Apple Inc. (NASDAQ:AAPL) is facing an antitrust complaint in China. Per Reuters, local developers have accused the iPhone maker of charging exorbitant fees and removing apps from its local store without proper clarification. The complaint is now being reviewed by China’s State Administration for Industry and Commerce (SAIC).

Like many other U.S.-based companies, China has been a tough nut to crack for Apple as well. The country is the second largest iPhone market. However, strict regulations have often played havoc with its operations.

Per New York Times, last year, the State Administration of Press, Publication, Radio, Film and Television “asserted its authority” and shut down Apple’s iTunes Movies and iBooks services after being in operations for not even seven months.

Moreover, competition from local players such as Huawei and Oppo is also hindering growth prospects. Additionally, in a bid to promote domestic manufacturers, the Chinese government has created an increasingly challenging regulatory environment for foreign companies to operate.

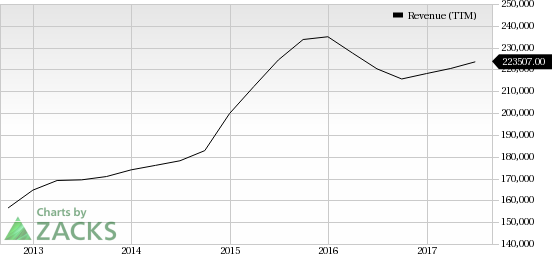

Notably, in the last reported quarter, Apple revenues declined around 10% year over year in the Greater China region to $8 billion. The regulatory issues faced by the company in the region can aggravate the problem further.

However, the company remains optimistic about the long-term growth prospects of the region, especially given the hype surrounding iPhone 8, which is rumored to be launched in Sep 2017. A survey conducted by Maxim Group in May indicates a "significant pent-up demand" for iPhone 8 in China. Per Maxim Group, iPhone sales in China will increase 170% year over year to 80.7 million units in fiscal 2018.

Notably, shares of Apple have gained 40.7% year to date, slightly outperforming the industry’s 39.9% rally.

Notable Moves In China

Apple has stepped up investment in the country to woo the government in a bid to protect its business interests. The company's optimism regarding the region is further evident from its recent appointment of Isabel Ge Mahe to the newly created post of vice president and managing director of Greater China to “provide leadership and coordination across Apple’s China-based team.”

Recently, the company collaborated with local internet services companies to establish its first data center in China that will ensure compliance with the country's newly implemented cyber-security regulations.

New York Times reported last month that Apple had taken off virtual private networks (VPN) applications from its China App Store that were used to breach the Great Firewall. Last year, the company had even removed a news app by New York Times following a request by the Chinese government. Such moves from Apple definitely show its cooperation with the Chinese government with respect to Internet censorship.

Earlier last year, the company had invested $1 billion in the ride-hailing company, Didi Chuxing (DIDI). Moreover, in March, it announced plans to build two R&D centers in Shanghai and Suzhou, Jiangsu province. It established two R&D centers in Beijing and Shenzhen last year.

Zacks Rank & Stocks to Consider

Apple has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Applied Materials (NASDAQ:AMAT) , Activision Blizzard (NASDAQ:ATVI) and Applied Optoelectronics (NASDAQ:AAOI) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Applied Materials, Activision and Applied Optoelectronics is currently projected to be 17.1%, 13.6% and 17.5%, respectively.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Apple Inc. (AAPL): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research