The greenback continued moving higher on Tuesday on the back of supportive US home sales data, which came in at 619k versus just 523k expected, one of the best levels seen since 2008.

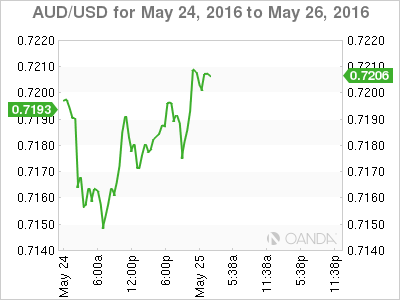

Aussie – topsy-turvy times

There was a moderate nosedive in the Aussie overnight on the back of the RBA’s Glen Stevens, who was making his first appearance since the RBA surprise rate cut.

During his prepared speech, he stated inflation is probably a little bit too weak. He also highlighted the fallout risk from China, referencing that its ‘’economic transition is on a scale that no-one has ever done before”.

RBA Stevens' comments did provide some clarity to the mixed signals the markets was running with after the RBA slashed its forecasts for inflation. They also hinted its board needed some persuading to cut interest rates.

While the governor provided little in the way of forward guidance, the China reference was enough to get the Aussie bears looking lower, which accelerated in London as commodity prices, particularly gold, continued to slide.

However, with oil prices rebounding mid-session in New York and US equity markets buoyant with the S&P 500 + 1.4%, the Aussie found strong support at .7160. It has since rebounded to just below the .7200 handle in early APAC trade.

There was very constructive price action in equity markets overnight, despite traders pricing in a greater likelihood of a summer Fed rate hike. Shifting investor sentiment suggests the market is viewing a likely Fed move optimistically, inferring a rate hike would imply the Fed are very confident about the US economy.

Oil prices rallied when the American Petroleum Institute reported that U.S. crude supplies fell by 5.1 million barrels for the week ended May 20. The market was wrong-footed as expectations were running in the region of a 3.3 million draw.

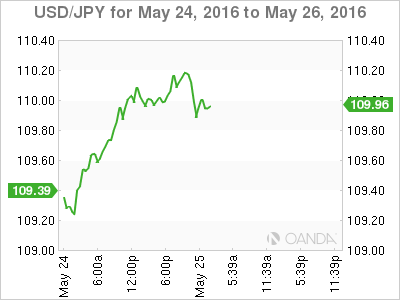

Yen – getting a little support

The USD/JPY found solid footing on the back of upbeat US economic data and improving global risk sentiment as well as growing support for the summer rate-hike camp. April’s Fed policy minutes revealed that four voting members (Cleveland, San Francisco, Richmond and Kansas City) supported an April rate hike.

With Fed speak ratcheting up the hawkish rhetoric, the significance of April’s policy minutes should not be understated. Specifically, rate hike support is up by two additional voting members (originally it was just Richmond and Kansas City) from the prior meetings. With current US data suggesting economic conditions are improving, the likelihood of a summer rate hike continues to gain momentum.

USD/JPY has accelerated through the 110 resistance level in early APAC trade on positive USD momentum from overnight markets.

Yuan – PBOC guessing game

There is lots of noise in the market surrounding the RMB reaction to a Fed hike. In particular, a reference to the leaked report suggesting the PBOC has moved off a market-based fix and is setting the fix to suit their needs. This report has thrown a wrench into analyst CFETS models and partially explains the muted CNY reaction to a possible June rate hike.

This revelation implies that the PBOC is driving the path of depreciation with stability in mind. So much for a market-based fixing mechanism. I guess it’s back to the drawing board trying to decipher the PBOC’s exchange rate policy.

Ringgit – at the mercy of the Fed (and oil)

The ‘’buy USD sell EM’’ macro theme has started to slow down, suggesting markets are closer to a balance heading into June’s Fed decision. For the MYR fortunes, it all boils down to the Fed and oil prices over the short term. Over the long run, the MYR will continue to face hurdles as the market re-prices the pace of the Fed hikes.

The likely shift in the Fed hike trajectory curve will negatively affect Malaysia’s US-denominated borrowing costs, and a possible domestic interest rate cut if economic growth continues to deteriorate.