Theoretically, the prospect for investing in riskier assets should be dim. Consider the weakness in real estate – a major component of the U.S. economy. Mortgage application volume recently fell to its lowest level since 1995. Meanwhile, U.S. stocks are expensive on nearly all of the traditional measures. Cyclically-adjusted P/E ratios suggest that stocks may be overvalued by as much as 40%-50%.

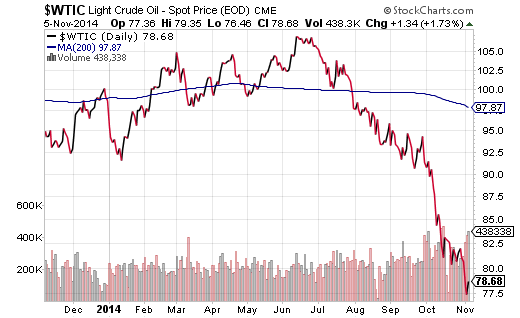

The global economic picture is equally disconcerting. Both Europe to Japan require emergency-level stimulus in the form of electronic money creation. Moreover, the deceleration in gross world output (GWP) is largely to blame for a 25% oil price smack-down.

Not surprisingly, most analysts believe the decline in Oil is a win for consumers, businesses, the U.S. stock market as well as the U.S. economy. The spin? Everyone benefits from lower energy costs. What many folks may be missing, however, is that oil price deflation can undermine confidence in global demand. It is not too dissimilar from making a singular claim that falling home prices are a positive for home-buyers without looking at the recessionary nature of housing busts.

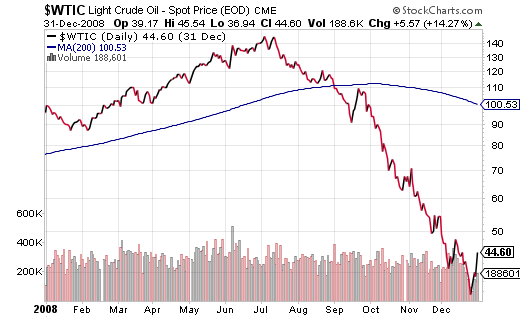

The question that many might wish to address is, “Will the oil market stabilize in and around $80 per barrel, or will it continue to tank the way it did in 2008?” Some of the challenges that occurred in 2008 are happening today, including real estate uncertainty and the deceleration in gross world output.

Of course, there are key differences between year-end 2014 and mid-2008. Central banks around the world have since added trillions to their balance sheets, pushing bond yields to remarkable lows. The U.S. 10-Year Treasury yielded 4.3% in mid-2008, whereas it yields closer to 2.3% today. The low yield increases the attractiveness of 2%-plus dividend yielding stocks, particularly for those with 10-year time horizons. In a similar vein, one recalls “negative-am” and “no-doc” loans fueling the previous decade’s housing bubble and subsequent credit crunch. Today’s housing slowdown is more a function of relatively responsible lending requirements as well as buyer skittishness.

The current economic concerns notwithstanding, one has to look at Fed zero-percent rate policy and quantitative easing from the likes of Japan and Europe as tailwinds for broader equity gains. That said, it may be difficult for the value-oriented to pay 25x cyclically adjusted earnings for U.S. equities at all-time highs.

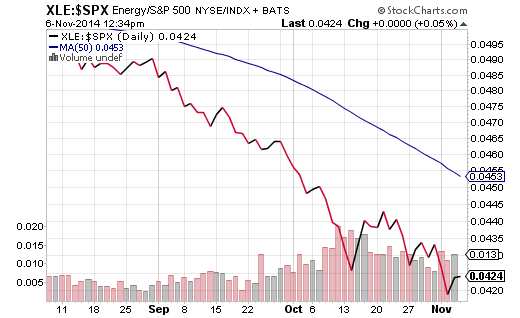

It follows that more reasonable valuations might be found in the energy patch. Sure, oil might drop from $80 to $75. It might even reach the low $70s. Yet the more likely outcome is for oil to stabilize, and that should be a huge boost for the beaten-down bargains in SPDR Select Energy (ARCA:XLE).

Recently, I suggested that the overall health of the bull market will largely depend on value-oriented mutual funds as well as institutional dollars flowing into price-to-earnings bargains in the energy sector. The XLE:S&P 500 price ratio has not yet shown sustainable relative strength for energy stocks, though the last few days have been more promising.

In sum, the bull market in U.S. stocks can continue with the blessing of severe laggards like XLE. On the other hand, plummeting tech shares in proxies like PowerShares NASDAQ 100 (QQQ) eventually ushered in the 2000-2002 bear; the early downtrend in SPDR Select Financials (ARCA:XLF) foreshadowed the 2008-2009 bear. Could XLE be the next harbinger?

In my estimation, oil will stabilize in the $75-$80 range, rather than free-fall towards $60. If I am wrong – if global deflation anxiety surpasses the stimulative efforts of central banks around the world – then the questionable global economy would turn recessionary. And if that happens, stocks would fall dramatically to reflect economic realities as well as investor psychology.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.