Throughout the last several days, Chinese retailers have decreased iPhone prices. This follows the lower-than-expected sales of iPhones in China announced on Jan 3. Six days later, a 10 percent reduction in the production of iPhones was also announced by Apple (NASDAQ:AAPL).

Overall losses have been experienced by AAPL shares during this period as a possible result of these events.

Bitcoin (BTC) also suffered heavy losses between Jan 3 and 11. Though these losses were greater than Apple’s, BTC’s volatility has not affected its long-term value. In fact, the value of BTC over the last five years has greatly exceeded that of both AAPL and the S&P 500 Index.

This raises the question: Which is the better investment: Bitcoin or Apple?

A Look at Apple

Apple announced decreases in iPhone production after the close of the stock market on Jan 9.

When the market reopened on Jan 10, the value of AAPL dropped nearly one percent in the first hour of the day.

When the market closed for the day, AAPL had regained its lost value and exceed the previous closing price rising from $153.31 to $153.78.

The announcement of production costs on Jan 9 does not appear to have affected prices as significantly as the low iPhone sales announced on Jan 3. AAPL lost 10 percent of its total value between the close of Jan 2 and 3.

7.9 percent of the value was regained by the close on Jan 9. However, despite the growth seen on Jan 10, AAPL experienced overall losses between the close on Jan 2 and Jan 11 — dropping from $157.88 to $152.26, a total loss of 3.56 percent.

Bitcoin vs. Apple

During this same period, Bitcoin suffered greater losses.

At the close of the stock market on Jan 2, BTC was priced at $4,048.20 on Bitfinex. When the stock market closed on Jan 11, the price had dropped to $3,692.90 — 8.78 percent of its total value was lost. This is 5.12 percent higher than the loss experienced by AAPL during the same period.

On Jan 6, it reached a high of $4,218. At the close of Jan 11, BTC dropped 12.45 percent in value from this high. Greater volatility was, thus, experienced by BTC than AAPL during this period. Where AAPL prices fluctuated within a range of 10 percent, BTC fluctuated between a price range of 12.45 percent.

Five-Year Analysis

Examining these figures alone may give the illusion that AAPL is performing better than BTC, but this is only true for the period Jan 2 to Jan 11, 2019. A multi-year analysis illustrates that BTC continues to perform better than both AAPL and the S&P 500.

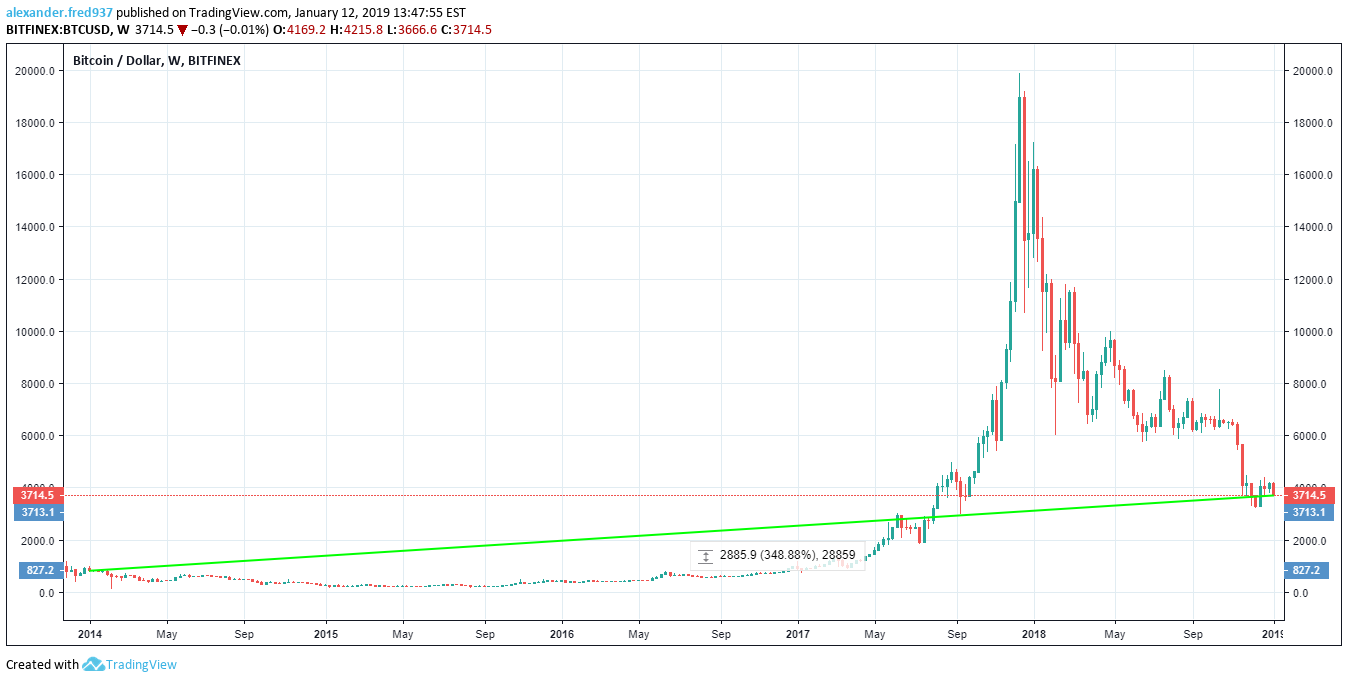

During the week of Jan 6, 2014, BTC closed at $827.20. Over the next five years, it increased by nearly 350 percent — closing at $3,713.13 for the week of Jan 7, 2019.

During this same year period, AAPL increased by just over 100 percent in value.

Furthermore, Bitcoin has also outperformed the S&P 500 Index — which has increased by only 40.92 percent.

Bitcoin has proven itself a much better investment than Apple and the S&P 500.

Do you think that Bitcoin will continue outperforming Apple and the S&P 500 Index in the future? Let us know your thoughts in the comments below!

[Disclaimer: This article is not financial advice and should not be construed as such.]