The Monday reversal wasn't enough to light a fire under bulls as sellers quickly returned to reverse all of that gain. Indices are now left with just the lows of February to hang on too, but even that is under pressure for the Russell 2000.

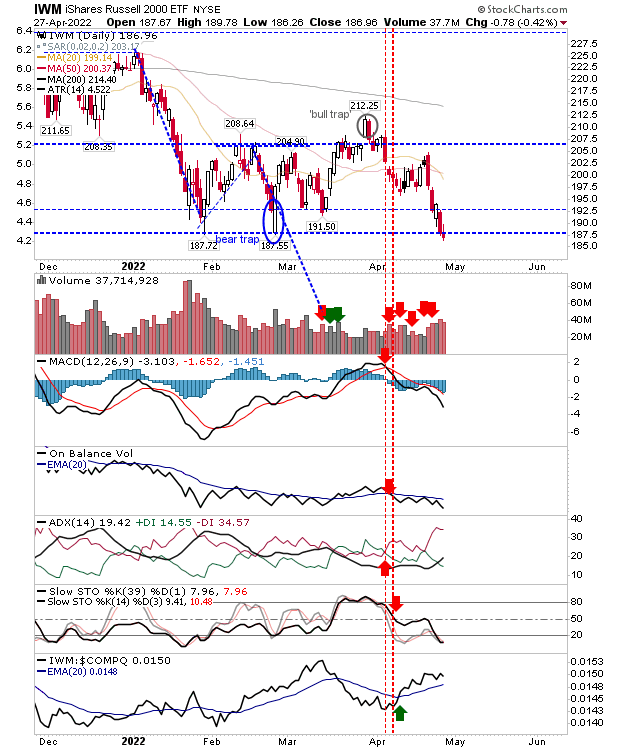

The Russell 2000 (via IWM) had looked like it was going to lead a recovery when it broke out of its base in March, but the resulting 'bull trap' did what most 'bull traps' do and reversed all the way back to the lows of the base and then break support. Technicals are net bearish but momentum is at least oversold—although price crashes occur from an oversold condition. Because we have a test of support there is a buying opportunity, but keep the stop tight.

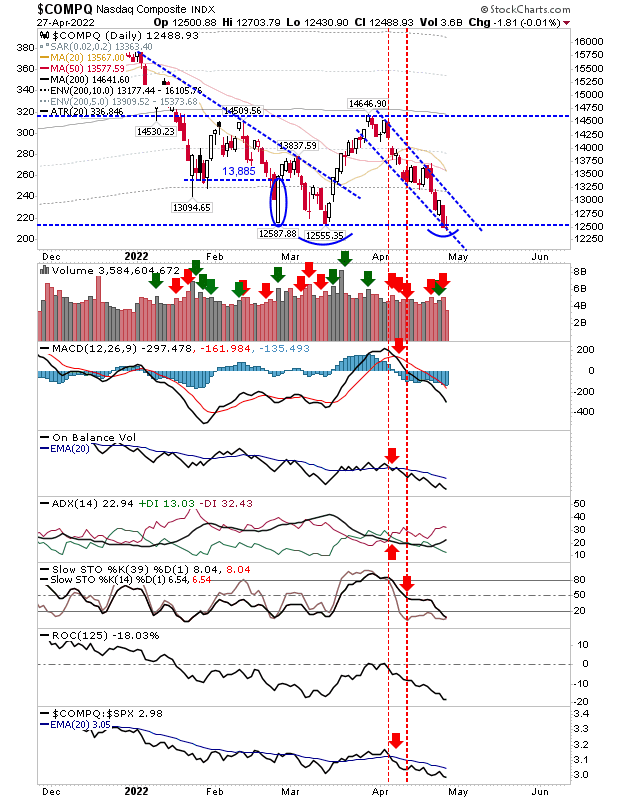

The NASDAQ has remained in its base for all of 2022 and Wednesday's doji marked a (so far successful) test of support. It's a potential buying opportunity, but given what happened on Monday we can take nothing for granted.

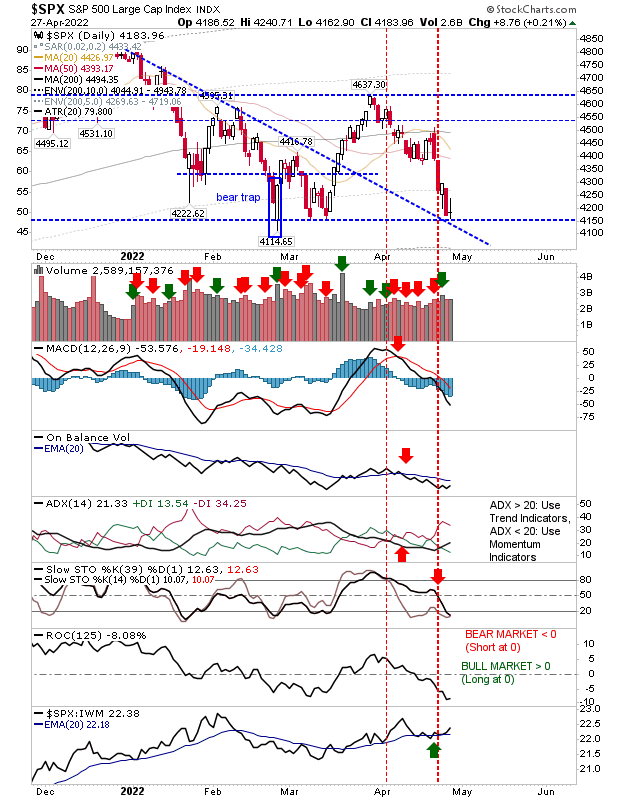

Likewise, the S&P is at support of its February low with a 'bullish harami cross'—a strong reversal candlestick pattern. The index is finally oversold on intermediate term stochastics, so there is a a good chance we will see a bounce, but it's questionable how far any bounce could go. The index is outperforming both the NASDAQ and Russell 2000, so its best placed to attract buyers in the current circumstances.

For the rest of the week we are running out of actionable buying opportunities; yesterday was one, but beyond the day's lows, we will have to look at weekly charts for the next point of support.