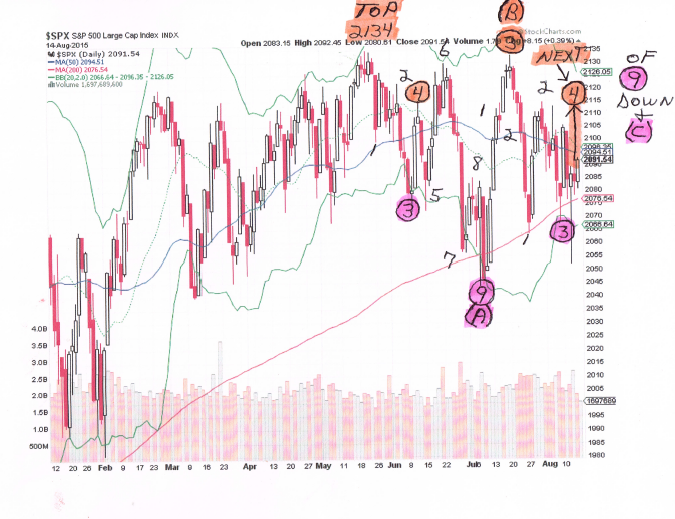

It's a Elliott Wave pattern I have been following since the S&P 500 top of 2134, back near the middle of May. These short term up and down trends are based on my waves that last about 5-8 days.

It is a large A/B/C "bear market pattern" of 9 waves down, followed by 3 waves up, and finally another 9 waves down. We have completed the big (A) wave of 9 waves down. We have also completed the big (B) wave up of 3 waves up and we are now starting the 4th wave up of the big (C) wave down.

Reference my attached chart and notice that we have recently completed wave-3 down (circled 3 in red) and we have started the next up wave (circled 4 in orange). The circled 4 in orange will be a repeat of the previous circled 4 in orange from the big (A) down wave.

It's been an amazing pattern with each wave down or up having the same sub wave counts as the previous down or up wave. That has been true for each big (A) and (C) segment. The current big(C) wave has been 7 sub waves down and 9 sub waves up. Those sub wave counts are from my hourly charts.

It's been great for trading purposes, because we know when we could get a "reverse" in direction.

The fact that it's a "bear market pattern" has me believing that we are "now" in a bear market. Interesting that lately the DOW and the NYSE have both had their 50 dma and their 200 dma do a crossover. It called a "Death Cross" and its a technical sign that the index has entered into a "bear market". Sometimes the indexes will cross a couple of times, so we have to watch and see if these recent crossovers, stay in a "down" postion.

How many investors out there still believe the stock market is random chaos? If you could see what I see every day, you would be amazed. Its the Elliott Wave 5s and 3s repeating on a stock

market chart. I count them and when I get to a target total, I know that I could get a reverse in direction.