And A Little Child Shall Lead Them...

This phrase, from the Bible, specifically Isaiah 11:6, gets taken out of context all the time. It really has nothing to do with a child leading all the animals. So lets take it out of context one more time. The Russell 2000, the small cap index or the child, has been leading the charge higher on this leg up in the market since the beginning of April. The Dow Jones Industrials, S&P 500 and NASDAQ 100 have been slower to move, following the small caps higher.

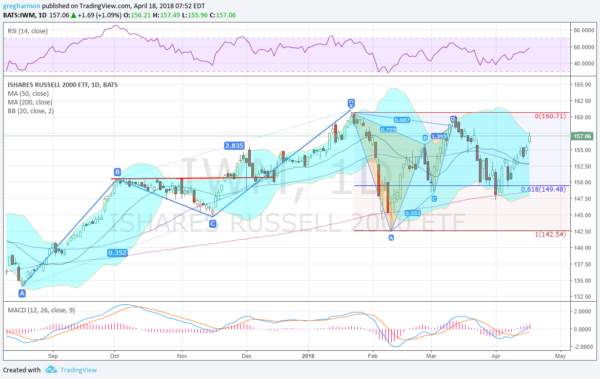

When we look at the chart of the Russell 2000 ETF, $IWM, it shows some strong technical characteristics leading to the price action. The AB = CD pattern that played out through to the January high. This was followed by a retracement of that pattern and a bounce at the 200 day SMA. The morph into a bearish Bat harmonic that reversed at its Potential Reversal Zone (PRZ) and retraced 61.8% of the pattern, finding support at the 200 day SMA again.

It is since then that the Russell 2000 has taken its leadership role. Rising off of the 200 day SMA, it is now pushing the Bollinger Bands open and driving towards its all-time high. As I write it is less than 3 points from that top or less than 2%. The other indexes are 4% or more from their highs. Yet the IWM looks strong and ready to continue. Momentum is building with the RSI pushing 60 and the MACD crossed up, positive and rising. Look for the child to continue to lead them higher.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.