Yen – GDP better than expected

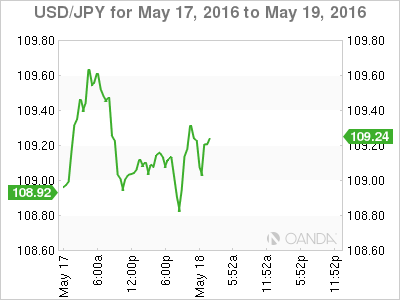

The correlation between USD/JPY and US equities is back in play, as you can virtually overlay yen movements with the latest gyrations in S&P futures. So, traders will be paying particular attention to investor risk sentiment for USD/JPY moves.

Overnight US equity markets gave back almost all of Monday’s gains on Tuesday, with the S&P 500 closing down 0.9%. Fed members have ratcheted up their Hawkish language, which weighed on investors sentiment.

In turn, we saw USD/JPY trade off this week’s highs above 109.60, positioning itself around 109.10 heading into this morning’s GDP. GDP printed above market expectation coming in at 0.4 vs. 0.1 expected. This uptick in GDP gives rise to the notion that recent BoJ stimulus measures are taking hold.

USD/JPY is trading lower, below 109.00, on the better-than-expected print.

G7 is primary focus

However, all eyes remain on the outcome of this week’s G7 meeting, which will likely focus on intervention, tax cuts and the BoJ introducing additional fiscal stimulus. The market is underpricing the risk of additional stimulus from the BoJ and is not factoring in the central bank unleashing the mother of all stimulus packages.

So this week, there is a significant market risk from the G7.

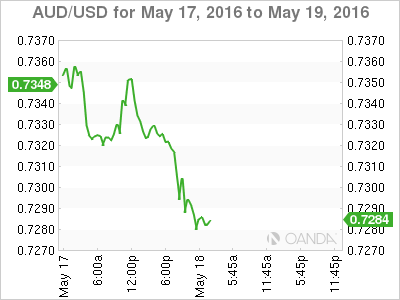

The Aussie – beginning of the easing cycle?

The key take-away from the RBA minutes indicated that the decision to drop rates earlier in the month was a hotly contested issue. This now has traders questioning if the RBA move was a one-off rather than the beginning of an easing cycle. Certainly the decision was more balanced than originally thought, which has given a bounce to the Aussie in recent sessions.

There was a reversal in overnight risk sentiment on the back of hawkish Fed rhetoric, which has temporarily capped the short-term Aussie momentum. However, the uptick in oil prices, coupled with renewed upward momentum in iron ore prices, is suggesting the recent move higher on the Aussie has more to run.

Given the RBA’s heightened focus on inflation, today the Wage Price Index will be carefully viewed by the market. While CPI is a more highly regarded inflation metric, any economic data that feeds into the inflation equation will take on a significant emphasis.

Today’s WAGE PRICE INDEX Q/Q: 0.4% V 0.5%E; Y/Y: 2.1% V 2.2%E came in below consensus, keeping the RBA rate cut expectations in the forefront.

We should expect short-term pressure on the Aussie as rate curve prices in higher probability of RBA interest rate cut, but unlikely to have any significant lasting with oil and commodity prices remaining firm.

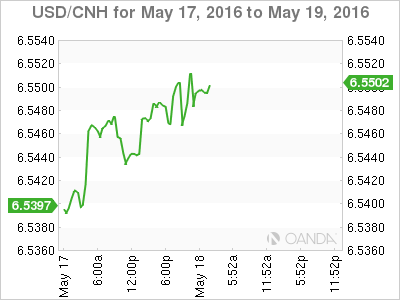

Yuan – struggling with the soft data

Soft data over the weekend is still fresh on traders’ minds. While the overall market risk reaction was muted, the data does heighten concerns that the Chinese economy continues to struggle.

Price action has remained relatively quiet as the regional focus has again turned to USD/JPY with the debate over the outcome of this week’s G7 hogging the limelight.

Ringgit on the up?

Asian currencies are opening stronger after the broader USD sell-off overnight. The ringgit should also benefit from firmer oil prices and improved oil patch sentiment, so expect the MYR tor trade with a positive bias.

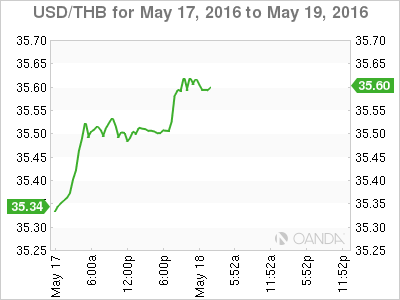

Bhat boosted by GDP

Q1 GDP came in at 0.9% (expected 0.6%). The y-o-y number is 3.2% (expected 2.8%). The surprising uptick in GDP has countered the dovish Bank of Thailand comments last week.

However, with political risk coming to the fore, we should expect the USD/THB to resume its upward trajectory.