Aflac Incorporated (NYSE:AFL)

Aflac, $AFL, started moving higher in May. It continued to run higher until it topped in early January. From there it pulled back to the 100 day SMA before bouncing back to the prior high. A second drop to a lower low, under the 100 day SMA also reversed higher to the prior resistance. then a third drop made a higher low and pushed up and through that resistance. The RSI is bullish and rising with the MACD also rising. Look for continuation to participate higher…..

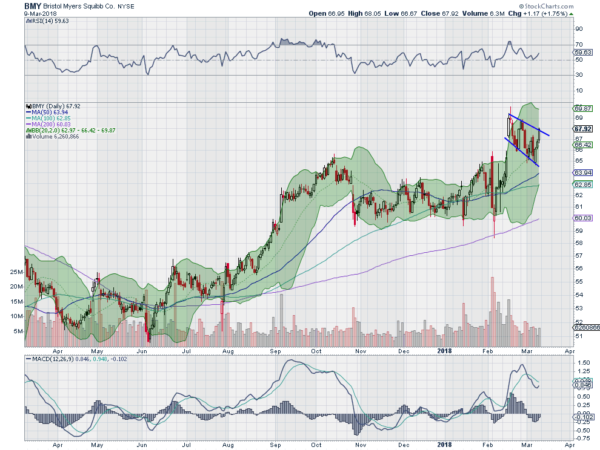

Bristol-Myers Squibb Company (NYSE:BMY)

Bristol-Myers Squibb, $BMY, had a brief pullback at the end of October and then consolidated sideways for almost 3 months. It started higher then and made a top in February. Since then it has pulled back in a channel, until Friday when it peeked over the top of the channel. The RSI is bullish and returning higher with the MACD turning to cross up and positive. Look for upside continuation to participate…..

Capital One Financial Corporation (NYSE:COF)

Capital One, $COF, moved higher off of a September low to a December high in two steps. It pulled back to the 100 day SMA from there before a bounce higher. A second pullback to the 100 day SMA made a higher low and then it bounced again to the prior high. The RSI is rising toward the bullish zone with the MACD crossed up and rising. Look for a push over resistance to participate…..

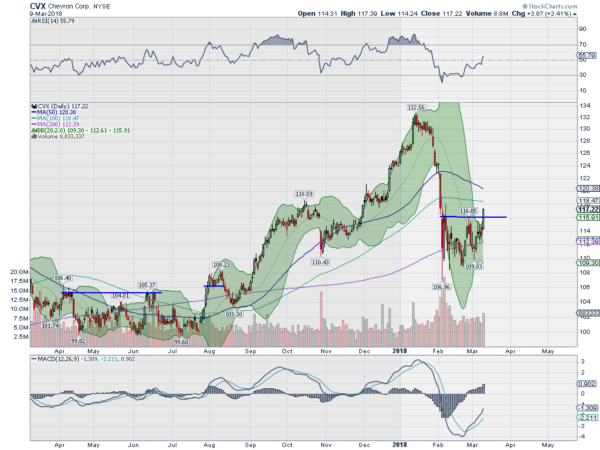

Chevron (NYSE:CVX)

Chevron, $CVX, ran higher from July through to a top in January. It pulled back hard from there to a bottom in February and has settled there consolidating ever since. Friday saw a strong move over the consolidation zone. The RSI is rising towards the bullish zone with the MACD rising. Look for continuation to participate higher…..

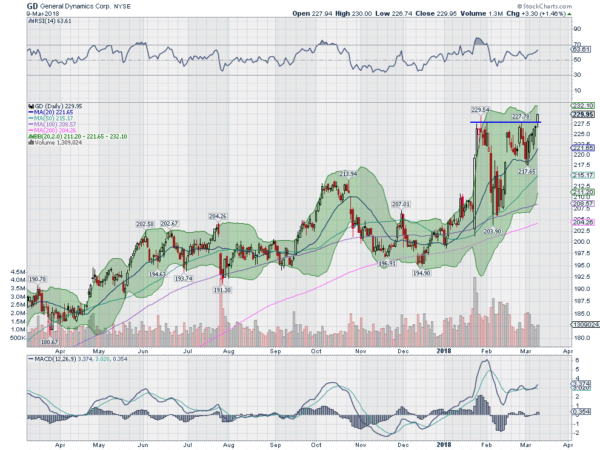

General Dynamics (NYSE:GD)

General Dynamics, $GD, rose out of a double bottom in December. It topped in January before pulling back to the 50 day SMA in February. It rose from there, retesting the top, before a pullback to the 20 day SMA. The following reversal then shot up through resistance Friday. the RSI is rising in the bullish zone with the MACD rising and positive. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into March options expiration week sees the equity markets looking strong, with the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) at all-time highs and the iShares Russell 2000 (NYSE:IWM) and SPDR S&P 500 (NYSE:SPY) near their highs and almost out of danger.

Elsewhere look for Gold to consolidate in a broad range while Crude Oil consolidates with a longer term bias lower. The US Dollar Index is treading water in a downtrend while US Treasuries consolidate in their downtrend. The Shanghai Composite and Emerging Markets are both consolidating, the former from a bounce and the latter at the highs.

Volatility continues to drift lower easing the path for equities. The equity index ETF’s SPY, IWM and QQQ all posted stellar performance for the week, printing bullish Marubozu candles, with the QQQ ending at all-time highs. The SPY and IWM are close to new highs and should they print them the all clear signal will sound for equities. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.