Apple Inc (NASDAQ:AAPL) has entered the race for buying Toshiba Corp.'s chip unit at the eleventh hour. Per reports, Apple has been roped in by a consortium led by Bain Capital to strengthen its offer for the Japanese conglomerate’s lucrative chip business.

In June, Bain Capital along with Innovation Network Corp of Japan (INCJ) and Development Bank of Japan (DBJ) reportedly submitted a fresh bid of 2.1 trillion yen (approximately $19 billion).

It is reported that Apple will inject around ¥400bn (possibly upfront) while South Korean chipmaker SK Hynix and Bain will provide about ¥1.1 trillion with Toshiba’s banks supplying the remaining funds.

Why is Apple Interested in Toshiba?

Notably, Toshiba is the second largest NAND flash memory maker, a technology that is now preferred over legacy hard-drive storage systems due to speed and reliability. Apple sources flash memory for iPhone and iPods from Toshiba.

Analysts observe that by acquiring Toshiba’s chip business, Apple can not only reduce its dependence on Samsung (KS:005930) but also maintain competitive pricing.

Bloomberg quoted Michael Walkley, an analyst with Canaccord Genuity, saying “There are supply shortages of that type of memory. They’re always looking to work closely with key suppliers and lock in long-term supply agreements.”

Toshiba Fails to Meet Creditors’ Deadline

At its board meeting held on Thursday morning, Toshiba failed to arrive at any consensus, thereby failing to meet the deadline set by its creditors’ to sell its chip business. Reportedly, in a statement, Toshiba’s board said “While Toshiba exercised its best efforts to reach a mutually satisfactory definitive agreement with one of the consortia seeking to purchase TMC, the negotiations with each consortium have not reached the point which will allow Toshiba's Board of Directors to make a decision.”

The chip unit, which Toshiba values at 2 trillion yen, has attracted a number of suitors. With many backing out including Broadcom (NASDAQ:AVGO), Toshiba at present is considering three offers, per media reports.

One is the abovementioned Bain consortium-led offer. The second bid is led by Western Digital (NASDAQ:WDC) . Now Western Digital’s division SanDisk and Toshiba jointly run a flash memory factory in Japan. The two have been at loggerheads over the sale of the chip business for quite some time now.

Citing the joint venture (JV) agreement, Western Digital insists that it has the rights to approve/disapprove any transaction that involves the JV. However, Toshiba counterclaimed that the JV agreement doesn’t give the right to either party to block the other from selling its share. It also pointed out that Western Digital bought SanDisk without seeking or receiving Toshiba’s approval. There continues to be high level tension between the companies with claims, counterclaims and arbitrations involved.

Western Digital is looking to get its hands on the memory business as it will strengthen Western Digital’s competitive position in the profitable NAND flash memory market.

The final bid is from a group of buyers, which includes Taiwanese electronics maker Hon Hai Precision Industry Co, parent company of Foxconn. Chances of Hon Hai striking the deal are relatively low due to its significant presence in China. This is not going to go down well with the Japanese government.

Toshiba is in a awful situation. The company needs to raise capital to remain a listed entity. Currently, the company has negative shareholder’s equity after it posted a colossal loss of 950 billion yen (almost $8.6 billion) in the fiscal year ended March. Most of the loss stemmed from write-downs pertaining to its now-defunct Westinghouse nuclear business.

Zacks Rank and Share Price Movement

At present, Apple carries a Zacks Rank #3 (Hold).

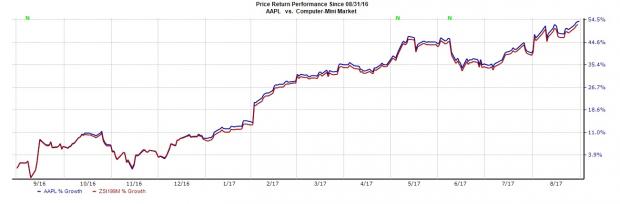

Notably, the company has outperformed the industry in a year. Shares of Apple have surged 54% compared with the industry’s 52.3% increase.

Stocks to Consider

Better-ranked stocks in the broader tech space include Garmin Ltd. (NASDAQ:GRMN) and The Trade Desk, Inc. (NASDAQ:TTD) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Garmin and Trade Desk have delivered average positive earnings surprise of 22.89% and 483.79%, respectively in the trailing four quarters.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Western Digital Corporation (WDC): Free Stock Analysis Report

The Trade Desk Inc. (TTD): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Original post

Zacks Investment Research