After the huge run-up on Monday, I was deathly concerned that we were in for another month-long grind higher, just like we experienced from February 9th to March 9th. Tuesday’s tumble helped lay that concern to rest.

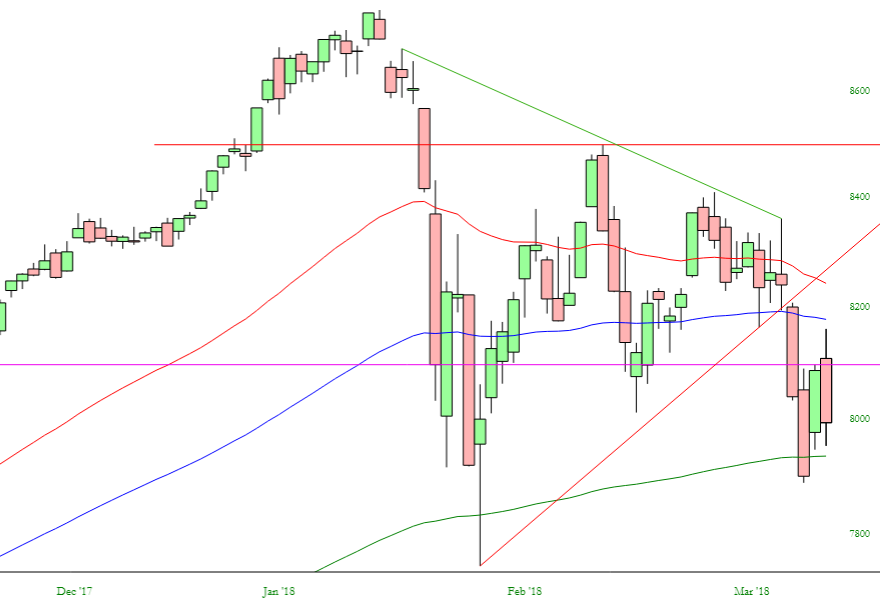

Let’s just take another look at some big indexes and what they tell us. Let’s first examine the Dow Jones Composite.

What jumps out at me is what’s on the left side of the chart versus what’s on the right side. What do you see on the left? Boredom. Minuscule daily ranges. An unending grind higher, day after day. Dullsville.

How about on the right? Dynamism. Volatility. Huge moves. And a general downtrend.

I guess no one will be surprised to read that I greatly prefer what’s on the right. The stuff on the left sucked.

You’ll also notice that, slowly but surely, the moving averages and tipping lower, plus they are doing a yeoman’s job hemming in the price activity.

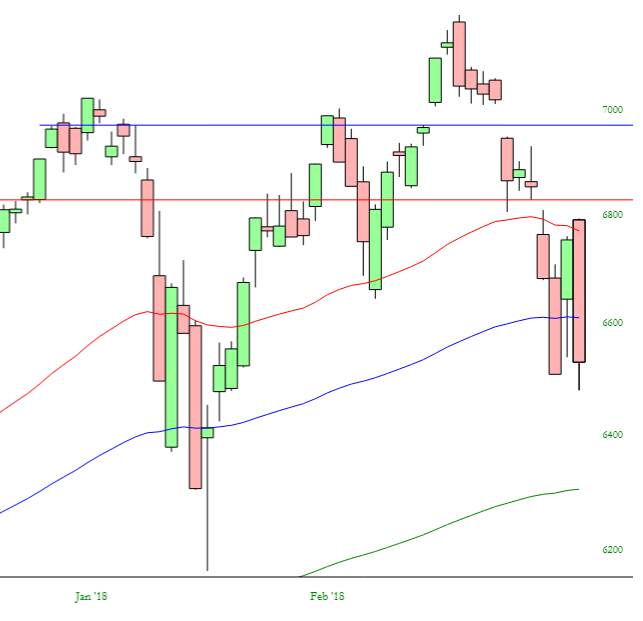

Looking at the S&P 500, below, you can see how we didn’t even get within spitting distance of the Wednesday/Thursday gap (red arrow), and, importantly, we created a monster of a bearish engulfing pattern today. There are only two trading days left this quarter, and in spite of nothing important on the economic calendar, they could be exciting ones.

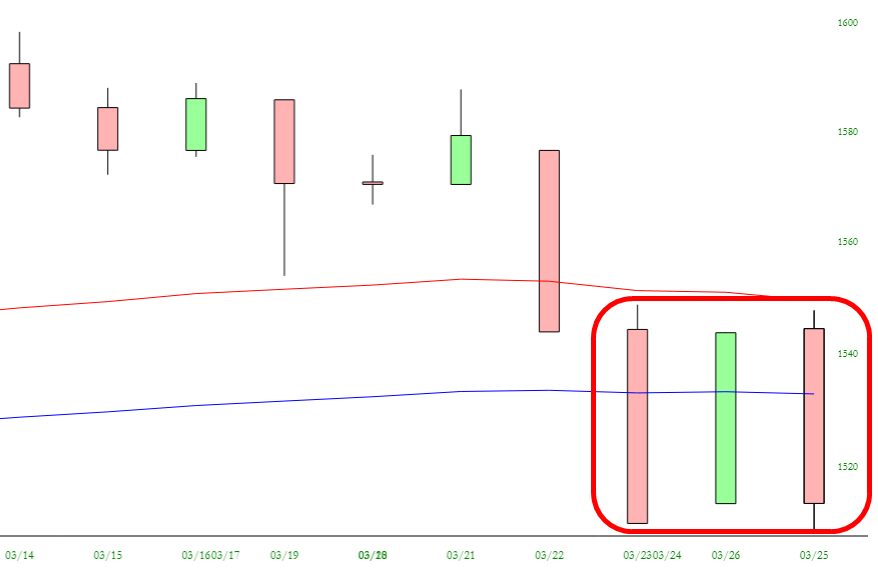

The Russell 2000 is in a weird state. I’ve zoomed in close on recent activity. It seems that the small caps simply made it their purpose in life to piss everyone off. Just look at how range-bound it is!

Not so with the NASDAQ, however. As leaders such as Nvidia and Tesla (NASDAQ:TSLA) have their high-tech nuts blown off, the entire tech complex is rolling over (led by Facebook (NASDAQ:FB), which has lost an incredible ONE QUARTER of its entire market cap only since last month began). Check out the king-sized bearish engulfing pattern on the NASDAQ today:

Lastly, on the Dow, I’m more convinced than ever that the ultimate high has been set as of January 26th. We remain thousands of points off the high, and I think it will be a long, long time before we ever see such levels again. The Wednesday/Thursday gap remains key across the board.