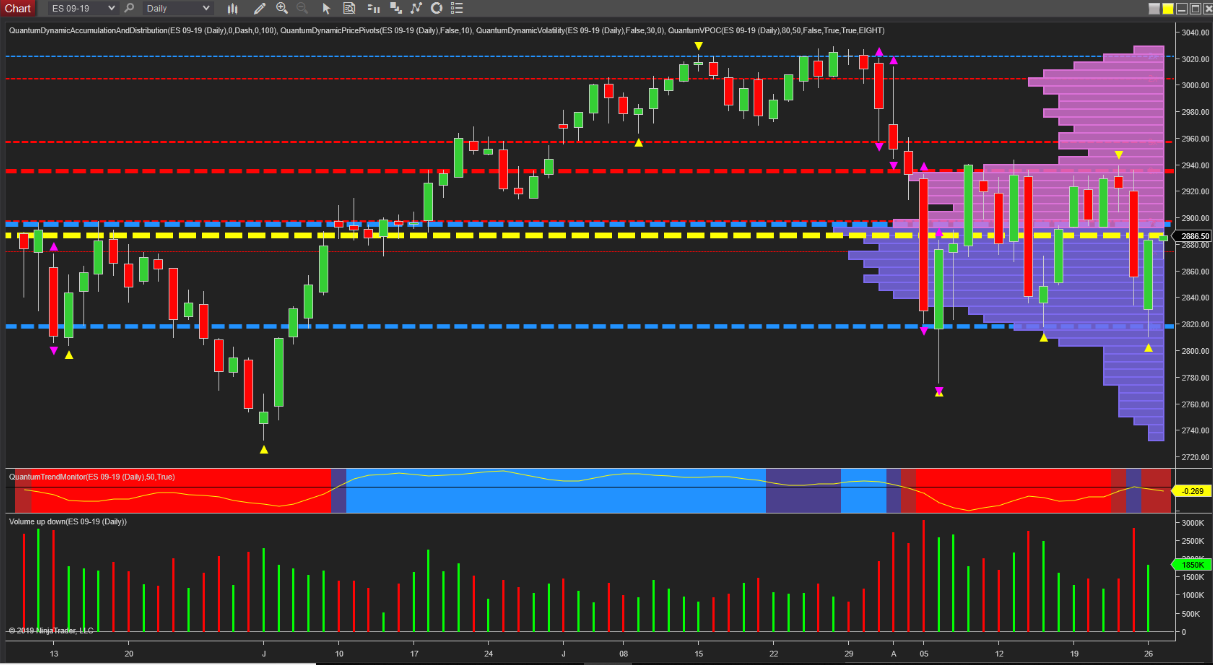

The futures contract for the S&P 500, the ES Emini for September, neatly reflects that of the AUD/JPY – albeit in a more extreme way. It also mirrors the ‘good-news-bad-news’ stories of risk assets like equities as the US and China continue to trade punches. What can we, therefore, glean from such a chart that is identical to those for YM Emini (Dow Jones future) and the NQ Emini (NQ future)?

First and foremost, we look at volume, price action, levels and volatility. Beginning with volatility, note that the index continues to trade within the volatility range of the wide spread-down candle of August 5, which is to be expected given the brutality of the price action on that day. And as we clear the range of this candle, further congestion will follow.

It's All About Volume

Next, for any recovery or breakaway, volume is the key. Note how the volume during the middle of August fell away as the market began to rise, a sign of weakness that was followed by a sell-off late last week and a wide-spread down candle on Friday with heavy volume.

Looking at Monday's price action, once again the rally looks labored and anomalous, with a wide-spread up candle on ‘low volume’. It looks lightweight compared to other candles of similar price spread, reinforcing the idea of a fragile market lacking conviction and participation. While the summer season will certainly be a factor, what we are seeing is a thin volume response higher and a return to the volume point of control (the yellow dashed line ) at 2885, which is being tested as I write.

And so on to levels that are clearly defined. Very strong resistance at 2900 (the blue dashed line of the accumulation and distribution indicator) and working in concert with the volume point of control itself, above which is a further level of strong resistance with the red dashed line at 2940, which has been in play several times, capping any advance or breakaway from the VPOC.

Finally, support sits as a platform in the 2820 region and is a springboard for recovery and another one, which has come into play several times recently.

Charts from NinjaTrader and indicators from Quantum Trading