We hear talk of the FAANG stocks – Facebook, Apple, Amazon, Netflix and Alphabet (Google) – leading the market higher. Mega large-cap stocks that seem to be able to produce mega returns, year in and year out. But are they really leading the market now? Clearly they are still flying high and making investors rich. But they are not pulling the S&P 500 up to record highs, at least not yet.

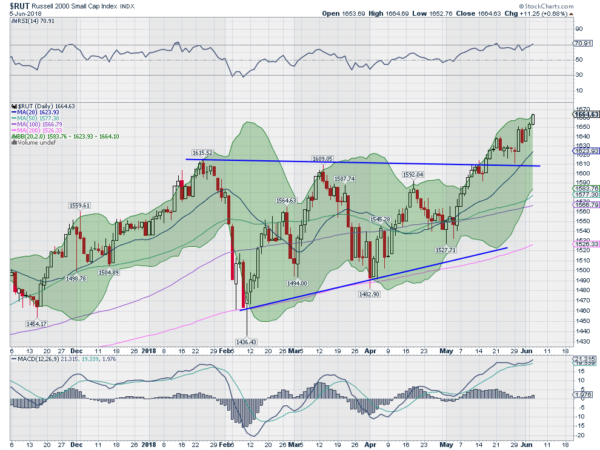

For now it's the Russell 2000 that is leading the charge higher. In other words, small-cap stocks are driving the market. The chart below details the Russell 2000's move. After making a January high, the index then pulled back and moved into a consolidation phase. That phase took the shape of a triangle consolidation with lower highs but also higher lows. On the 5th touch of the triangle, Russell broke out to the upside in the middle of May. It was the first major U.S. index to do so. It came back to retest the breakout at the end of May, held and reversed.

Technical Target

All of which gives a target move to 1760. it would only take a mild overshoot to reach 1776 and wouldn’t that be a grand target for U.S. small caps? Momentum is strong. The RSI is on the edge of overbought, but running sideways and strong. The MACD has just avoided a cross and is moving up again. Both suggest a pause would be welcome to rest momentum lower for the next run, but could continue to support more upside. And the Bollinger® bands are open and turned to the upside to allow a move up. The small leading them all.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.