Upcoming US Events for Today:

- Consumer Sentiment for July will be released at 9:55am. The market expects 83.0 versus 82.5 previous.

- Leading Indicators for June will be released at 10:00am. The market expects a month-over-month increase of 0.5%, consistent with the previous report.

Upcoming International Events for Today:

- Canadian CPI for June will be released at 8:30am EST. The market expects a year-over-year increase of 2.4% versus an increase of 2.3% previous.

The Markets

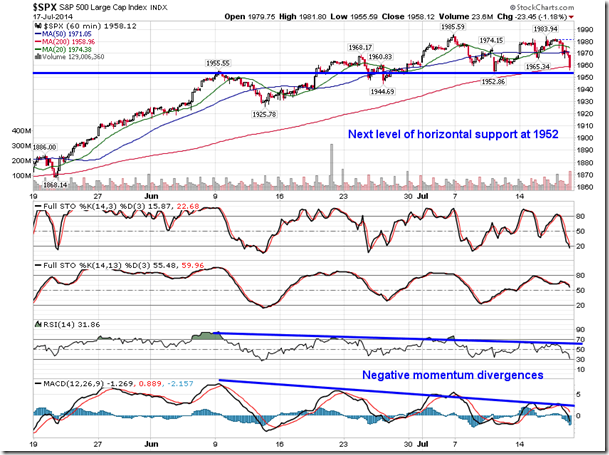

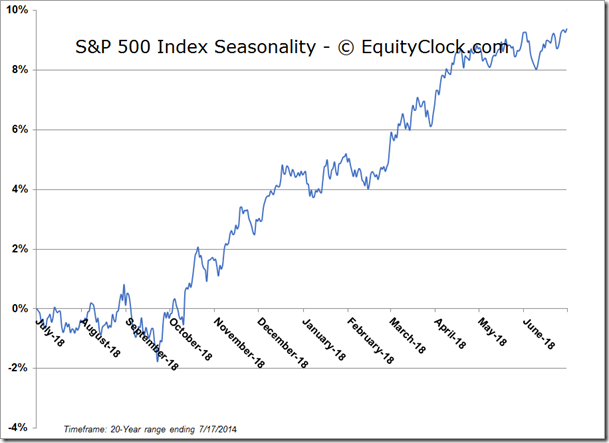

Tough day for stocks as investors reacted to news of a civilian airline shot down over Ukraine. Both the S&P 500 and NASDAQ Composite shed more than 1%, trading below their 20-day moving averages for the first time since mid-May. Turning to the hourly chart of the S&P 500, double top resistance around 1985 has become apparent; momentum indicators have negatively diverged from price over the past month and a half, suggesting waning short-term upside strength. A level of support below the broken 20-day average can be found around 1952, below which support at the 50-day is the next logical test should the event risks prove to be too much for the positive trend of the equity market. As investors continue to digest the news that is being released, it remains premature to speculate on a potential target over the near-term.

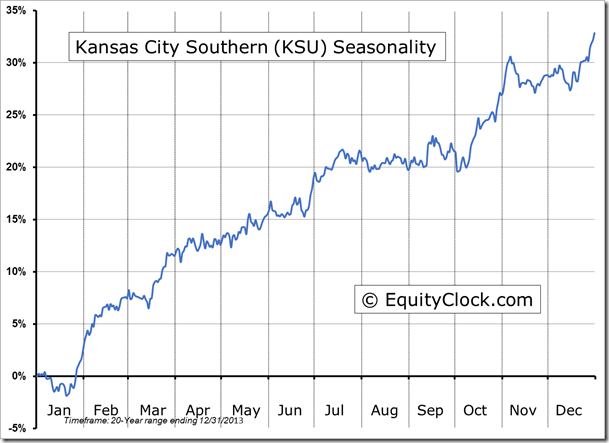

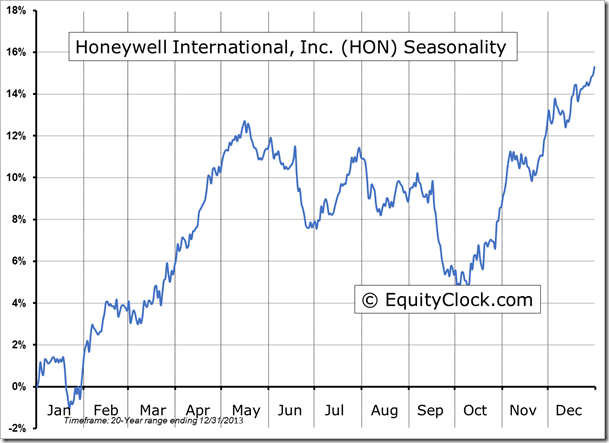

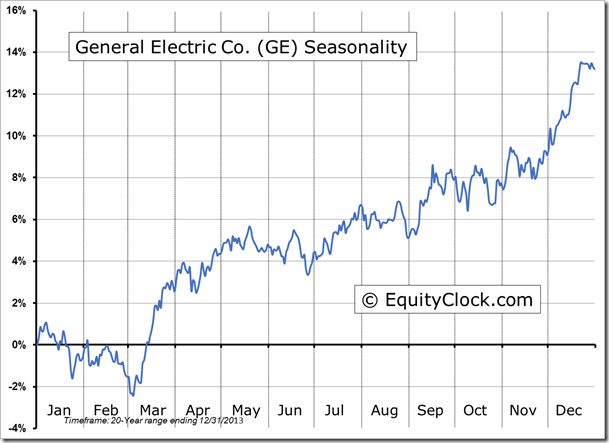

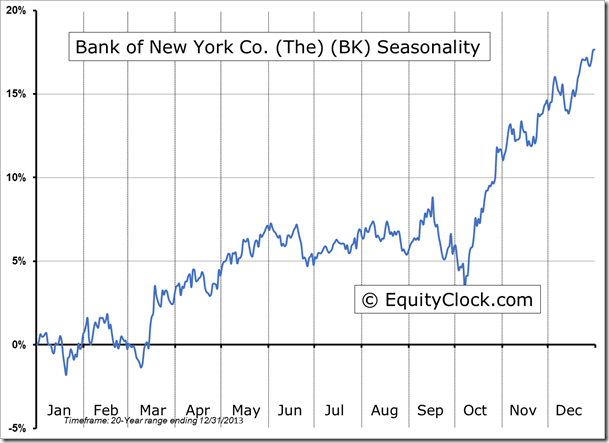

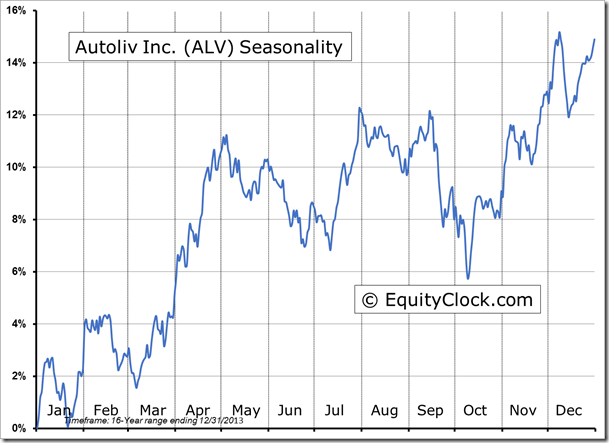

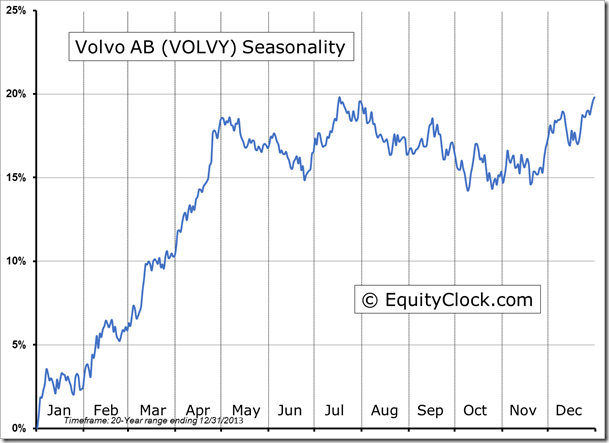

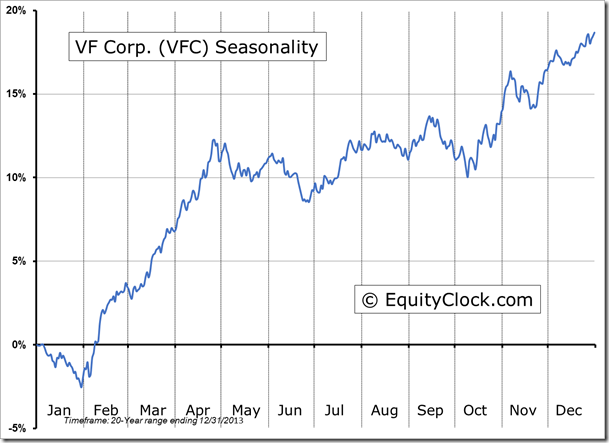

Seasonal charts of companies reporting earnings today:

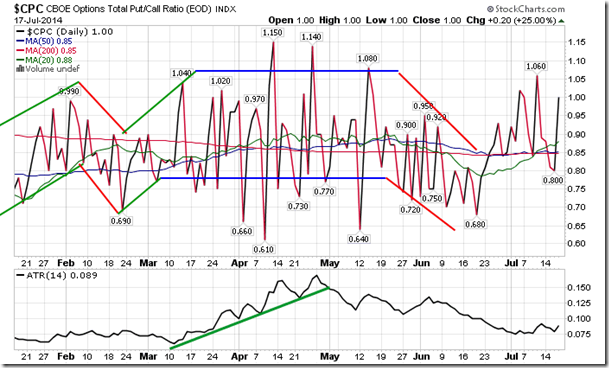

Sentiment on Thursday, as gauged by the put-call ratio, ended neutral at 1.00. With the event risk that fuelled the selloff on Thursday, the Volatility Index (VIX) spiked over 32% to close at the highest level since April as investors sought put options to protect portfolio positions. Both the VIX and the put-call ratio are pointing to bearish trends as the level of cautiousness amongst investors grows.

S&P 500

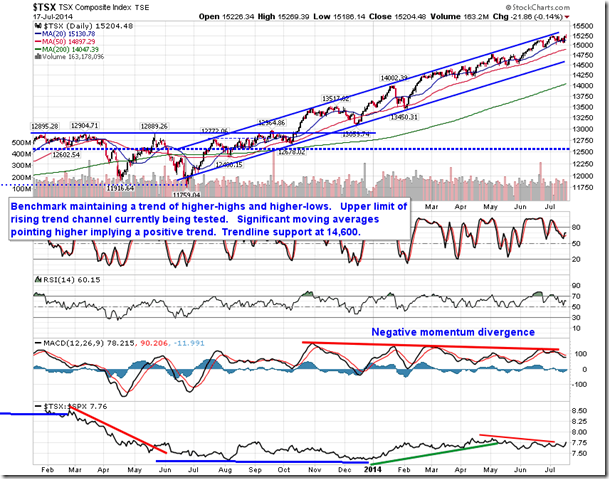

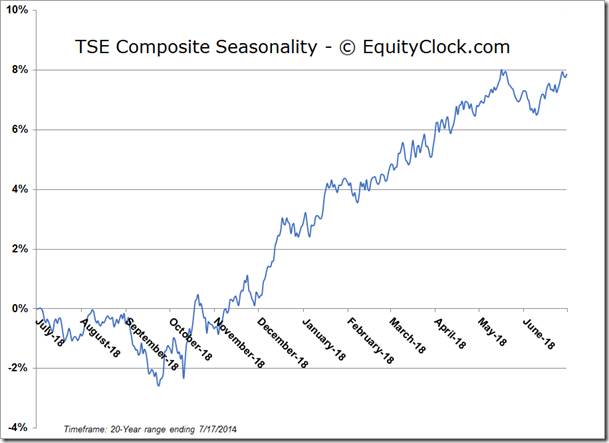

TSE Composite

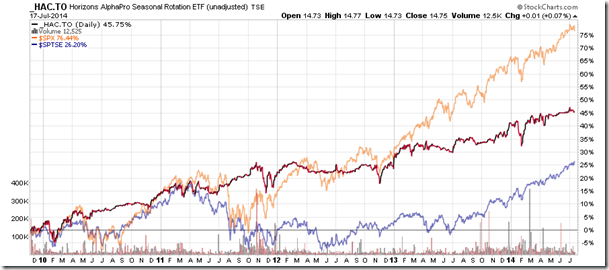

Horizons Seasonal Rotation ETF (TO:HAC)

- Closing Market Value: $14.75 (up 0.07%)

- Closing NAV/Unit: $14.72 (down 0.13%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.94% | 47.2% |

* performance calculated on Closing NAV/Unit as provided by custodian