Alphabet Inc.’s (NASDAQ:GOOGL) Google has reportedly acquired Belarus-based startup AIMatter for an undisclosed amount.

AIMatter has developed a neural network-based artificial intelligence (AI) platform and software development kit (SDK) for quick detection and processing of images on mobile devices. It has also build a photo and video editing app known as Fabby.

The acquisition underscores Google’s continuous push into AI, leading the company to launch innovative products and services for multiple industries.

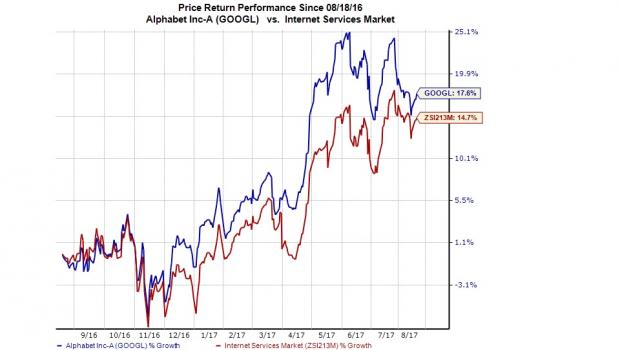

We believe that continuous focus on innovation is likely to drive Alphabet’s stock price going ahead. Shares have appreciated 17.6% in the last one year compared with the industry’s gain of 14.8%.

Possible Usage Options

The AI powering Fabby reportedly uses a number of filters to identify various parts of a selfie and wisely applies hairstyle, makeover effects and digital beautification features. This filtering technology is probably what drew Google’s interest as it can be put to use in its selfie app and Android camera application.

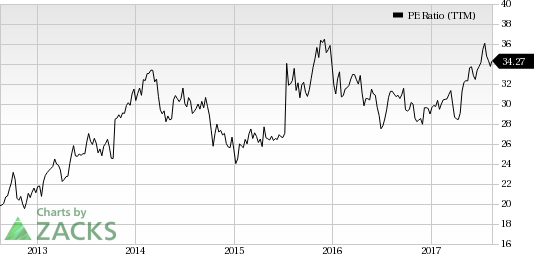

Alphabet Inc. PE Ratio (TTM)

Augmented and virtual reality are other potential areas. The company has been ramping up efforts in these spaces. In its I/O 2017, Google announced that it will be merging its Tango augmented reality system with virtual reality, and that its Tango powered “WorldSense” technology will track a user’s location in the virtual space.

The company is also developing machine learning platforms like TensorFlow to enable developers to build their own apps. AIMatter’s SDK could be of significant use in this respect.

Our Take

Google is well on track with its transition from “Mobile-first” to “AI-First” and its continued AI-based acquisitions indicate that it is increasingly banking on AI and machine learning technologies for growth.

Google’s ability to innovate has translated into strong growth as it continues to adapt to changing market trends. Its innovations outside the core search business include healthcare, self-driving cars, cloud computing and drones, all being driven significantly by machine learning.

Other key players like Apple (NASDAQ:AAPL) , Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) are also ramping up their technologies to develop more solutions. However, each has a different approach toward the use of the technology.

We believe Google is just starting to scratch the surface of what it can do with AI.

Currently Alphabet is a Zacks Rank #3 (Hold) company.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research