.

Since most funds have rules that prevent them from simply sitting in cash, institutional funds are constantly rotating in the stock market from one industry sector to another.

As outlined in my Sector Trading Strategies course book, your goal is to simply identify that sector rotation, then continusouly ride on the coattails of the instituitonal money flow into the leading sectors.

Sector rotation out of the Nasdaq and into the S&P 500 started becoming clear after the Nasdaq stalled at its February highs.

Is it soon time for rotation to flip back in the other direction?

The answer may lie in analyzing the weekly charts of a few key sectors that have been moving the markets lately.

Financial sector

The Financial Select Sector ETF (NYSE:XLF)), an ETF comprised of a broad array of banks and other financial-related stocks, has been in a strong uptrend since breaking out above its 200-week moving average in November 2020.

Like the S&P 500 Index, XLF formed a bearish hanging man pattern two weeks ago, followed by a lower close the following week:

We will be keeping an eye on the performance of XLF in the coming days, as a break of the two-week low would technically increase the odds of further weakness and rotation out of financials.

Transportation and Basic Materials sectors

In addition to financials, the transportation and basic materials sectors have been leading the S&P 500 higher since the index started showing relative strength to the Nasdaq Composite.

The iShares Transportation Average ETF (NYSE:IYT) and Materials Select Sector SPDR® Fund (NYSE:XLB) are two popular ETFs that are representative of the transportation and basic materials industries.

Both sector ETFs have been in steady uptrends since testing and holding support of their 20-week exponential moving averages in early 2021.

However, like financials, both the transportation and basic materials sectors may be due for some sideways to lower price action after forming weekly hanging man candlesticks two weeks ago:

Like the benchmark SPDR® S&P 500 (NYSE:SPY), both IYT and XLB confirmed their hanging man patterns by closing lower the following week.

Again, a break below the low of the past two weeks would increases the odds of further weakness in the transportation and basic materials sectors.

Technology sector

If the financial, transporation, and materials sectors follow through lower on their recent weakness, then institutional funds will need to flow somewhere else.

One possible scenario is that we may start seeing fundss rotate back into the tech sector.

Technology Select Sector SPDR® Fund (NYSE:XLK) is an ETF comprised of tech companies in the hardware, software, communications, and semiconductor sub-sectors.

XLK has essentially been in base mode (consolidation) since February, after failing its breakout attempt above the base highs in April.

Although tech stocks have overall lagged so far in 2021, the sideways price action in XLF and the NASDAQ Composite has been constructive.

Check out the annotated weekly chart of XLF below:

On point “A,” notice that XLK’s pullback in early 2021 held the highs of the prior base and 20-week exponential moving average.

The price is still above the 20-week EMA, and XLK is (so far) setting another higher low (“B”).

As shown on point “B,” XLK is now heading into week five of forming a new base on its weekly chart.

Lengthy bases of support are the foundation for explosive breakouts that lead to massive winners in The Wagner Daily, our flagship nightly stock picking report since 2002.

Can the price hold the 20-week EMA and begin to set higher lows on its shorter-term daily chart as well?

If so, then it will be setting up nicely for bullish rotation back into the tech stock arena.

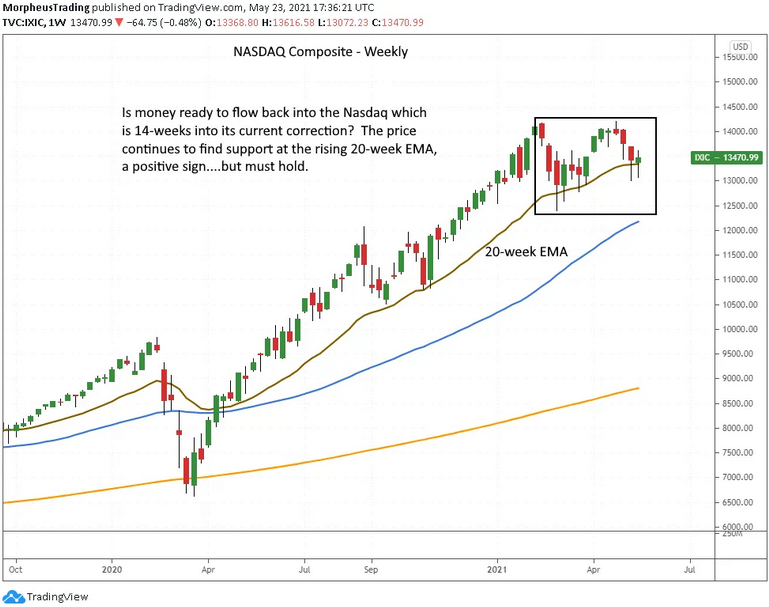

NASDAQ Composite – Is money ready to flow back in?

Like XLK, the NASDAQ Composite Index is also trying to hold above support of its 20-week EMA.

From here, we are looking for the two-week low to hold and produce another higher low.

We would also like to see the price swings tightening up (from left to right on the chart).

Tighter consolidation with the formation of another higher low on the weekly chart would be bullish, and could lead to a breakout to new highs in the tech-heavy NASDAQ Composite:

Conclusion

If leading sectors in the S&P 500 follow through on their hanging man patterns and continue to weaken, then look for funds to rotate back into technology and set the stage for a strong second half of the year in the Nasdaq.

All the charts above represent what the main stock market indexes are doing right now, but you should always prepared for any possible scenario.

For example, the S&P 500 could blow off the recent weakness and makes its way to another new high.

Such a scenario could easily cause the NASDAQ Composite to break below its 20-week EMA that it has been holding until now.

Furthermore, a break below the $13,000 area in the NASDAQ Composite could lead to a swift test of the 200-day moving average (currently around $12,600).

Consistently profitable traders must always be prepared for the unexpected in the market.

Above all, remember to always trade what you see, NOT what you think!