About three weeks ago, I wrote about opportunities in European equities (see Worried about US equities? Here's an alternative!). I pointed out that stock prices in Europe were far cheaper than US, the fears about European integrity and financial system were overblown, and the market seemed to be ignoring signs of a growth recovery.

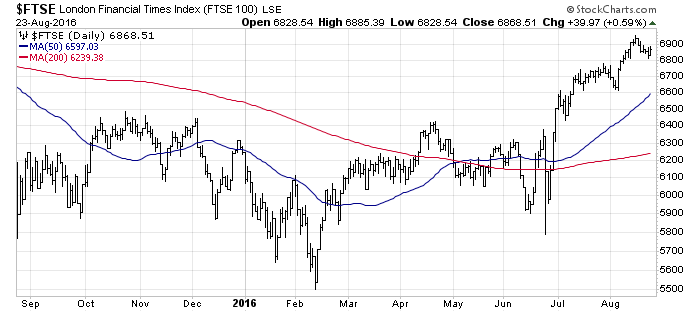

Since then, the FTSE 100 has moved to new recovery highs since the Brexit vote.

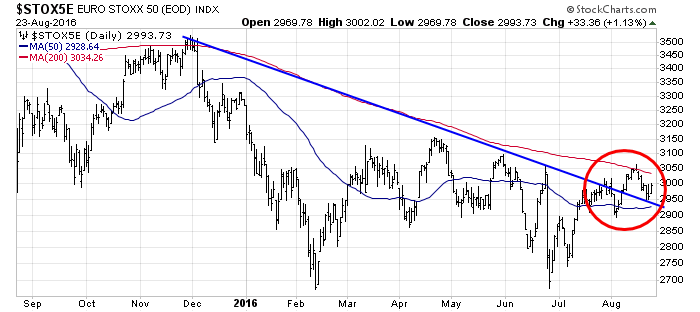

The Euro Stoxx 50 has rallied through a downtrend resistance level and it's has retreated to test support.

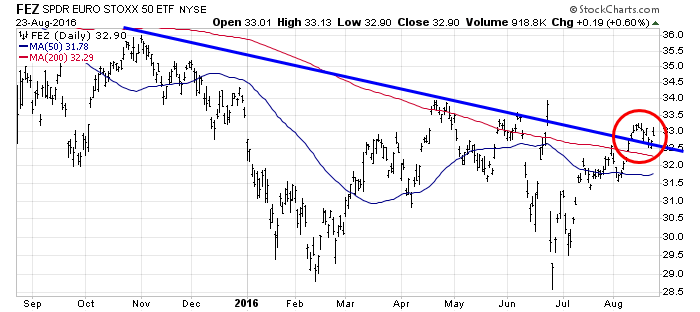

American investors can see a similar pattern on the USD denominated ETF (SPDR Euro Stoxx 50 (NYSE:FEZ)).

If you missed the first opportunity to buy into Europe, this may be your second chance.

DISCLAIMER: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (""Qwest""). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest. None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui June hold or control long or short positions in the securities or instruments mentioned."