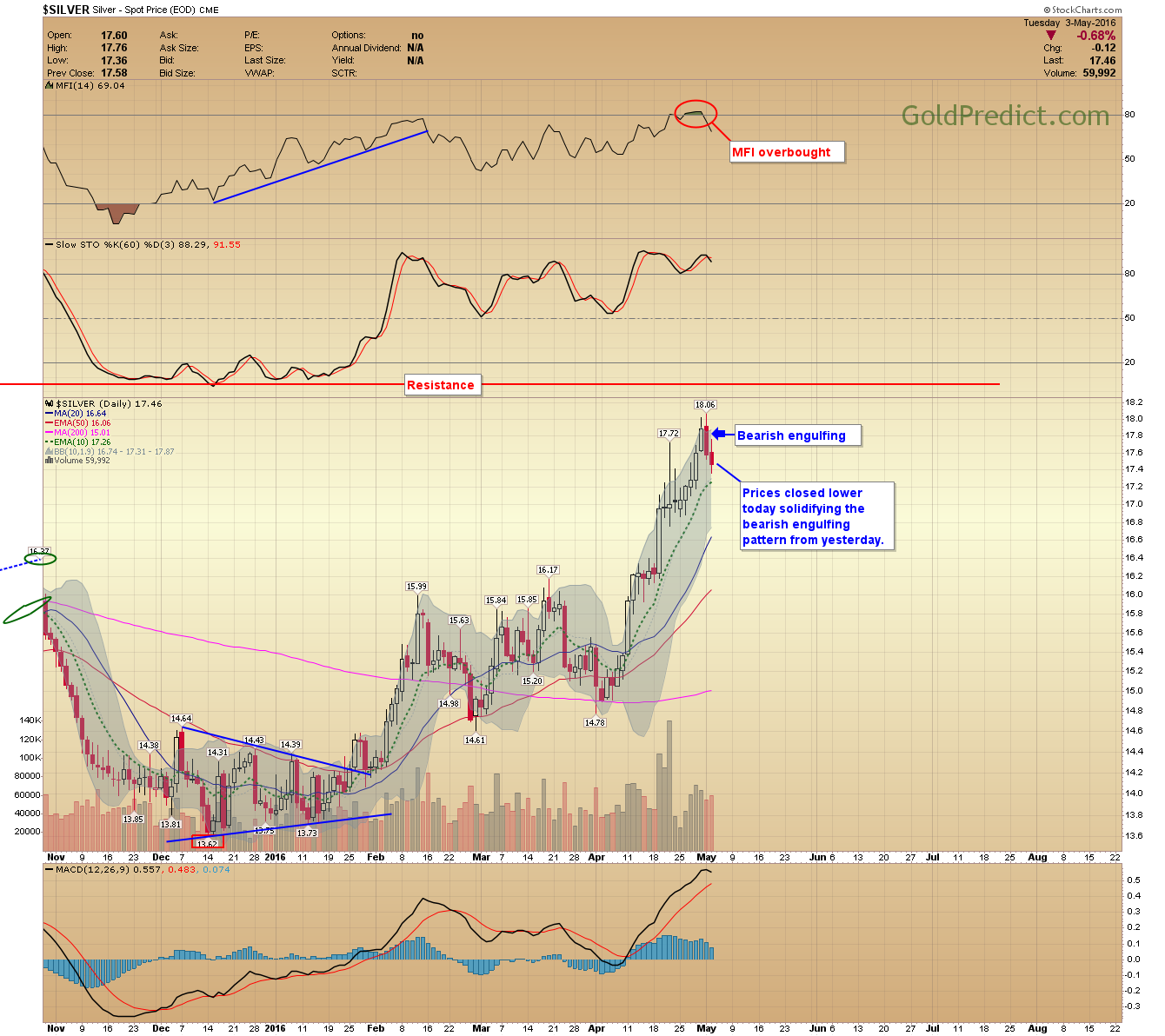

I recently assigned a 20% chance that the 8-year cycle low has not yet bottomed and that precious metals will make new lows later this year. We are now being presented with an opportunity for those odds to increase considerably if the US dollar makes a significant reversal here. Combine this with the bearish engulfing pattern reported in the Silver and COT Update we may be on the cusp of an intermediate correction in precious metals or more.

-US dollar: The big news today is the US dollar, prices made a long reversal candle (hammer) day after breaking through support at 92.50. Today's low must hold for this to turn into a significant low. A panic selloff caused prices to overshoot the lower boundary of the wedge, but the MACD (bottom) is holding its form.

-GOLD: Gold produced a confirmed price swing after the shooting star on Monday; prices aren't keeping the new highs.

-Silver: Prices closed lower today while making a price swing further solidifying the bearish engulfing pattern from yesterday.

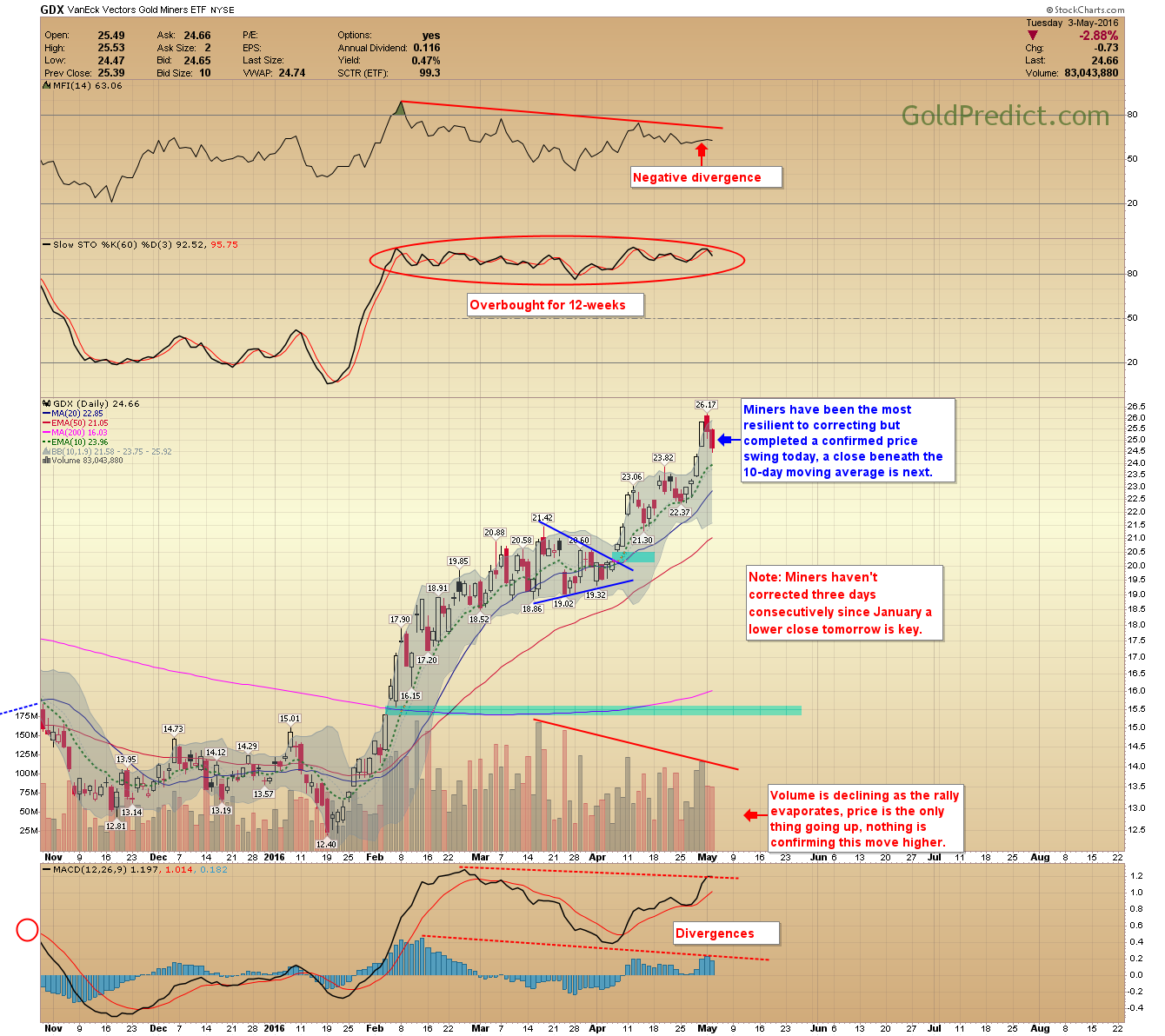

-Market Vectors Gold Miners (NYSE:GDX): Miners have been the most resilient to correcting but completed a confirmed price swing today; a close beneath the 10-day moving average is next. Note: Miners haven't corrected three days consecutively since January a lower close tomorrow is key.

-Market Vectors Junior Gold Miners (NYSE:GDXJ): The same setup as GDX (NYSE:GDX), I get the feeling if miners close lower tomorrow for the third day they will do so exceedingly.

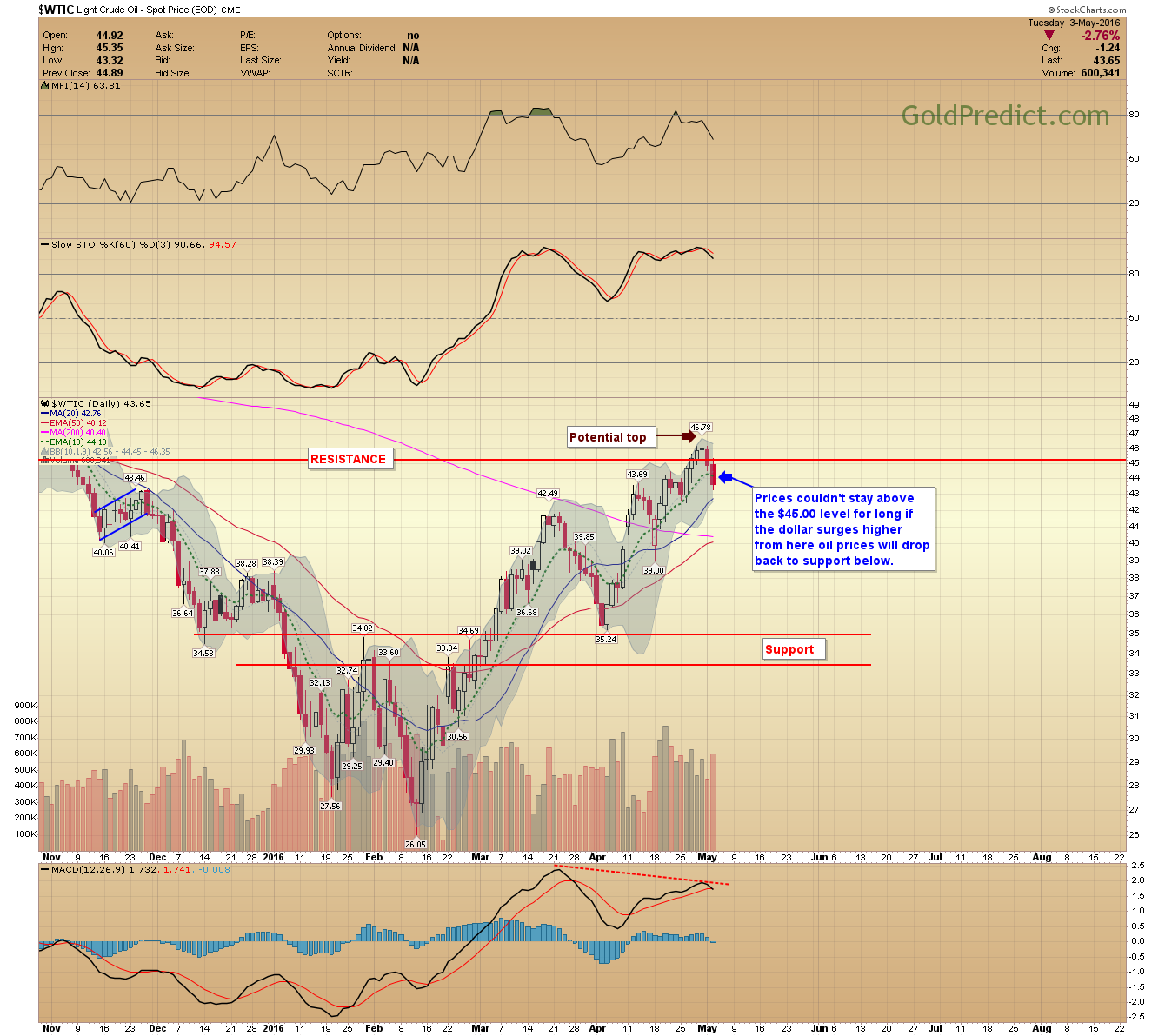

-WTIC: Prices couldn't stay above the $45.00 level for long if the dollar surges higher from here oil prices will drop back to support below.

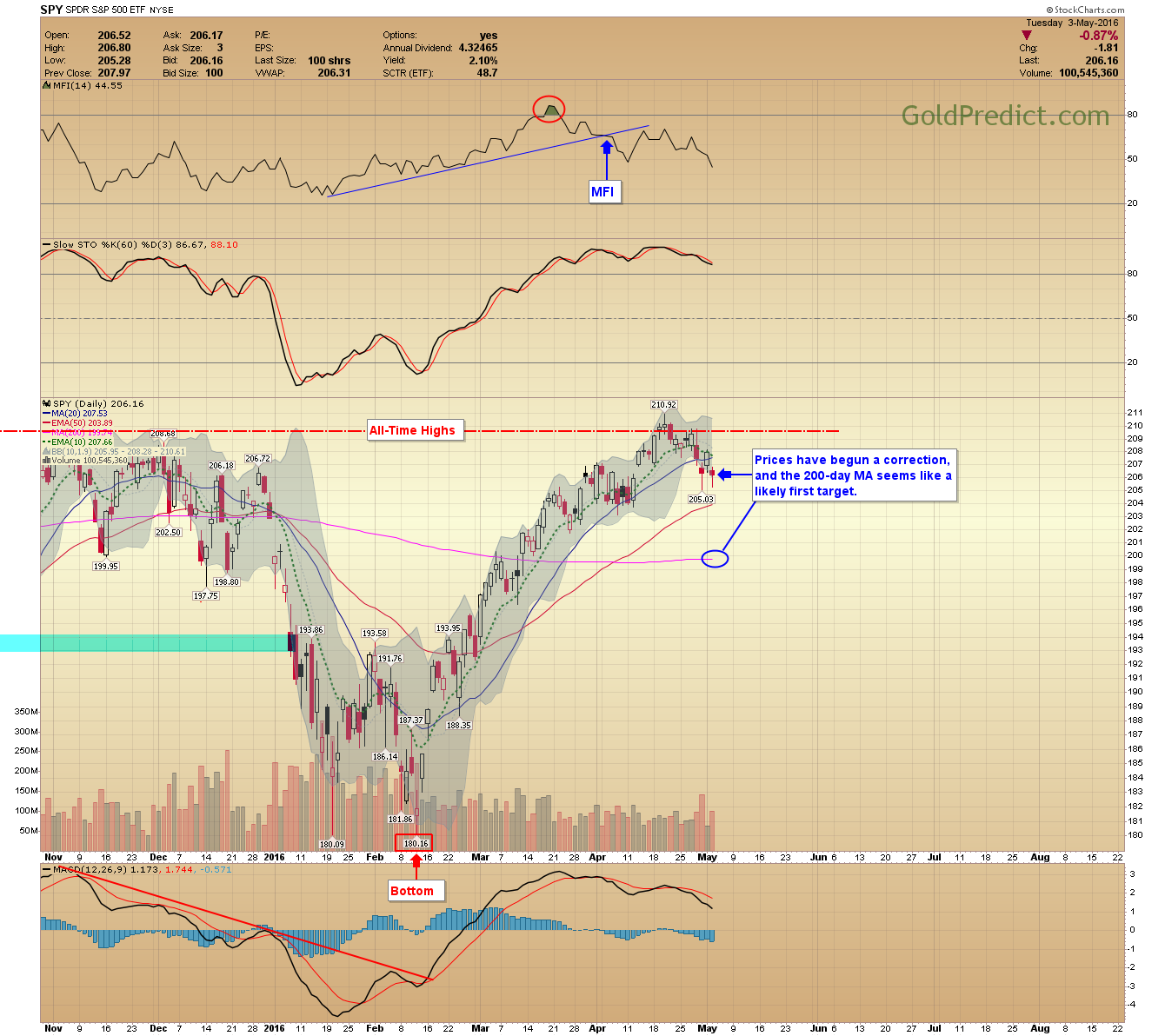

-SPDR S&P 500 (NYSE:SPY): Prices have begun a correction, and the 200-day MA seems a likely first target.

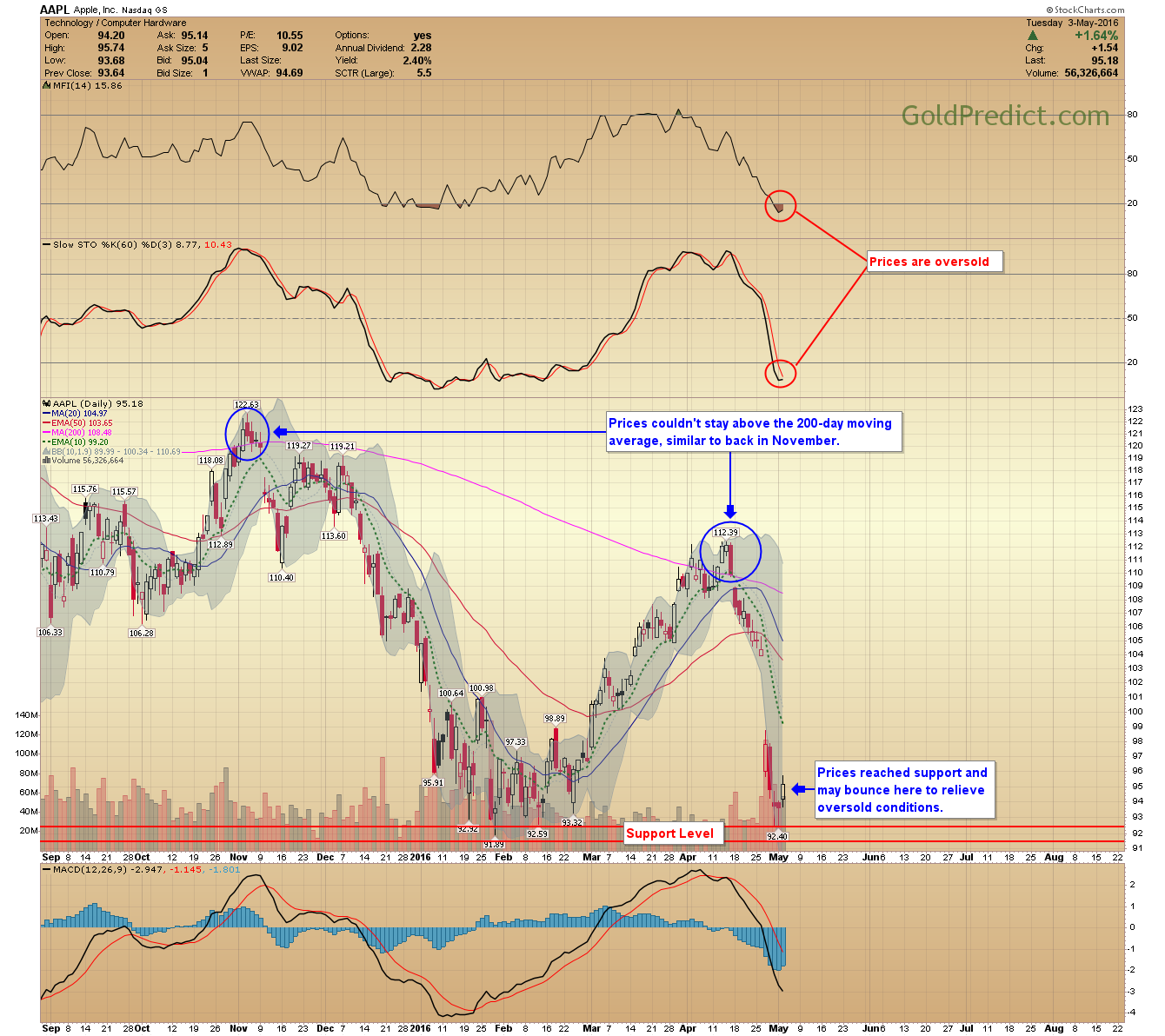

-Apple Inc (NASDAQ:AAPL): Prices reached support and may bounce here to relieve oversold conditions.

Tomorrow is imperative! If the dollar follows through higher then gold, silver and miners are going to drop, probably sharply. I will update throughout the day if necessary.