That popping sound you just heard is the Fed popping the housing bubble. The housing bubble that it inflated with ZIRP and zero-bound credit requirements to qualify for a mortgage. But first, let’s get this out of the way: Goldman’s Jan Hatzius – apparently the firm’s chief clown economist commented that the Fed’s “faster pace” of rate hikes reflects an economy close to full employment. That statement is hand’s down IRD’s winner of “Dumbest Comment of the Year by Wall Street.”

Is an economic system in which 38% of the working age population is not working really able to be defined as “full employment”?

Before we start assuming the Fed will raise rates three times in 2017, let’s consider that Bernanke’s “taper” speech was delivered in May 2013. 3 1/2 years later, the Fed Funds rate has been nudged up a whopping 50 basis points – one half of one percent.

I hope the Fed does start raising rates toward “normalized” rates, whatever “normalized” is supposed to mean. Certainly there’s nothing “normalized” about an economic system in which real rates are negative – that is to say, an economic system in which it’s cheaper to borrow money and spend it than it is to save.

Having said all that, put a big pitch-fork into the housing market. Notwithstanding the highly manipulated “seasonally adjusted annualized rate” data puked on a platter and served up warm by the National Association of Realtor and the Census Bureau – existing and new home sales data, respectively – the housing market in most areas of the country is deteriorating at an increasing rate.

Even just marginally higher mortgage rates will choke off the ability of most buyers to qualify for anything less than an conventional mortgage, with 20% down and a 720 or better credit score. With a rapidly shrinking full-time workforce – the Labor Department reported that last month the economy lost 100,000 full-time jobs – the percentage of the population that has a 720 credit rating and can afford 20% is dwindling rapidly.

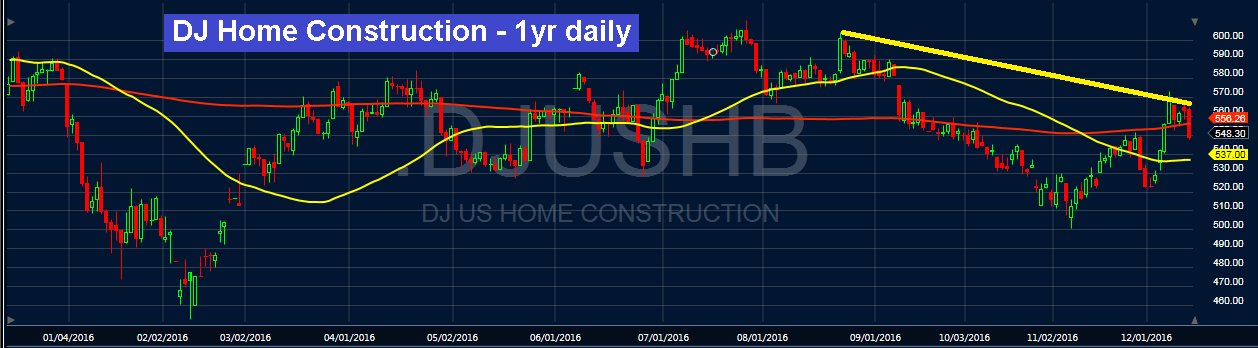

The Dow Jones Home Construction Index is down 2.5% today. What will happen to the stocks in that index when the Fed cranks back up it’s “we’re raising again” song and dance?

Despite the rampant move in the Dow/SPX since the election = while the Dow and SPX were hitting all-time highs almost daily – the momentum was not enough to propel the homebuilder stocks even remotely close to a 52-week high. Hell, the 50 dma (yellow line) has remained well below the 200 dma (red line) and has not even turned up. THAT is the market sending a message.

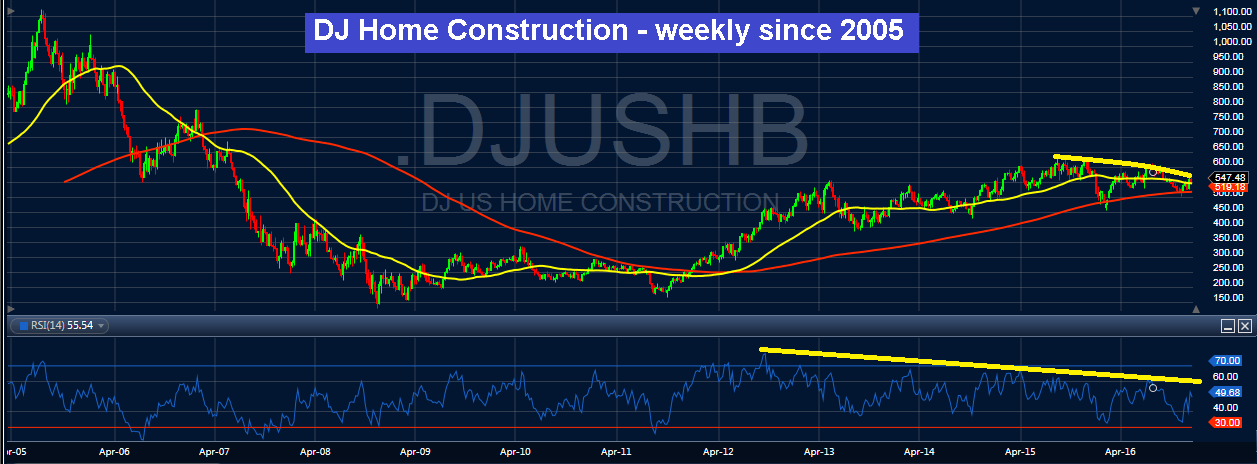

Here’s a weekly version of the same graph that goes back to 2005, when the DJUSHB hit an all-time high:

When looked at it in that context, one has to wonder where this great housing boom has been hiding. The stock market certainly didn’t price in a booming housing market. That’s because the truth is that the housing market since 2008 has been driven by massive Fed and government intervention.

The intervention enabled a segment of the population to buy a home that could not have otherwise afforded to buy a home. It was really not much different than the previous bubble fueled by liar loans and 125% loan-to-value mortgages. As I detailed yesterday, the system is now re-entering a cycle of delinquencies, defaults and foreclosures.

If you are thinking about buying a home – primary, vacation or investment – wait. You will be happy you waited. Prices have been pushed up to near-record levels by 3% down payment mortgages and credit assessment that gears the amount of mortgage available to a buyer based on maximizing the monthly payment based on monthly gross income. That system is over now. Prices and volume are going to spiral south.

If you need to sell your home, you better list it as soon as possible. You will find that you will be competing with a surge in new sellers that descend like locusts. “Price reduced” signs will blossom everywhere. Just like 2008…