Zacks Rank #1 (Strong Buy) stocks have a long history of outperforming the market over a 1-3 month time period. The number 1 ranking is very exclusive list with only 5% of the Zacks Rank universe earning this grade. The ranking system helps you identify companies that are poised for near term growth, and like the example below can keep you in the best performing stocks over a longer period of time.

Whether it's a widely known large-cap stock, little known small-cap stock or somewhere in between, the steps to success are the same.

The example below demonstrates how being added to the Zacks Ranked #1 list not only helps you identify a top stock over the short term, but how they can continue to grow while they remain on the list.

Example: The Brinks Company

The Brinks Company (BCO) is a mid-cap growth stock in the business services/outsourcing industry that provides business and security services. They have three major segments; Brinks Inc., Brinks Home Security, and BAX Global.

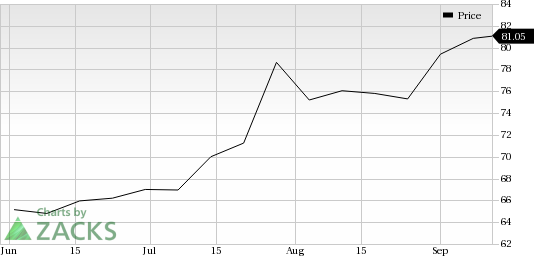

On May 30th, BCO received a Zacks Rank #1 designation as management began to implement new business initiatives in both the U.S. and Mexico. That morning the stock opened at $62.65. Brinks saw positive estimate revisions up through their earnings announcement on July 26th where they posted a +30.6% EPS surprise and handedly beat the Zacks consensus revenue estimate. Analysts responded to the earnings report with another upwards earnings estimate revision. This kept BCO on the Zacks Rank #1 list and the stock price continued to grow.

Three months after being added to the Zacks Rank #1 list, (August 30th), Brinks closed at $77.05; a +23% gain. But not surprisingly as BCO remained a Zacks Ranked #1, the stock price continued to rise and on September 12th shares closed at $81.05; a total increase of +29.4%. Over the same time periods, the S&P 500 was up +1.9%, and +3.5% respectively.

Brink's Company (The) (BCO): Free Stock Analysis Report

Original post

Zacks Investment Research