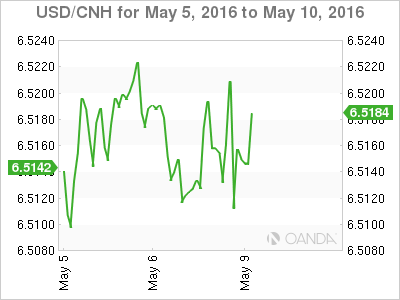

Yuan

Over the weekend, China’s trade balance saw exports slump nearly 2% in April compared with the same month last year. Shocking the market was the 11% decline in imports, another sign that economy continues to stagnate due to tepid domestic and external demand.

Negative data in both areas of trade illustrate the ongoing economic issues faced by the region. Negative investor sentiment continues to grip markets over the fact the PBOC may further devalue the yuan to boost weak exports.

Sentiment around the yuan could set the tone for all FX markets this week, not just the regional basket. I expect a lot of interest in the PBOC fixings this week.

PBOC Midpoint 6.5105 vs. 6.5205

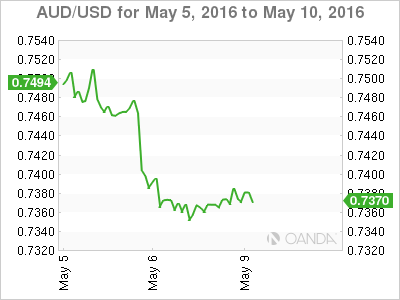

Aussie dollar – plenty to ponder

A monetary policy statement from the RBA painted a very gloomy picture of the domestic economic landscape. However, the significant downgrade in inflation targets grabbed traders’ attention, suggesting more aggressive rate cuts are waiting in the wings. Traders were quick to jump on this forecast change, resulting in the main moves lower in the Aussie dollar.

The bigger downgrade in the inflation forecast implies the market is underpricing the amount of RBA easing that will be required to return inflation to the original 2%-3 % target band.

Moving forward, we should expect the AUD to underperform, especially on the crosses. With interest rates front and center, traders will likely use any commodity-inspired rally to fade Aussie upticks, similar to this morning’s price action when WTI futures opened 2.8% higher in early trade but Aussie’s attempt to rally was met with good selling interest.

Also weighing on Aussie sentiment was China’s latest trade balance figures, which saw exports slump nearly 2% in April compared with the same month last year. But the real shocker was the 11% decline in imports, another sign that its economy continues to stagnate due to tepid domestic and external demand.

However, while the Aussie interest rate path is clearly lower, just how quickly the Aussie will react to the lower domestic interest rates will greatly depend on the US interest rate path, which at this stage is looking lower for longer.

U.S jobs data misses targets

The US employment report failed to provide any clear guidance to a Federal Reserve board struggling to come to grips with the mixed bag of domestic economic data and moderate inflation globally. The nonfarm payrolls print missed the forecast, coming in at 160,000 jobs in April rather than the 200,000 expected.

Despite the market’s initial knee-jerk reaction, traders were ambivalent about the employment miss as the print probably reflects the market positioning, which is short USD and long interest rates.

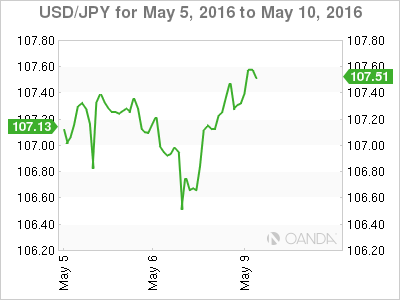

JPY – weaker Yen on the cards?

I suspect the JPY will continue to move in line with broader US dollar moves and domestic equity sentiment. With traders now looking at Japan’s expanding money supply as a precursor for a weaker yen, given the sheer mass of the monetary base expansion, it’s hard not to imagine at some point in the future it will result in a weaker yen.

But with the likelihood of lower for longer US interest rates in the wake of Friday’s weaker-than-expected payrolls data, yen strength should be supported in the short term, especially with Japan’s rising trade and current account surplus translating into global yen demand.

The Nikkei opened up 0.7% on the back of higher oil prices this morning, which is supporting USD/JPY in early trade.

WTI and Brent gapped open this morning on the back of wildfires affecting Canada’s Oil Tar Sands production.

MYR

The Malaysian ringgit continues to slide despite oil prices stabilizing. Oil prices have rallied more than 2% as supply outages persisted over the weekend due to Canada’s wildfires, which have shut half the country’s vast oil sands capacity.