AmerisourceBergen (NYSE:ABC)

AmerisourceBergen, $ABC, rose from a November low to a peak at the end of January. It pulled back then with the market, touching the confluence of the 100 and 200 day SMA’s. The bounce from there made a lower high and it pulled back again. Since then it has made a series of marginally lower highs with lower lows, the last one breaking the 200 day SMA. Thursday saw a push to the upside though. The RSI is also turning higher with the MACD leveling. Look for continuation to participate higher…..

Ally Financial Inc (NYSE:ALLY)

Ally Financial, $ALLY, had a long and strong run higher from a low in May last year to the top in January. Since then it has moved lower in 2 steps or an ABC correction. Least week ended with a move to the upside, potentially ending the downturn. The RSI is moving back higher with the MACD turning up for a cross. Look for more upside to participate…..

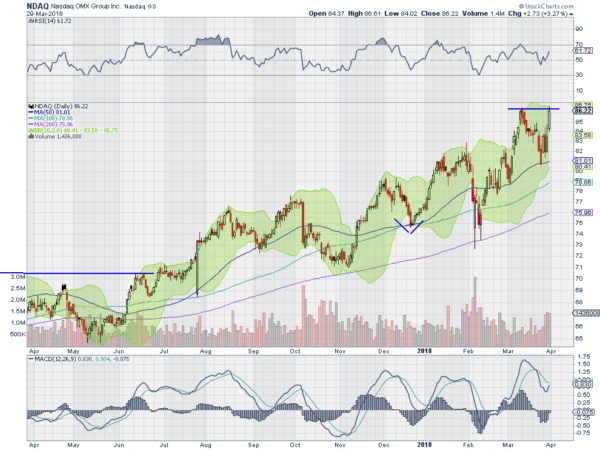

Nasdaq Inc (NASDAQ:NDAQ)

Nasdaq, $NDAQ, has been trending higher since 2012. It has been a choppier trend than other but a strong one nonetheless. Last week ended with the stock back at resistance with the RSI rising in the bullish zone and the MACD about to cross up. Look for a break through resistance to participate higher…..

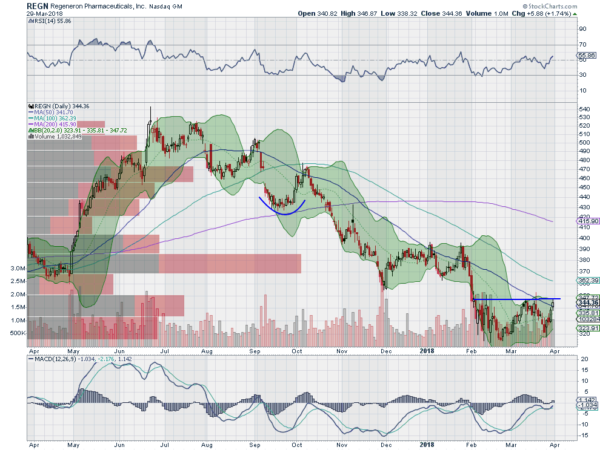

Regeneron Pharmaceuticals Inc (NASDAQ:REGN)

Regeneron Pharmaceuticals, $REGN, fell from a Double Top in July and has kept moving lower. It may have found support in February and at the end of last week was up near resistance. The RSI is pressing higher over the mid line and toward the bullish zone with the MACD avoiding a cross down and turning back higher. Look for a break through resistance to participate higher…..

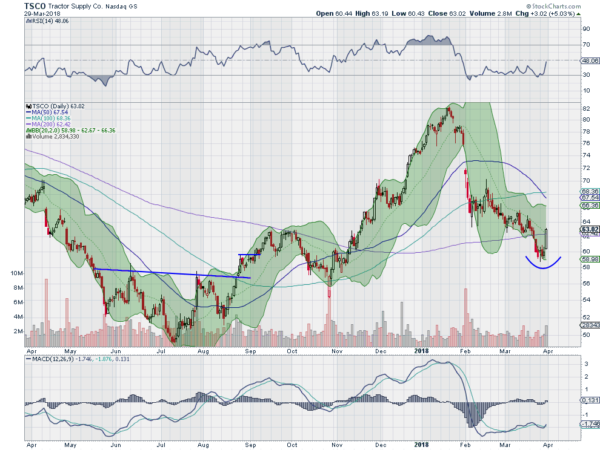

Tractor Supply Company (NASDAQ:TSCO)

Tractor Supply, $TSCO, started higher in July last year, pausing at its 200 day SMA in October and retreating slightly, before a second touch pushed it through in November. That push continued to a top in January. It pulled back with the market then, but failed to get the early March bounce and continued lower. It may have bottomed last week with confirmation higher Thursday. The RSI is making a higher high and the MACD is crossing up. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the books closed on the 1st Quarter of trading saw the equity indexes with their first down quarter in over 2 years and hanging onto long term bullish trends by a thread.

Elsewhere look for Gold to consolidate with a downward bias while Crude Oil turns from an uptrend to consolidation. The US Dollar Index continues to move sideways while US Treasuries are biased higher. The Shanghai Composite and Emerging Markets look to continue to consolidate, the Shanghai Composite at the retest of lows and Emerging Markets at their highs.

Volatility looks to remain elevated keeping pressure on the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show that the bleeding has stopped in the short run, but no strength for a reversal at this point. That said the longer trend remains to the upside. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.