Very glad that we all got that April Fools stuff out of our systems. Bravo to everyone for one of the most creatively deceitful 24 hours we've had in years.

What's happening in the markets right now is far from fun and games though. Bitcoin is below 7k. Ether is below $400 and XRP is less than 50 cents.

Furthermore, we're coming off the worst stock correction in years with many traders screaming "buy the dip" and many more predicting much further losses.

In tomorrow's premium webinar we will discuss the best ways to play both sides of the market. So we can take advantage of the dip and protect ourselves against further declines at the same time.

Today's Highlights

Shakey Handoff

Going into Q2

Bitcoin stocks correlation

Please note: All data, figures & graphs are valid as of April 2nd. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Asian markets are at full gas in neutral. The holiday in Europe is sure to stop any momentum created. The United States is coming back from Easter Weekend and April Fool's Day so will likely receive a rather shaky handoff.

The combination of high expected volumes with low liquidity due to the European holiday could make things rather interesting this afternoon.

Stocks are now giving the lows a good test. We can see here how the S&P 500 is testing it's 200-day moving average. If it steps below, the consequences could be dire.

On the other hand, going into a new quarter. Stock prices have just come off a major pullback and some are gathering ammunition to buy up this massive dip.

Also, all of the copyfunds have now been rebalanced. So it's a good time to take a look at some of them and see what components the eToro algorithms have picked up on, especially to see who and what performed well under extenuating circumstances. By seeing what did well in Q1 we can get some excellent insight into how to position for Q2.

Crypto Integration

For those asking if Bitcoin is a safe haven, I think that the market action over the last two months has made it clear that the answer is a resounding no.

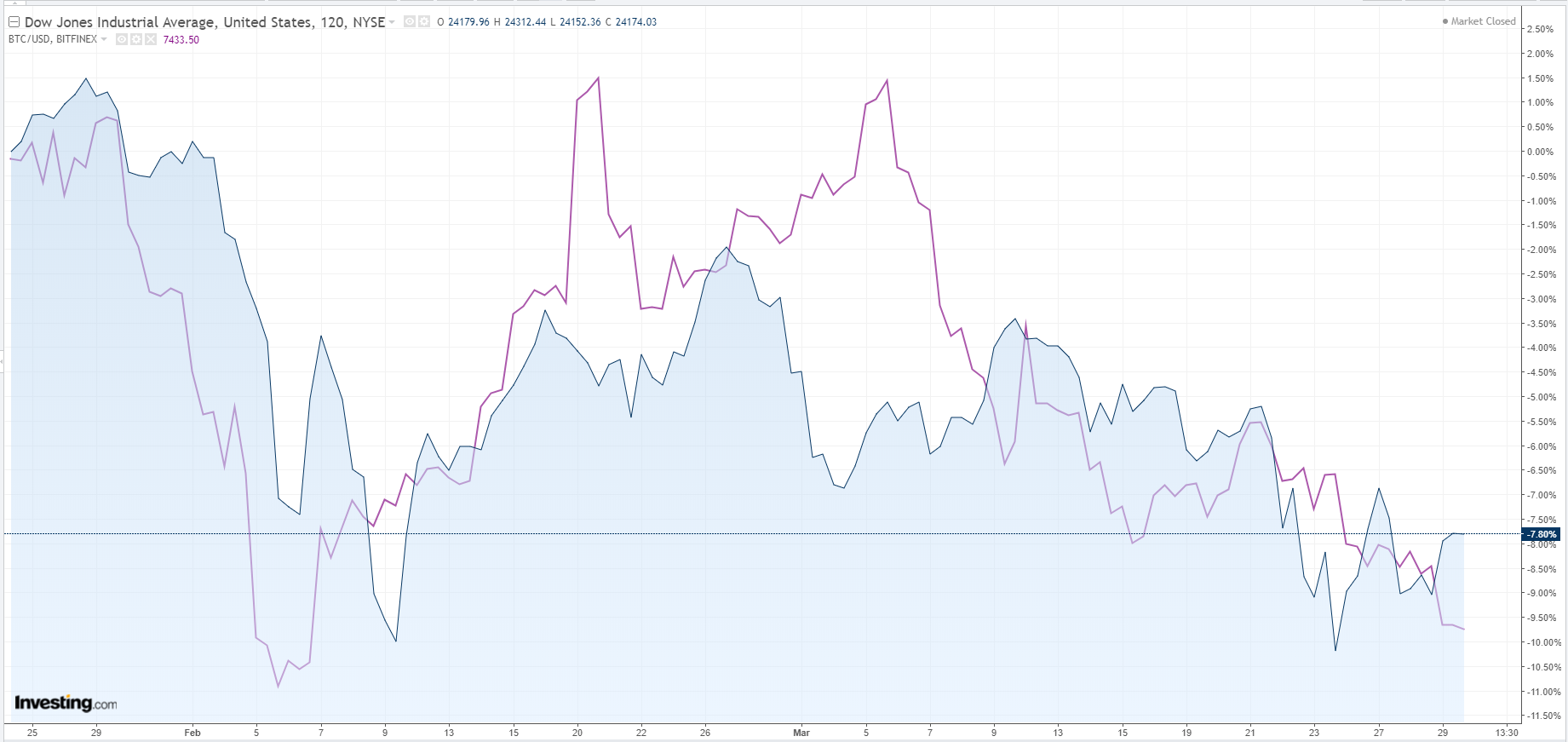

Here we can see Bitcoin in Purple and the Dow Jones in Blue.

Other than a few short bursts of movement in opposite direction we can see that the general trajectory is rather correlated. Meaning, that bitcoin is being considered as a risky asset for now. This may change if things get worse for the stocks but for now it is what it is.

Of course, everything is relative. So if you're faced with a currency like the Turkish Lira, which just reached a new all time low of 4 Liras to the Dollar, perhaps the relative stability that bitcoin offers doesn't seem as bad.

Let's have an amazing day ahead! See you all tomorrow.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.