Stocks finished the week off flat with the S&P 500 at 2,706. The NASDAQ did fall about 30 basis points, but some of those losses are likely due to Amazon’s decline of nearly 5.5%. The S&P 500 did struggle a bit at a minor technical resistance around 2,716, but I do not expect that level to act as a significant problem for the market.

Amazon (AMZN)

Amazon fell to technical support right at$1,620. It held near that level all day. The chart is looking even worse than before earnings. It shows that a downtrend is still firmly in place, with the chances for the stock falling to $1,475 increasing. Additionally, the RSI continues to trend lower, with no sign for a change in direction. It is a bearish trend, and it is hard to ignore because after the RSI trend has been the right call now for some time.

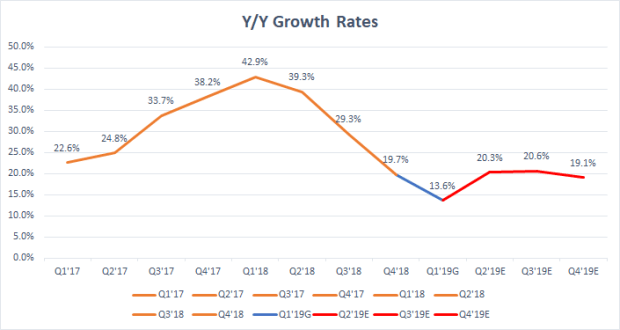

The chart below shows the trend in total sales growth including the company guidance and then analysts future sales estimates. It would suggest to me that perhaps 2019 growth estimates still have further to fall.

Micro (MU)

The chip stocks continue to be hot, with Micron (NASDAQ:MU) rising to about $39.60 and the stock is quickly approaching our resistance zone between $40 and $42. I think the stock can rise to the upper area of $42. The reason is that RSI has now apparently broken its downtrend and is trending steadily higher. A big positive!

On Semi (ON)

On Semi is another name that is rallying and is nearing resistance at $21.90.

Roku (ROKU)

Roku Inc (NASDAQ:ROKU) continues to trend nicely higher, and the stock is still likely heading towards $48.

Visa (V)

Visa Inc (NYSE:V) was down yesterday following results, for reasons that are still beyond me. But today investors seemed to change their mind because the shares rose sharply recovering tall their losses and adding on some to resistance at $140. It looks like this might be a tough level for the stock. We need to watch this one.

Tesla (TSLA)

Tesla Inc (NASDAQ:TSLA) still appears to be on its way towards $330.

Disclaimer: Michael Kramer and the clients of Mott Capital own Tesla and Visa.