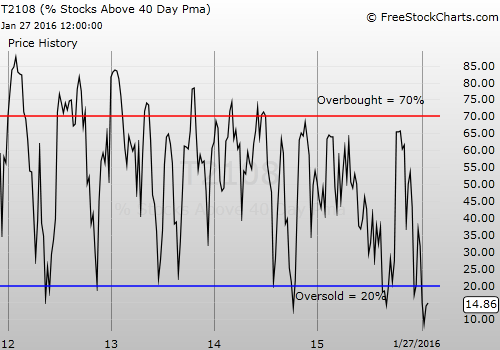

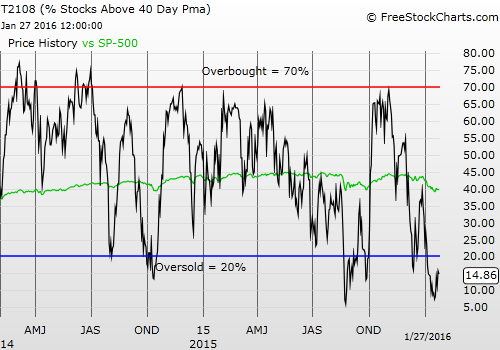

T2108 Status: 14.9%

T2107 Status: 14.9%

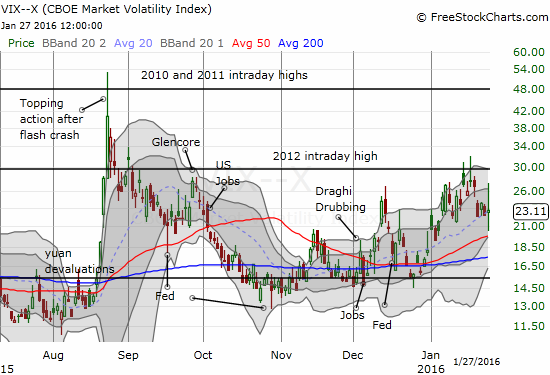

VIX Status: 23.1 (ranged from 20.4 to 27.2)

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #14 under 20%, Day #17 under 30%, Day #33 under 40%, Day #37 below 50%, Day #52 under 60%, Day #393 under 70%

Commentary

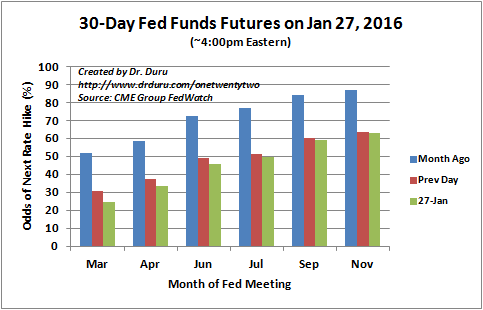

The Federal Reserve delivered the perfect “no new news” statement. It defied my expectation for delivering something substantial relative to the current context of market volatility. Media outlets of course tried to make headlines out of the Fed’s latest pronouncements on monetary policy, but fundamentally, nothing changed. The Fed reiterated its data-dependent approach to normalizing rates at a snail’s pace. It was a stalemate kind of day as a result. Notably, the trend pushing out the date of the next rate hike continued: September is now the first month where the odds go above 50%. Media outlets that claim the Fed’s statement keeps a March rate hike in play are off-base.

The market now expects the first rate hike in September.

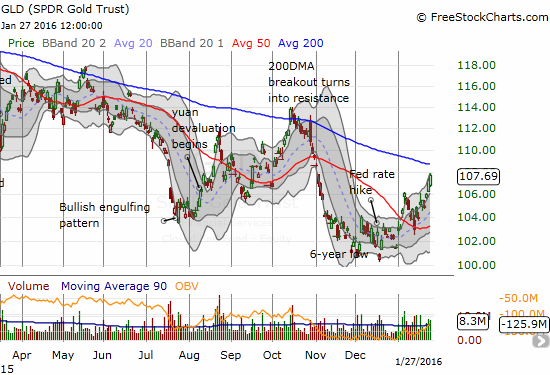

SPDR Gold Shares (N:GLD) is following the momentum in rate expectations: the further the push-out, the higher GLD goes…for now.

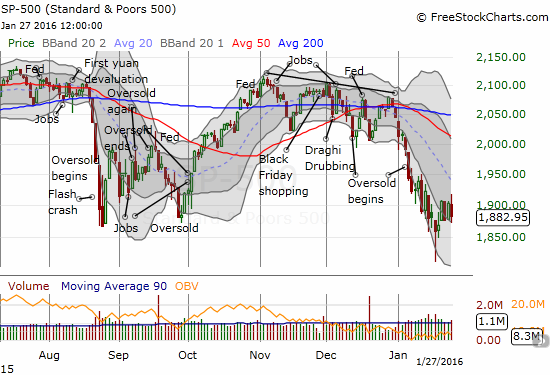

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), nudged downward to 14.9% after ranging from 13.1% to 17.7%. At one point, the S&P 500 (N:SPY) was making a breakout move at its highs -an end to the oversold period seemed near. Instead, the index closed down 1.1% to stay within a tight 4-day trading range of alternating up and down days

.

The S&P 500 (SPY) stays stuck in churn mode after failing to hold a breakout.

The volatility index, the VIX, experienced the most dramatic stalemate. It ranged from 20.4 to 27.2 before closing with a mere 2.7% gain. This means my pre-Fed fade of volatility is actually not likely to work this time around.

The volatility index closes with a minimal response to the Fed.

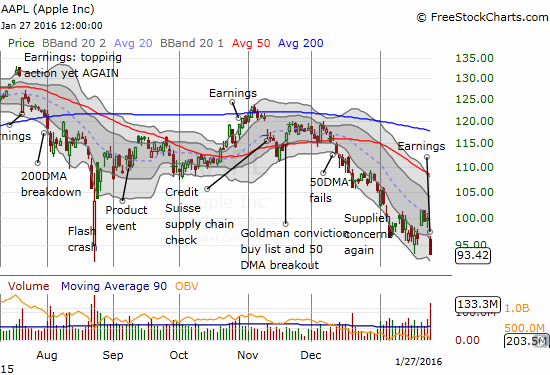

Much bigger and more important than the Fed for the regular trading day were Apple (O:AAPL) and Netflix (O:NFLX).

Like the last earnings cycle, Apple opened for post-earnings trading on a Fed day. Apple (AAPL) closed down 6.6%. It was a move consistent with the Apple pre-earnings trade and confirmed that AAPL remains a very sick stock. The following commentary on China put as good a face as possible on Apple’s business there, but the softening in Hong Kong caught the headlines (emphasis mine, quote from Seeking Alpha transcripts):

“We know the conditions in China have been a source of concern for many investors. Last summer, while many companies were experiencing weakness in their China-based results, we were seeing just the opposite, with incredible momentum for iPhone, Mac and the App Store, in particular.

In the December quarter, despite the turbulent environment, we produced our best results ever in Greater China, with revenue growing 14% over last year, 47% sequentially, and 17% year-over-year in constant currency. These great results were fueled by our highest ever quarterly iPhone sales and record App Store performance.

Notwithstanding these record results, we began to see some signs of economic softness in Greater China earlier this month, most notably in Hong Kong. Beyond the short-term volatility, we remain very confident about the long-term potential of the China market and the large opportunities ahead of us and we are maintaining our investment plans.

Despite the economic challenges all over the world, Apple remains incredibly strong.

”

Apple (AAPL) collapses after reporting earnings to a new 17-month low.

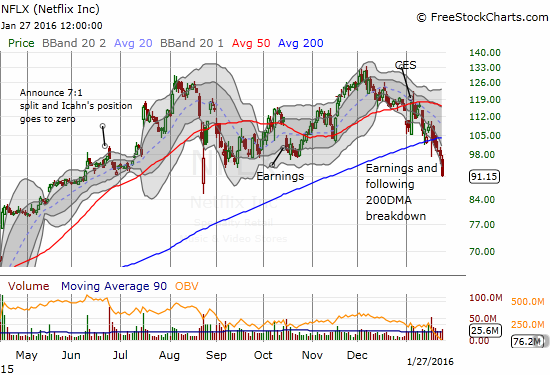

The market has already become accustomed to a weak Apple. However, the growing weakness in Netflix (NFLX) is something new. The post-earnings fade in NFLX continues with a confirmed 200DMA breakdown.

Netflix (NFLX) has not closed this low since the summer of 2015

Now the big question: is market leadership and participation narrowing even further or are new leaders emerging? How long can NFLX and the general stock market continue to diverge? Which one will blink first?

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long SVXY shares, long and short UVXY put options, long SSO call options, long SSO shares, long GLD