A dove takes flight and lifts others…

There is a risk that the intensification of international cross currents could weigh more heavily on U.S. demand directly, or that the anticipation of a sharper divergence in U.S. policy could impose restraint through additional tightening of financial conditions. For these reasons, I view the risks to the economic outlook as tilted to the downside. The downside risks make a strong case for continuing to carefully nurture the U.S. recovery– and argue against prematurely taking away the support that has been so critical to its vitality.

…and top Fed birdwatcher, Jon Hilsenrath, publishes his notes…

The chances of a Federal Reserve interest-rate increase in 2015 are diminishing amid new signs of anemic economic activity, a disappointing development for central bank officials who have been hoping to move this year after a prolonged period of easy-money policies. Lackluster readings on consumer spending, inflation and jobs have virtually eliminated the chances of a move this month. Already, two Fed governors expressed doubts this week about whether the timing will be right this year, and the recent trove of data hasn’t reassured top officials about the economic outlook

…Tim Duy even drops his binoculars…

This is the most exciting speech I have read in forever. Not necessarily for the content. But for the politics. Evans and Kocherlakota are no longer the lunatic fringe. This could be a real game changer that shifts the Fed toward the Evans view of the world, with no rate hike until mid-2016. Brainard muddied further the already murky December waters

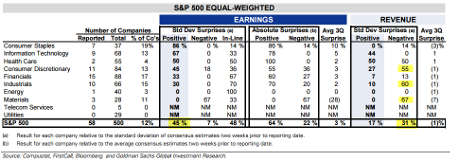

The market is thankful for the release of the Fed doves, because Q3 earnings have not been a positive. And there have been several significant banana peels for some of the S&P 500 stocks…

S&P 500 traded sideways this week as dovish comments by two Fed officials trumped disappointing macro data and 3Q company results. Retail sales and manufacturing surveys missed expectations, while year/year core CPI registered 1.9%. Uncertainty around the Fed liftoff increased as Governors Brainard and Tarullo separately argued for holding rates constant through year-end. The first major week of 3Q earnings reports was disappointing with negative results and guidance from companies including Netflix (O:NFLX) and Wal-Mart (N:WMT).

(Goldman Sachs (N:GS))

Digging through some of the earnings related commentary I found the following data points:

The most notable earnings comment came from Wal-Mart, which crushed its own stock price (along with many other retailers) with their comments about higher wages and plans to lower prices:

"Operating income is expected to be impacted by approximately $1.5 billion from the second phase of our previously announced investments in wages and training as well as our commitment to further developing a seamless customer experience. As a result of these investments, we expect earnings per share to decline between 6 and 12 percent in fiscal year 2017.”

Delta Airlines (N:DAL) made a specific comment about airplane prices that led to a selloff in Boeing (N:BA) and Airbus (OTC:EADSY):

“We’re seeing a huge bubble in excess wide-body airplanes around the world…. we do think that the aircraft market is going to be ripe for Delta over the course of the next 12 to 36 months and we think that that weakness and that aircraft bubble in wide bodies is going to spread to narrow bodies and that there will be some huge buying opportunities. Because low interest rates really have created a huge wide-body bubble in the world.”

Hugo Boss (OTC:BOSSY) blamed weakness on China slowdown and fewer tourists visiting their U.S. stores:

“While performance in Europe remained strong and in line with original expectations, momentum in Asia and the Americas deteriorated considerably towards the end of the period,”

the group said in a statement on Thursday evening.

“This was due to sales declines in China, as well as a negative development in the Group’s U.S. own retail and wholesale businesses. Weaker demand from tourists contributed to the slowdown in the U.S.”

Burberry (OTC:BURBY) saw similar high-end retail impacts:

Carol Fairweather, finance director, said sales from stores open at least a year fell 4 per cent in the second quarter, compared with a 6 per cent increase in the first. She blamed the deceleration on waning demand from Chinese consumers. “We believe the slowdown is macro,” she said. However Burberry said demand was also “uneven” in the US, and weaker among local shoppers in London… Ms Fairweather said the group believed the problems were not specific to Burberry. “We have been quite clear that we believe that in this quarter it has been a challenging market for luxury consumers all over the world. This has been slightly amplified by our geographic mix,” she said

Staying at the high end… is Del Frisco's Restaurant Group (O:DFRG) facing more competition, or is the environment changing?

“Del Frisco’s Double Eagle faced customer count challenges at several locations, driven significantly by fewer private dining events, and experienced softer sales during shoulder periods.”

Digging into the core industrials… Fastenal (O:FAST) is still seeing a slowdown.

“The industrial environment is in a recession – I don’t care what anybody says, because nobody knows that market better than we do.”

Blackstone (N:BX) has a big portfolio of private companies so listen closely…

“From our perspective, we do not see a recession, but we are seeing slowing in certain regions and sectors with some excess coming out of markets.”

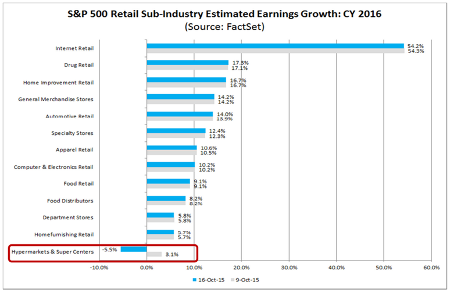

Back to Wal-Mart, how will their labor and price pressures not ripple through to the rest of retail?

Wal-Mart Stores (N:WMT) is part of the Hypermarkets and Super Centers sub-industry. As a result of the guidance from Wal-Mart, this sub-industry is now projected to report a decline in earnings in CY 2016 of 5.5%, compared to an expectation of earnings growth of 3.1% last Friday… Given the earnings decline now expected for the Hypermarkets and Super Centers sub-industry in CY 2016 due to the guidance from Wal-Mart, have analysts revised their earnings outlook for other retail sub-industries for next year? Do analysts believe the reasons for the lower guidance from Wal-Mart Stores are unique to Wal-Mart, or do they believe they are reflective of broader issues in the retail space

Away from earnings, it was a very big week for the IPO market as the 3B First Data (N:FDC) IPO came to market… and struggled. Another big IPO from Albertsons was pulled after the collapse of Wal-Mart. Not good news for the health of the total market.

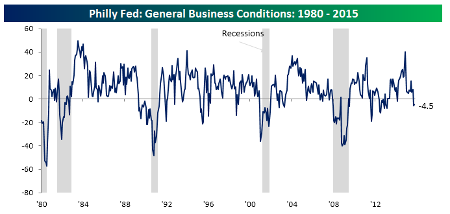

Among top data last week, the Philly Fed was not inspiring for the industrial economy…

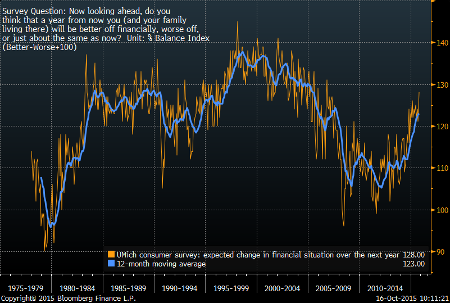

…however, Consumers are feeling the best in 10 years…

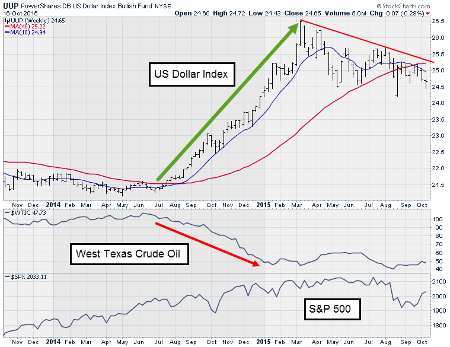

The U.S. dollar is also in the news as flying doves and soft economic data are helping it lower against both developed and emerging currencies. A weak dollar will add stability to commodity prices and should help multinational revenues and earnings. But will it also pull dollars back into local bonds and equities? Stay tuned.

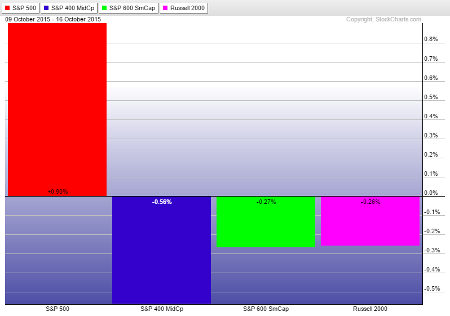

It was another up week for the S&P 500. But what happened to the Small Cap (N:SLY) and Mid Cap (N:IVOO) indexes?

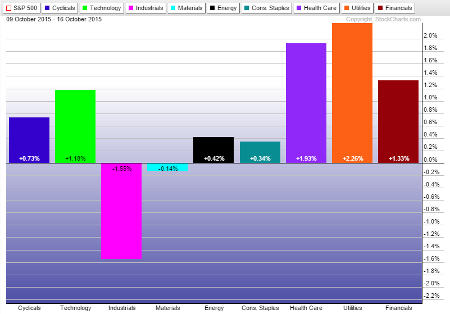

Among the U.S. equity sectors, Utilities and Healthcare led, while Industrials were held back by the difficult earnings releases…

The earnings train will continue full speed this week. From JPMorgan (N:JPM), some of the larger reports…

Top earnings Mon morning 10/19: N:HAL, N:MS, N:VRX

Top earnings Mon night 10/19: N:IBM, N:VALE

Top earnings Tues morning 10/20: N:BK, N:EAT, N:LMT, N:RF, N:TRV, N:UTX, N:VZ

Top earnings Tues night 10/20: N:ACE, N:CMG, N:DFS, N:VMW, O:YHOO

Top earnings Wed morning 10/21: N:BAC, N:BHI, N:BHP, O:BIIB, Credit Suisse (VX:CSGN), N:EMC, N:GM, N:ITW, N:KMB, N:KO

Top earnings Wed night 10/21: N:AXP, O:EBAY, O:LRCX, N:LVS, O:SNDK, O:TXN

Top earnings Thurs morning 10/22: N:BEN, N:CAT, N:DHR, N:DOW, N:LLY, N:MCD, N:MJN, N:MMM, O:TROW, N:UA, N:UNP

Top earnings Thurs night 10/22: O:AMZN, N:COF, O:GOOGL, O:MSFT, N:T

Top earnings Fri morning: O:AAL, N:CFG, N:PG, N:STT

Barron’s ran its Big Money Poll over the weekend. Often a good look for the Contrarians who must be seeing opportunities in Materials and Energy…

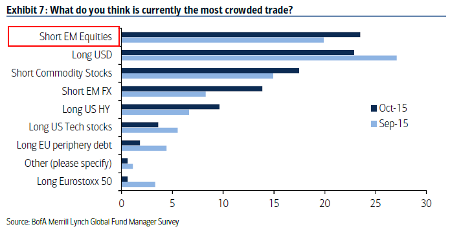

Merrill’s investor survey will point Contrarians to Long EM Equities/FX and Commodity Stocks…

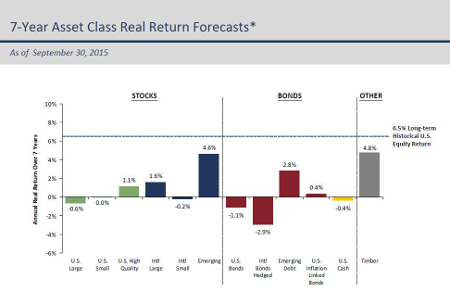

The team over at N:GMO would take the Contrarian play in Emerging Market Equities and Bonds along with a few acres of Timber…

@researchpuzzler: the GMO return forecast calls for challenging times ahead for asset owners (but then you knew that)

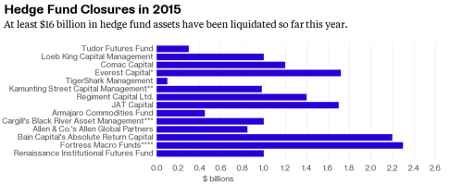

The lack of returns available in many asset classes, combined with highly correlated returns, has made for a hedge fund manager’s worst environment. As a result, many funds are shutting the doors…

Some 417 hedge funds announced shutdowns in the first half, according to Hedge Fund Research Inc. While that number isn’t on track to surpass the 864 funds that closed in 2014, the market turbulence of the last two months caused by concerns about China’s slowing economic growth could lead to a pickup in the fourth quarter. A record 1,471 funds liquidated amid the 2008 financial crisis

A very big story in Venture Cap last week as John Carreyrou, a Unicorn Hunter at the WSJ, looks to have uncovered some key research that few others have done on Theranos…

But here’s the thing about unicorns: They’re not real. Theranos billed itself as an alternative to big-needled, big-billed, big pain-in-the-arm standard blood tests. But on Wednesday, a Wall Street Journal article alleged this was all a lab of cards. Rather than using its hyped finger prick technology, the company was doing most of its work on the same boring machines used by stodgy old diagnostics giants Laboratory Corporation (N:LH) and Quest (N:DGX). On Thursday, the Journal dropped a second bomb: According to a company insider, the FDA has asked Theranos to stop using all but one of its finger-prick tests.

In other big tech news, Elon Musk unveiled Tesla’s auto-pilot and explains why his self-driving car will outperform your driving…

“The whole Tesla (O:TSLA) fleet operates as a network. When one car learns something, they all learn it. That is beyond what other car companies are doing,” said Musk. When it comes to the autopilot software, Musk explained that each driver using the autopilot system essentially becomes an “expert trainer for how the autopilot should work.”

He also shortened the window on when he thinks full self-driving will be available for all…

Elon Musk, Tesla’s co-founder and chief executive, told reporters at an event in Palo Alto on Wednesday that his ultimate objective was to create a car that behaved like a “really good chauffeur.” “It’ll actually do better than a person,” he said. “I think this is going to be quite a profound experience for people when they do it… It’s going to change people’s perception of the future quite radically.” Tesla is racing Silicon Valley rivals such as Google (O:GOOGL) and Apple (O:AAPL), as well as traditional auto makers including Audi (DE:NSUG) and BMW (DE:BMWG), towards a future of completely autonomous cars, which Mr. Musk now predicts will be technically possible – if not necessarily legal – by 2018. “I’m quite confident within three years the car will be able to take you from point to point – from your driveway to work without you touching anything,” he said. “You could be asleep the whole time and do so completely safely.”

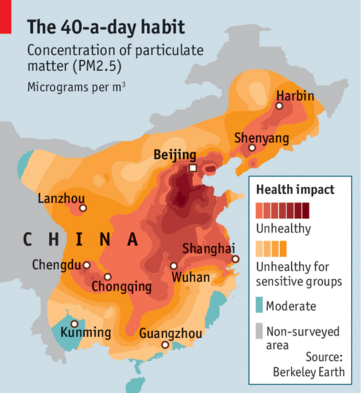

New research into China’s air pollution shows why the Government will be pushing electric cars in a major way…

Berkeley Earth’s scientific director, Richard Muller, says breathing Beijing’s air is the equivalent of smoking almost 40 cigarettes a day and calculates that air pollution causes 1.6m deaths a year in China, or 17% of the total. A previous estimate, based on a study of pollution in the Huai river basin (which lies between the Yellow and Yangzi rivers), put the toll at 1.2m deaths a year—still high.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.