The US dollar was found higher against most of the other major currencies, while most equity indices traded south. Maybe investors became concerned again with regards to the new covid-related restrictions around the globe, or they turned cautious ahead of today’s CPIs.

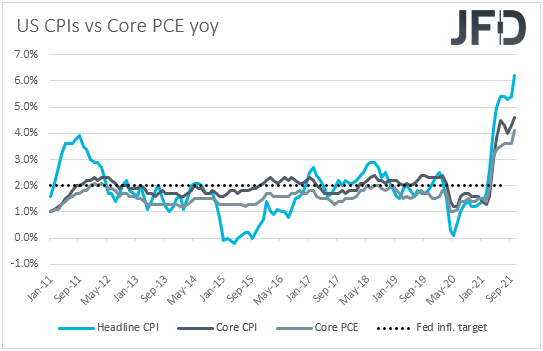

Expectations are for further acceleration in both headline and core inflation, something that could add credence to Fed Chief Powell’s view that tapering should end sooner than previously estimated.

Dollar Gains, Equities Pull Back, As Investors Turn Cautious Ahead Of The US CPIs

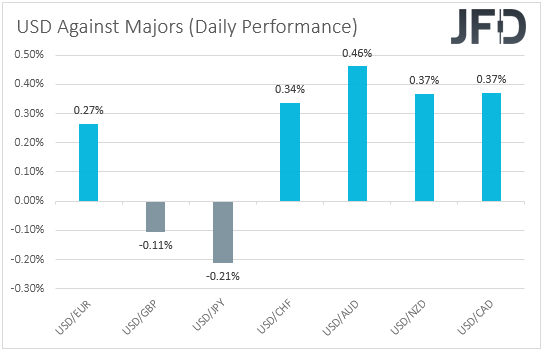

The US dollar traded higher against all but two of the other major currencies on Thursday and during the Asian session Friday. It underperformed only versus JPY and GBP, while it gained the most against AUD, NZD, and CAD.

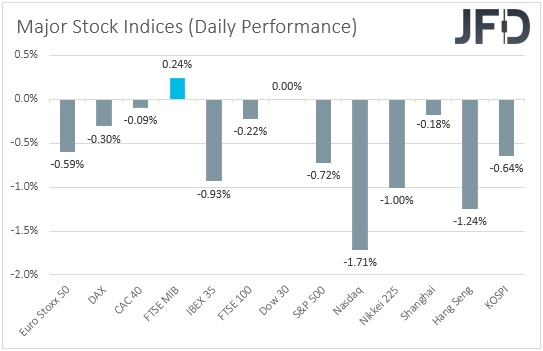

The strengthening of the Japanese yen and the US dollar, combined with the weakening of the risk-linked Aussie, Kiwi and Loonie, suggests that markets may have turned to risk-off yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that all but one of the EU indices finished their session in the red, with the only exception being Italy’s FTSE MIB.

The negative appetite rolled over into the US and Asian sessions as well. Although the Dow Jones closed virtually unchanged, the S&P 500 fell 0.72%, and the NASDAQ 1.71%. In Asia, all the indices under our radar are down.

After recording their strongest two-day rally in more than a year, EU shares pulled back perhaps due to concerns over stricter covid-related measures across the bloc. Yes, we have studies that the symptoms of the Omicron variant are not as severe as initially thought, and this was already cheered by the market, but the fact that it is more transmissible than prior strains, keeps the risk of more measures high, in our view.

What’s more, a less dangerous variant doesn’t mean that the other ones have disappeared. What may have also prompted market participants to reduce their risk exposure during the US and Asian sessions may be the fact that, today, we get the US CPIs for November.

Therefore, it remains to be seen whether market participants are still willing to add risk in the aftermath of the CPIs. This could mean that positive news with regards to Omicron is not fully priced in yet. On the other hand, a prolonged slide could mean that investors are more worried over another potential economic slowdown. That’s why we prefer to take things step by step and now try to examine the possible reaction of the markets to the outcome of the US CPIs.

The headline CPI is forecast to have accelerated further, to +6.8% yoy from +6.2%, while the core rate is expected to have increased to +4.9% yoy from +4.6%.

Last week, Fed Chair Jerome Powell appeared hawkish before the US Congress, surprising those expecting him to adopt a more cautious stance due to the new coronavirus variant and the restrictive measures adopted around the globe. In contrast, the Fed Chief said that the “transitory” wording with regards to inflation may have to be dropped out of the Fed’s monetary policy statement, and that QE tapering should end sooner than previously estimated.

Despite nonfarm payrolls missing expectations on Friday, the unemployment rate declined even more, to 4.2% from 4.6%, and combined with further acceleration in the CPIs, it could add more credence to Powell’s view.

Faster tapering could also mean faster rate hikes, and thereby a stronger dollar. As for equities, with market participants turning somewhat skeptical again with regards to the future performance of the global economy, they may decide to sell stocks for a bit more on speculation that higher borrowing costs sooner could hurt companies’ profitability. However, because they may have digested the idea to some extent, we don’t expect a large and extended fall.

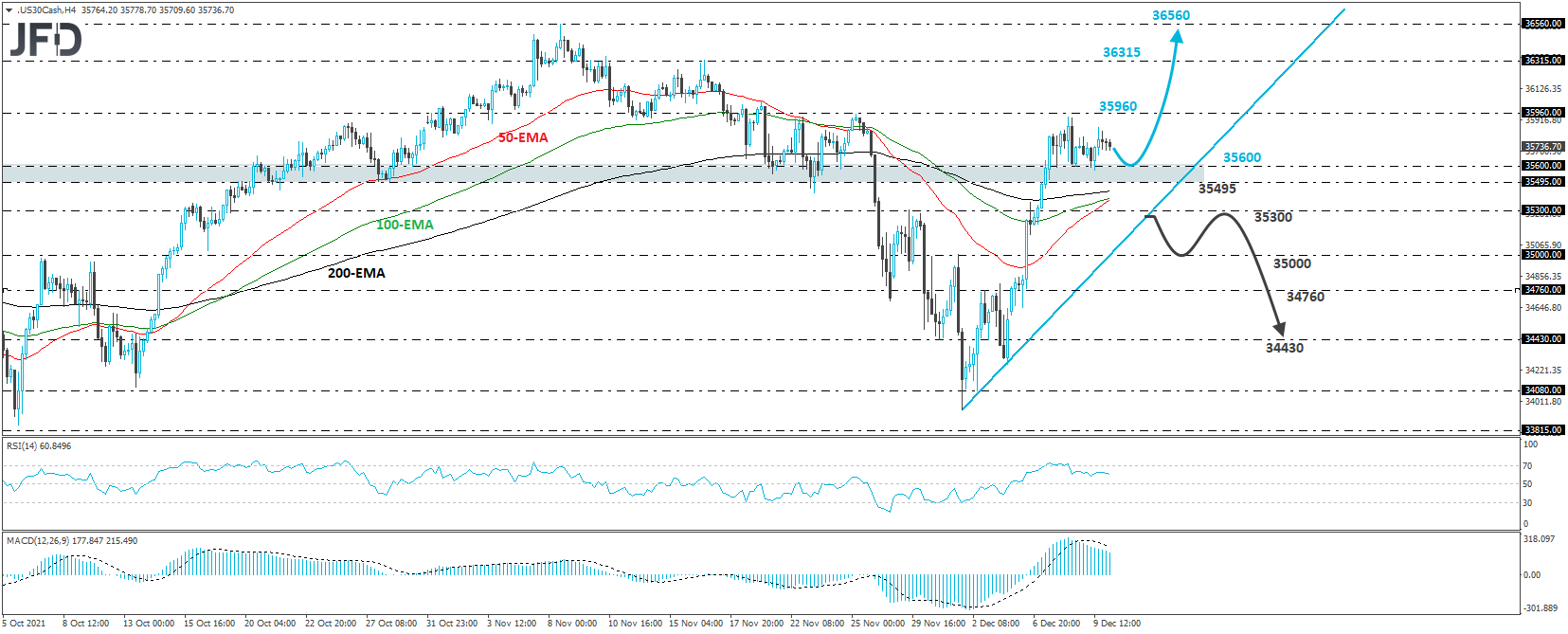

DJIA – Technical Outlook

The Dow Jones Industrial Average cash index traded in a consolidative manner yesterday, staying between the key support of 35600 and the resistance of 35960, marked by the high of Nov. 25. That said, it remains above the upside support line drawn from the low of Dec. 1, and that’s why we will still consider the short-term picture to be positive, even if we see some further retreat today after the US CPIs.

A clear break above 35960 will confirm a forthcoming higher high and could encourage advances towards the peak of Nov.16, at 36315. If market participants are willing to continue to add to their risk exposure, we may se a break above that barrier, which could lead to the index’s all-time high, at around 36560, hit on Nov. 8.

Now, in order to start examining a short-term bearish reversal, we would like to see a break below 35300, a support marked by the inside swing high of Nov. 29. This could confirm the break below the aforementioned upside line and could initially target the inside swing high of Dec. 1, at 35000.

Another dip, below 35000, could aim for the inside swing high of the day after, at 34760, the break of which could extend the fall towards the 34430 zone, defined as a support by the low of Nov. 30.

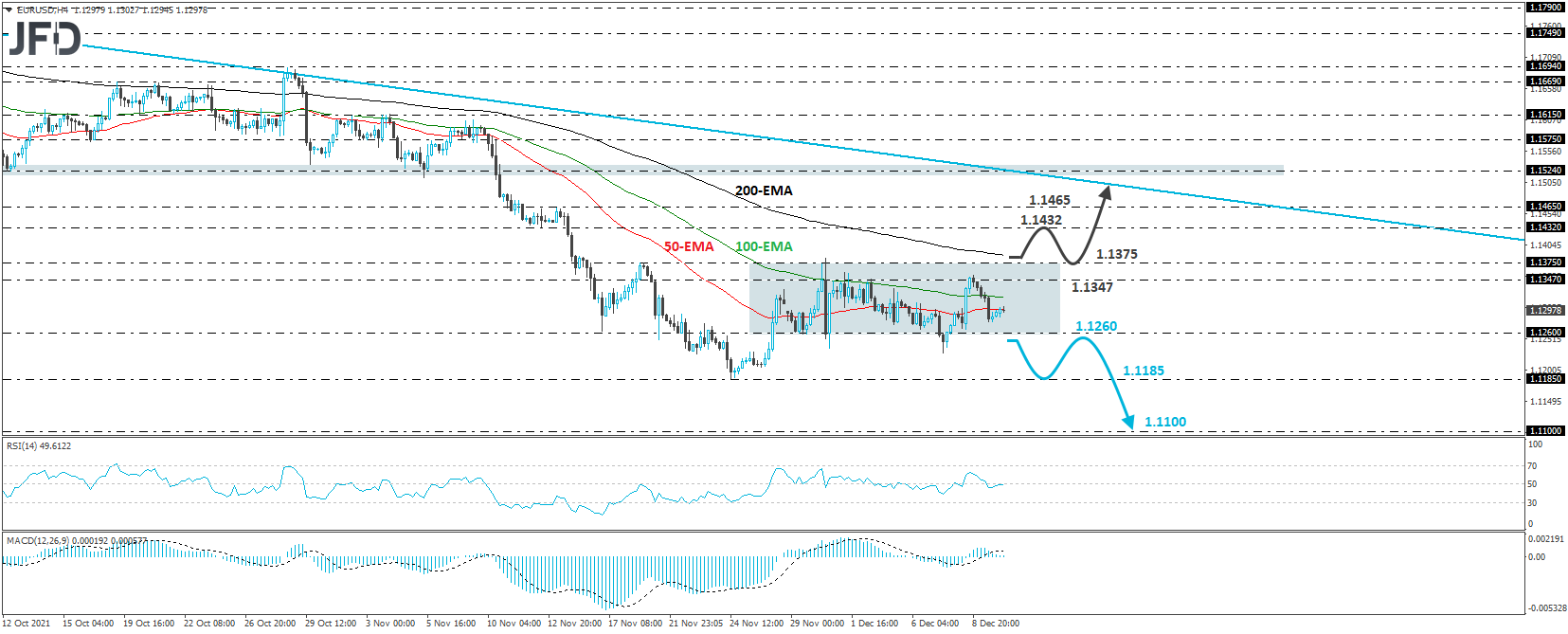

EUR/USD – Technical Outlook

EUR/USD traded lower yesterday, after it hit resistance slightly above the 1.1347 hurdle. Overall, the pair remains within the sideways range that’s been in place since Nov. 26, between 1.1260 and 1.1375, but in the bigger picture, it continues to trade below a downside resistance line drawn from the peak of May 25. Thus, we see more chances for a downside exit, rather than an upside, from the sideways range.

A break below 1.1260 could confirm the downside exit this time around, and may encourage declines towards the low of Nov. 24, at 1.1185. If the bears are not willing to stop there, then a break lower will confirm a forthcoming lower low on the bigger time frames, and perhaps see scope for extensions towards the low of June 1, 2020, at 1.1100.

On the upside, a break above the 1.1375 zone, which was the upper bound of the aforementioned range, could signal a decent correction higher, but not a trend reversal, as the rate would still be trading below the downside line taken from the high of May 25. The bulls could push the action towards the 1.1432 barrier, marked by the inside swing low of Nov. 12, or the peak of Nov. 15, at 1.1465.

Another break, above 1.1465, could allow a test at the pre-discussed downside line, or the 1.1524 barrier, which acted as a temporary floor between Oct. 6 and Nov. 5.

As For The Rest Of Today's Events

During the European morning, we already got the UK monthly GDP for October, alongside the industrial and manufacturing production rates for the month, all of which disappointed.

Although the pound did not react much at the time of the release, this, combined with concerns that the new measures imposed by Prime Minister Boris Johnson could hamper the economy more, may convince more participants to take off the table bets with regards to a December hike by the BoE.

Later in the day, besides the US CPIs for November, the only other release worth mentioning is the preliminary UoM consumer sentiment index for December, which is expected to have slid to 67.1 from 67.4.

We also have four ECB speakers on today’s agenda and those are: President Christine Lagarde, Executive Board member Fabio Panetta, Executive Board member Frank Elderson, and Supervisory Board member Elizabeth McCaul.