Apple Inc. (NASDAQ:AAPL) is leaving no stone unturned to expand its ecosystem and brand-appeal beyond iPhone. The company is striving to gain traction in uncharted areas of film distribution and original content as it is focused on doubling its services business to almost $50 billion by 2020.

Apple to Shake a Martini with James Bond?

Apple is reportedly bidding for the distribution rights of the upcoming James Bond movie. Per Reuters, which quoted Hollywood Reporter, e-Commerce giant Amazon.com Inc. (NASDAQ:AMZN) is also vying for the rights along with Time Warner Inc (NYSE:TWX).’s Warner Bros., Sony Corp (NYSE:SNE) , Comcast (NASDAQ:CMCSA) Corp’s Universal Studios and 20th Century Fox.

The James Bond franchise is worth almost $2-$5 billion. The movies have been successful at the box office and have a strong cult following. Per Reuters, which quoted film tracker BoxOfficeMojo.com, the last Bond movie “Spectre” earned approximately $880 million, globally. Notably, Sony was the distributor of the film and its rights expired in 2015.

MGM which controls the rights of the franchise along with Eon producers Barbara Broccoli and Michael G. Wilson has agreed to cast actor Daniel Craig for his fifth bond movie. The producers have set Nov 8, 2019 as the probable release date.

Both Apple and Amazon are ready to spend freely (at least similar to Warner Bros.) to grab the distribution rights. Strong cash balance will aid them to fund the expenditure. Apple had a cash balance of $76.8 billion at the end of the third-quarter fiscal 2017, while Amazon ended second-quarter 2017 with a cash balance of $21.45 billion.

Nonetheless, interest in distributing movies, particularly the James Bond series, is an aggressive step from Apple, given its lack of exposure in this business. Moreover, the company is well known for its tough negotiation practices (particularly when it comes to pricing) that might not succeed this time due to stiff competition.

We note that Apple is already at loggerheads with prominent Hollywood studios over pricing of 4K content. Nevertheless, if the bet is successful, the franchise can be a game changer for Apple over the long term.

Apple Signs Music Deal with Warner

Meanwhile, Apple has signed a deal with Warner Music Group, one of the most renowned music labels, to offer subscribers on-demand music via both iTunes and Apple Music. Per Bloomberg, the deal will give the iPhone-maker access to songs from the likes of Ed Sheeran, the Red Hot Chili Peppers and Bruno Mars.

Moreover, Apple now plans to pay a smaller percentage of sales to record labels from its paid Apple Music service. The company used to pay 58% of sales and plans to bring it down to 55%. This can further decline if subscriber level achieves certain benchmarks.

However, we note that Apple’s plan rate is still higher than what Spotify pays currently. Early this year, the Swedish music streaming service provider successfully negotiated rate cut, following which it will pay 52% of sales, down from earlier rate of 55%.

Apple is also set to secure a deal with Sony Music Entertainment, the second-largest record label, which will further fortify its position in the on-demand music streaming service market, in the long haul.

Investments to Boost Services Business

Apple is set to invest $1 billion on original television shows and movies in 2018 through Apple Music. To oversee this business, the company hired Jamie Erlicht and Zack Van Amburg, two former executives of Sony, in June this year, who has successful productions like Breaking Bad and The Crown to their credit.

In the last quarter, Services – including revenues from Internet Services, App store, Apple Music, AppleCare, Apple Pay and licensing and other services – surged 22% year over year to nearly $7.3 billion. More importantly, the number of paid subscribers grew 20 million to a total of 185 million.

The investment is expected to improve Apple’s competitive position against the likes of Netflix (NASDAQ:NFLX) and Amazon Prime. Moreover, the expanding catalog and a more exclusive original content will help in expanding Apple Music’s 27-million subscriber base going forward.

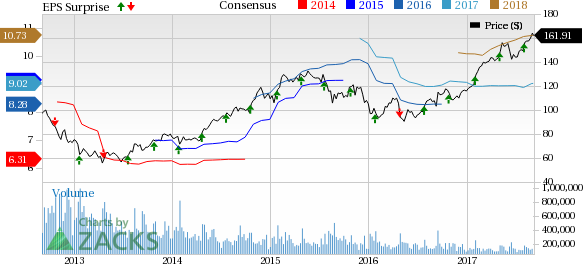

Apple carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Sony Corp Ord (SNE): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research