ADTRAN Inc (NASDAQ:ADTN)

ADTRAN, $ADTN, moved higher off of the rising 200 day SMA with a gap and go in July. It topped at the end of July and then started to pull back. It found support at the 50 day SMA and consolidated under resistance until the end of last week. The RSI is moving higher again and the MACD is crossed up. Look for continuation to participate higher…..

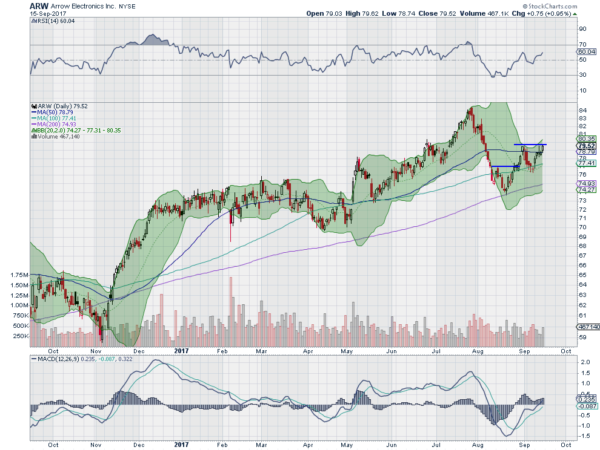

Arrow Electronics Inc (NYSE:ARW)

Arrow Electronics, $ARW, started to move lower in July finding a bottom at the 200 day SMA in late August. It popped from there and stalled at the 50 day SMA. A shallow pullback to the 100 day SMA then reversed again and is moving higher. Now it is at the prior high after making a higher low. An uptrend. The RSI is rising and on the edge of the bullish zone, while the MACD is rising. Look for a push over resistance to participate…..

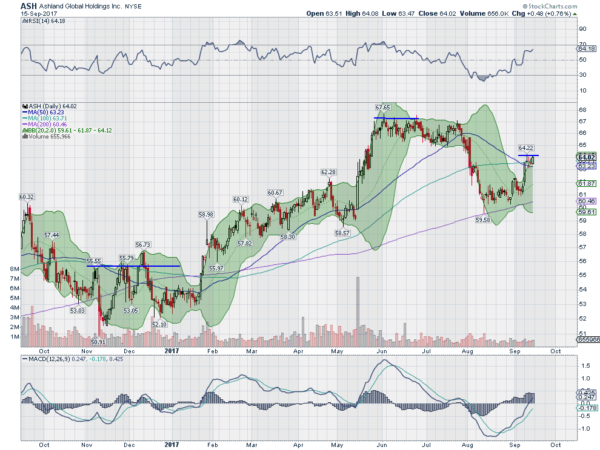

Ashland Global Holdings Inc (NYSE:ASH)

Ashland, $ASH, moved over its 200 day SMA in February and then started a trend higher. It accelerated in May to a top that lasted 2 months. The pullback began in August stopped over the 200 day SMA and moved higher last week. It ended the week in consolidation. The RSI is bullish and rising while the MACD is crossed up and rising. Look for a push over consolidation to participate higher…..

ConAgra Foods Inc (NYSE:CAG)

Conagra, $CAG, made a top in March and started back lower quickly. The fall accelerated in June finding a bottom 20% lower in July. After a quick bounce it stopped short at the 50 day SMA and reversed in mid-August. That drop made a lower low to start September. Then a funny thing happened. It started higher again, moving through the 50 day SMA and stalled just shy of the last high. But rather that fall back Friday showed strength out of consolidation. The RSI is bullish and the MACD rising. Look for continuation to participate to the upside…..

ConocoPhillips (NYSE:COP)

ConocoPhillips, $COP, pulled back from a Tweezers Top in December to a low in March, It gapped up higher out of that low but to a lower high in April and started a slow decline again. That found support at the same low this summer and has been consolidating against a top at the 200 day SMA. Last week saw the Bollinger Bands® widen and price push to a short term higher high. The RSI is in the bullish zone and rising and the MACD is positive and rising. Look for continuation to participate higher….

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as September Options Expiration came to a close saw the equity markets looking strong but with some short term rotation to small caps.

Elsewhere looked for Gold to pause in the pullback in its uptrend while Crude Oil continued higher. The US Dollar Index continued to lose ground while US Treasuries paused in their uptrend. The Shanghai Composite and Emerging Markets were marking time short term as they continued to grind through resistance in long term uptrends.

Volatility looked to remain low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed strength in the longer time frame for all three. In the short term the IWM was benefiting from some rotation, seemingly at the expense of the QQQ and SPY. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.