Technically speaking, this week could be very important for the major U.S. equity markets. There is an appearance of a “TOPPING PATTERN” forming. I am now awaiting confirmation by the actions of the equity markets this week. Expect downward pressure beginning this month of August of 2017.

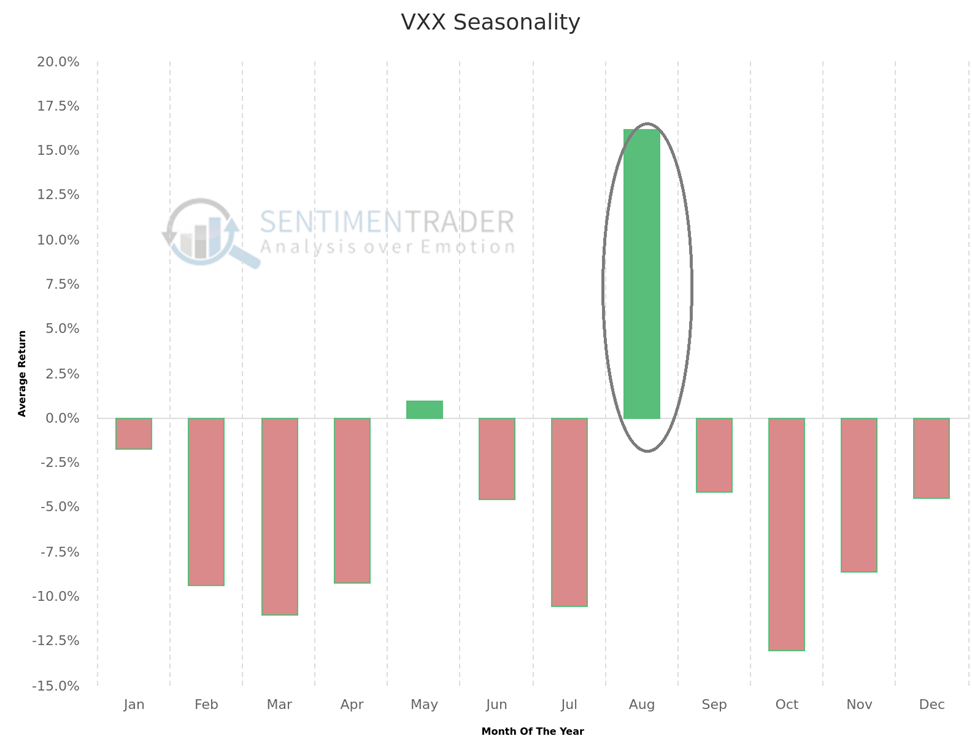

VXX Seasonality: The Only Chart You Need To See

There is currently limited upside potential in the SPX relative to potential downside for the months of August, September and the early part of October 2017. There are signs for the short, intermediate and longer-term trends returning for the best six months of trading officially inaugurated in November of 2017. This is the timing framework when ‘The Next Runaway Leg Up In The Stock Market Will Resume.’

In last week's market action, as the profit taking rotated out of the high-tech sector and into the Dow Industrials, it reflected a more defensive approach as money was invested in “Blue Chips,” during which time the Dow achieved a new high. The sector rotation was especially noticeable in the transports and technology sectors that were leading the markets higher.

If they continue lower, more sectors will join the decline. I am expecting a coming pop in the VIX on Aug 4, August 23, Sept 11 or 12 and finally September 28 or 29. 2017. There was a flight to safety in the yen as well as a strengthening of the price of gold, silver, Bitcoin and WTI crude oil.

An Unusual Anomaly:

Over the past couple of weeks, there was this unusual Anomaly which occurred, as you can see in the chart below. It now makes me more cautious about our long understanding of “risk inter-connectivity”.

How can the equity, gold, silver, crude oil and bitcoin markets ALL go HIGHER together?

In short, the major equities trend remains to the upside but it's likely to take shape in a slow grinding process with downward pressure starting in August for a couple of months.