Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

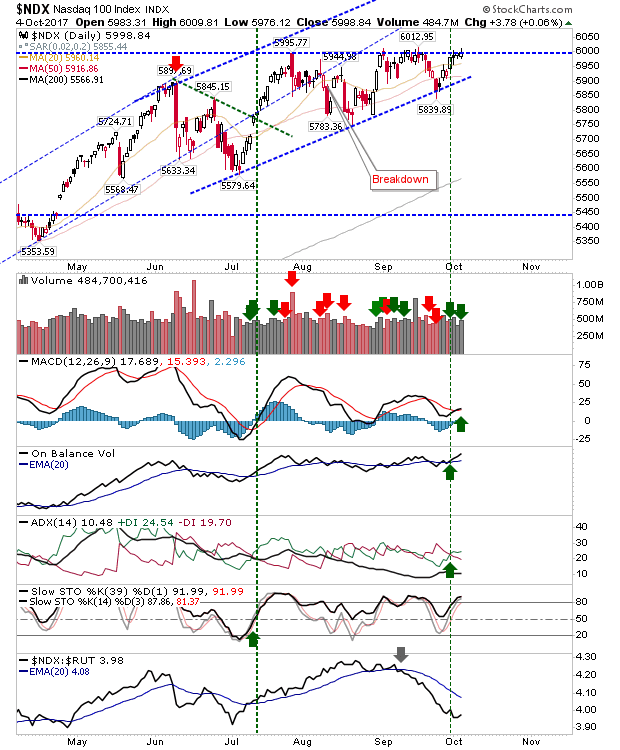

The index which looked ready to the pop spent another day on the sidelines. There is little room for maneuver for either side so if the Nasdaq 100 doesn't pop tomorrow it's hard to know when it will. Volume climbed in accumulation and the MACD triggered a new 'buy'.

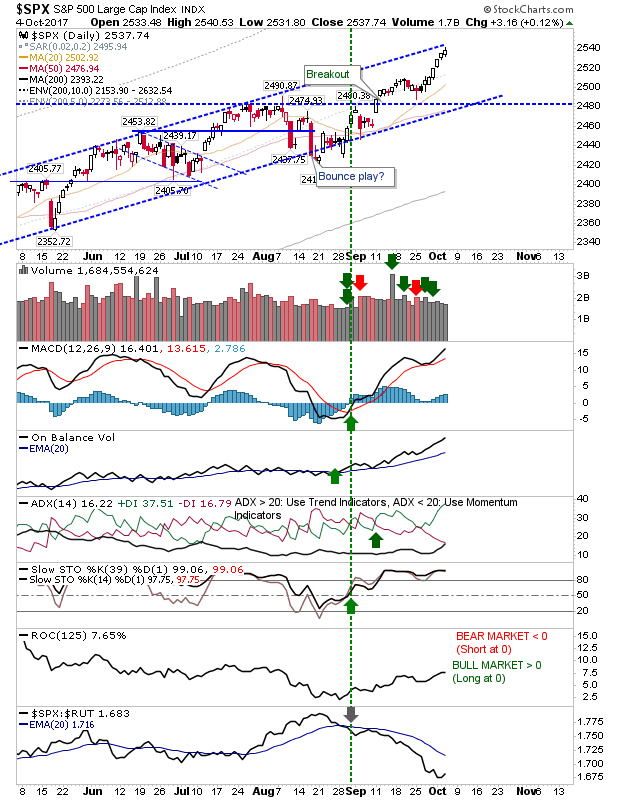

The S&P 500 came very close to tagging channel resistance and today's action came as close as to registering a channel hit. Technicals are healthy although a volume was a little light.

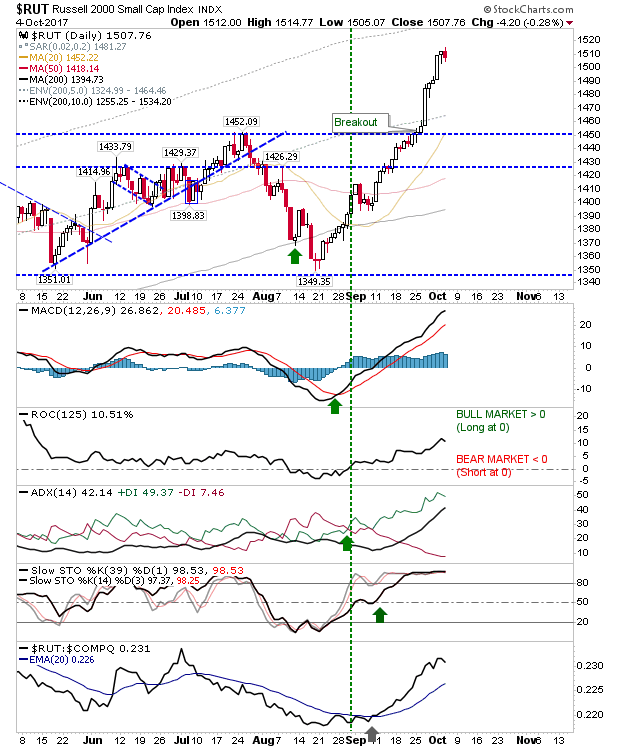

The Russell 2000 lost a little ground but this was to be expected given prior gains. Look for more of the same.

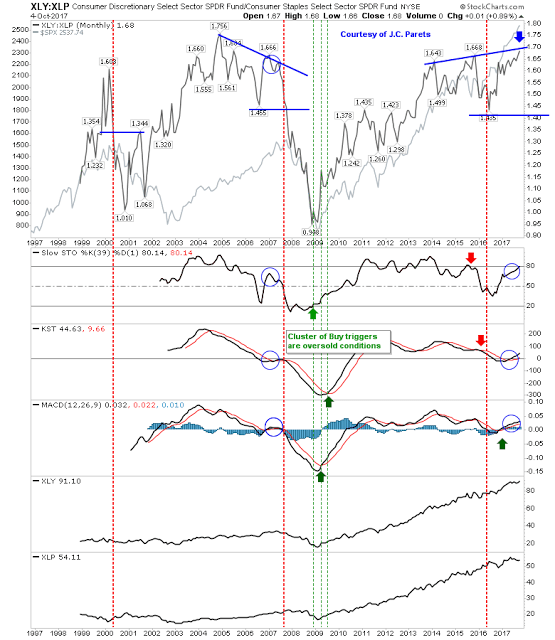

The one index is heading towards resistance is the relative relationship between Consumer Staples Select Sector SPDR (NYSE:XLP)) and Consumer Discretionary Select Sector SPDR (NYSE:XLY). Profit takers take note, now is the time to take some money off the table.

For tomorrow, the index to watch is the Nasdaq 100 but the S&P may be one for which taking some money off the table looks the more prudent action.