Global stock markets returned to growth after the US markets closed on a positive note. Although the NASDAQ closed Thursday with a token gain of 0.1 per cent, it managed to recover from an almost two per cent slump intraday.

Buying was concentrated near the close of the trading session, reflecting the positive sentiment of major investment funds and suggesting the positive waves are spreading to other markets.

Hong Kong's Hang Seng is adding 1.5% today, while China's A50 index China is up 2.3%. European and US index futures are also in the green today.

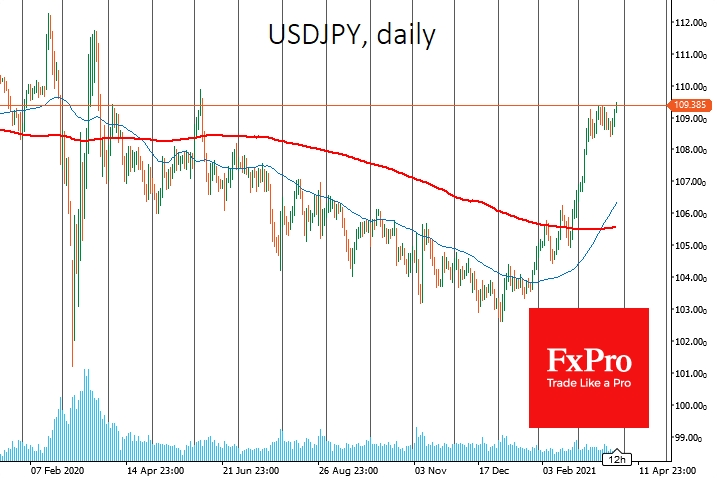

In FX, the most significant decline against the dollar was the safe-heavens, the Swiss franc and the Japanese yen. The USD/JPY returned to a nine-month high above 109.2 after a brief drop towards 108. USD/CHF exceeded 0.94 for the first time, reflecting the return of demand for risky assets.

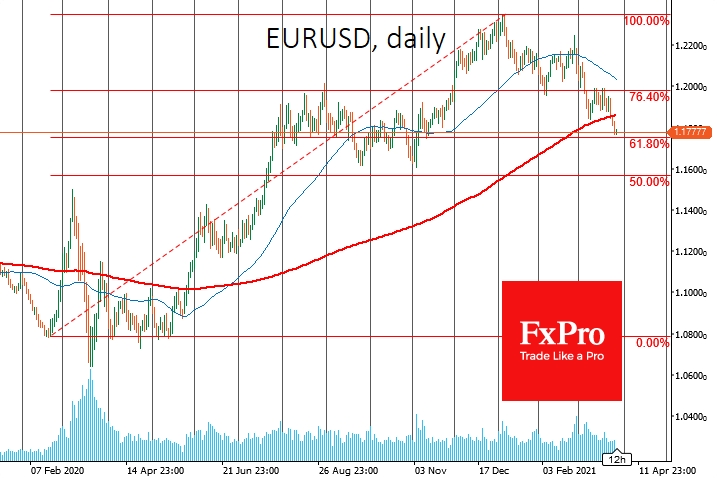

The single currency is now behaving more like a safe-haven, retreating on market gains. As a result, the dollar index has climbed above its 200-day average.

Risk-sensitive AUD, NZD, CNH and GBP stabilise for the second day after an impressive retreat against the dollar. It is worth keeping an eye on the upside of the dollar, as its sustained strengthening has the potential to suppress the markets' optimism very quickly.

The S&P 500 once again received support from buyers on the decline under the 50-day average. Buying took place on higher volumes, further reflecting buyer confidence.

These are all signals that promise to form positive momentum for at least the next few days.

Among the worrying factors, we should note that the test of the 50-day average is becoming more and more frequent. Such increased profit-taking should be a cautionary signal for long-term traders. At the same time, short-term speculators may well remain on the bull's side in the coming days.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

After A Pullback, Markets Find Support, At Least For Now

Published 03/26/2021, 06:41 AM

After A Pullback, Markets Find Support, At Least For Now

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.