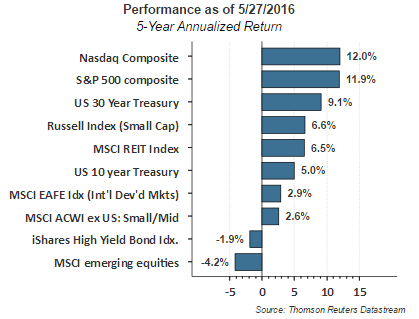

One dilemma that has faced investors over the past five years is the fact that diversification has detracted from a mostly large cap U.S. equity allocation. Investments in high yield bonds and emerging markets generated negative returns, while investments in the NASDAQ and S&P 500 Composites resulted in double digit annualized returns over the most recent five year period.

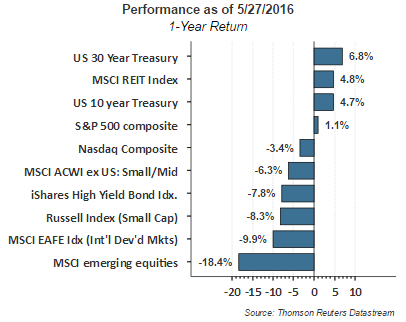

Looking at returns over the past year, a diversified portfolio fared even worse. Investors allocating their portfolio to US Treasury bonds were the big winners. This Treasury rally has occurred in spite of the Fed raising the Fed Funds interest rate in December and rhetoric that another rate hike is very near.

Although our firm is constructive on the potential return for U.S. equity markets as we expect recent earnings headwinds to subside in the second half of this year, we believe there is an opportunity in markets outside the U.S. Our firm maintained an underweight in international markets over the past several years. However, we recently initiated a position in international small/mid equities (ex U.S.) There are many reasons why we have a favorable view on international small/mid equities and will just touch on a few.

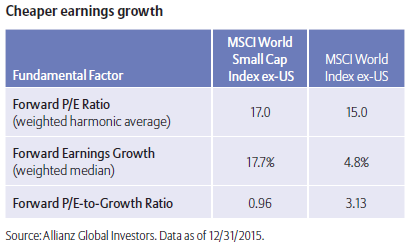

As the below table shows, although the forward valuation (price-to-earnings ratio) of international small cap stocks is slighting higher than the MSCI World Index ex-US, the earnings growth rate for international small caps is over three times higher. This results in a forward PEG (P/E-to-growth rate) of less than 1.0. In other words, whenever an investor can pay less than one times earnings for a stock, all else being equal, the prospects for decent returns is enhanced.

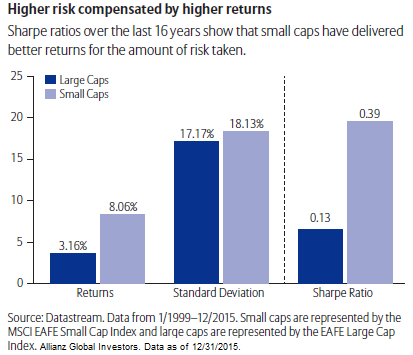

One factor present in international small caps versus developed international equities is the small cap universe of international stocks exhibits a higher level of risk as measured by their standard deviation. Offsetting this higher risk is the fact their returns have been more than double the return of international large cap equities when looking back over the past 16-years. The net result is the small cap universe has a much better risk adjusted return profile.

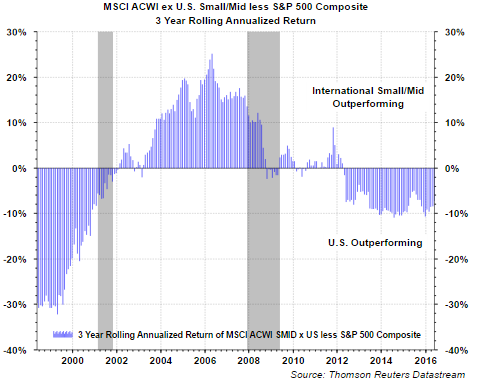

Again, from a return perspective, the below chart shows U.S. large caps (S&P 500 Index) have been outperforming the MSCI ACWI SMID ex-US Index since near the beginning of 2012. Our view is this may be about to change and hence our initiation of a small cap international position in our client accounts.

Certainly, Brexit will grab near-term headlines in Europe as will Greek debt issues. As will the lack of earnings growth in the U.S (although that may be changing) and a Fed 'wanting' to raise rates again. The point is there is always something to worry about. One can look at the glass as half full or half empty.

The recent equity market move in the U.S. proved to investors a 'half-full' perspective was the correct view. The market seems to continue its climb up the so-called wall of worry.