AT40 = 63.6% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 60.3% of stocks are trading above their respective 200DMAs

VIX = 9.6 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

The stock market had a relatively bland day yesterday, which matched a relatively bland statement on monetary policy from the Federal Reserve. The S&P 500 (SPDR S&P 500 (NYSE:SPY)), the NASDAQ, and the PowerShares QQQ ETF (NASDAQ:QQQ) all made VERY marginal new all-time highs. AT40 (T2108), the percentage of stocks trading above their relative 40-day moving averages (DMAs), even closed right where I left it last Friday in my last Above the 40 post. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, also closed where it ended last week. The volatility index, the VIX, closed just 0.2 above its Friday close.

The S&P 500 (SPY) is floating higher….

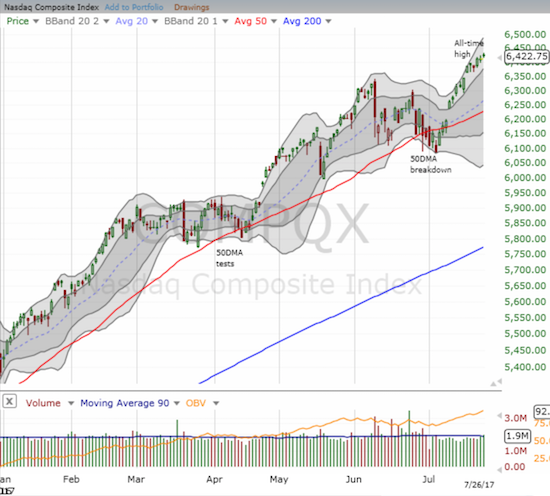

The NASDAQ continues to trend consistently higher since its last 50DMA breakout.

The PowerShares QQQ ETF (QQQ) was barely slowed by Google’s (NASDAQ:GOOG) post-earnings slip.

The volatility index, the VIX, has bounced notably off its lows two days straight. Is a bottom forming?

While the closes were unremarkable, the paths to these closes DO interest me. The major indices are still on general uptrends defined by their upper-Bollinger® Bands (BBs). The S&P 500 is threatening to break through the ceiling I expected for the next few months. Over the last three trading days, the VIX closed at levels lower than only one other trading day since 1990. Tuesday’s intraday low set a new record for this time period. Yet, as all looks calm and peaceful, AT40 struggled again to break into overbought territory: it faded from the edge of 70%. Tuesday, AT40 faded from a high of 68.7% to close at 66.8% and continued the fade yesterday with a close at 63.6%. So the caution that I expressed earlier remains.

The U.S. dollar index (DXY0) betrayed the calm of the day by losing another 0.8% and closing at its lowest level since early May, 2016. I guess the Fed did not give traders any reason to stop selling the dollar as they have done relatively consistently for most of 2017. It is possible to torture the Fed’s statement and tease out a driver like an implicitly more dovish inflation outlook. However, since the Fed said it “expects to begin implementing its balance sheet normalization program relatively soon, provided that the economy evolves broadly as anticipated,” I think the teases are a wash. Regardless of the headlines of the moment, the main story remains the dollar’s descent for most of 2017.

The U.S. dollar index (DXY0) sold off again as the Fed failed to provide any support…moral or otherwise.

One important consequence of the dollar’s fresh weakness is the renewed strength in the commodity complex which in turn breathed fresh life into the Australian dollar (NYSE:FXA). At the time of typing, AUD/USD got an additional boost during Asian trading and zipped past the 0.80 mark. I am fading anew per my assessment that the Reserve Bank of Australia has absolutely no interest in doing anything, like a rate hike, that would further strengthen the currency. (As a reminder, I am no longer bearish the Australian dollar, but I am still being opportunistic with shorts if the setup arises).

The Australian dollar soared against all major currencies. AUD/USD punched right through the 0.80 level.

Chipotle Mexican Grill (NYSE:CMG)

The earnings trade on CMG did not play out as I had hoped. I was looking for a big (upside) move. Instead CMG opened weakly and closed right at its recent low. The move was perfect for imploding the value of call and put options.

The previous day, I positioned for earnings when my conditional order to buy a $370 strike call option triggered once CMG surpassed its Monday high. While the upward momentum was enough to generate a small gain, I decided to hold and sell an out-of-the-money $390 strike call option against my profitable call and then use that premium to buy an out-of-the-money $315 strike put option. While the weak post-earnings open told me CMG was likely in trouble, I decided to sit on my hands and wait out the day. In after hours, CMG fell another 1.8% or so on news of a subpoena connected with the Sterling, VA incident. I think this is a short-term buyable dip given this subpoena looks like standard practice, but I will wait to see buyers show up. From the related 10Q filing:

“On January 28, 2016, we were served with a Federal Grand Jury Subpoena from the U.S. District Court for the Central District of California in connection with an official criminal investigation being conducted by the U.S. Attorney’s Office for the Central District of California, in conjunction with the U.S. Food and Drug Administration’s Office of Criminal Investigations. The subpoena requires the production of documents and information related to company-wide food safety matters dating back to January 1, 2013. We received a follow-up subpoena on July 19, 2017 requesting information related to illness incidents associated with a single Chipotle restaurant in Sterling, Virginia. We intend to continue to fully cooperate in the investigation. It is not possible at this time to determine whether we will incur, or to reasonably estimate the amount of, any fines or penalties in connection with the investigation pursuant to which the subpoena was issued.”

Chipotle Mexican Grill (CMG) looks like it is on the edge of a fresh swoon downward after suffering a notable post-earnings fade.

Ulta Beauty (NASDAQ:ULTA)

My latest trade in ULTA offset the losses on CMG.

In my last Above the 40 post, I noted the bearish implications of ULTA’s post-earnings downtrend and even hazarded a guess that investors were trying to ease out of the stock ahead of the Amazon Panic contagion. Sure enough, today came news that competitor Violet Grey may be in talks with Amazon.com (NASDAQ:AMZN). Frankly, given the stock’s breathtaking rise, I assumed that ULTA has no serious competitors. If this news is credible, then there is yet one more reason for investors to stop paying up for this momentum stock. I sold my put options into the dip (I had to wait out an initial obligatory bounce from the gap buyers), and I will let my single call option hedge sit.

The downtrend says it all: Ulta Beauty (ULTA) once again confirms its 200DMA breakdown.

U.S. Steel (NYSE:X)

In early June, I wrote about the case for speculating in U.S. Steel (X) after the stock was finally showing signs of life in the wake of April’s massive post-earnings sell-off. I did not initiate a new trade in X ahead of its earnings. I wish I did! X is now up 19.9% since my post.

The rebound in U.S. Steel (X) continues. A post-earnings bounce met with proximate resistance from a flattening 200DMA.

In other trades: Caterpillar (NYSE:CAT) soared ever closer to a new all-time high after earnings on Tuesday. Deere (DE) jumped in sympathy, and I took profits.

Active AT40 (T2108) periods: Day #362 over 20%, Day #176 over 30%, Day #43 over 40%, Day #14 over 50%, Day #9 over 60% (overperiod), Day #122 under 70%

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

Be careful out there!

Full disclosure: long SHLD call options

*Charting notes: FreeStockCharts.com uses midnight U.S. Eastern time as the close for currencies.