The dollar fell slightly against most other major currencies on Friday, after weak U.S. housing and consumer sentiment data backed bets of a slower pace of interest rate hikes from the Federal Reserve.

The subdued economic reports weighed on the dollar sending it to session lows.

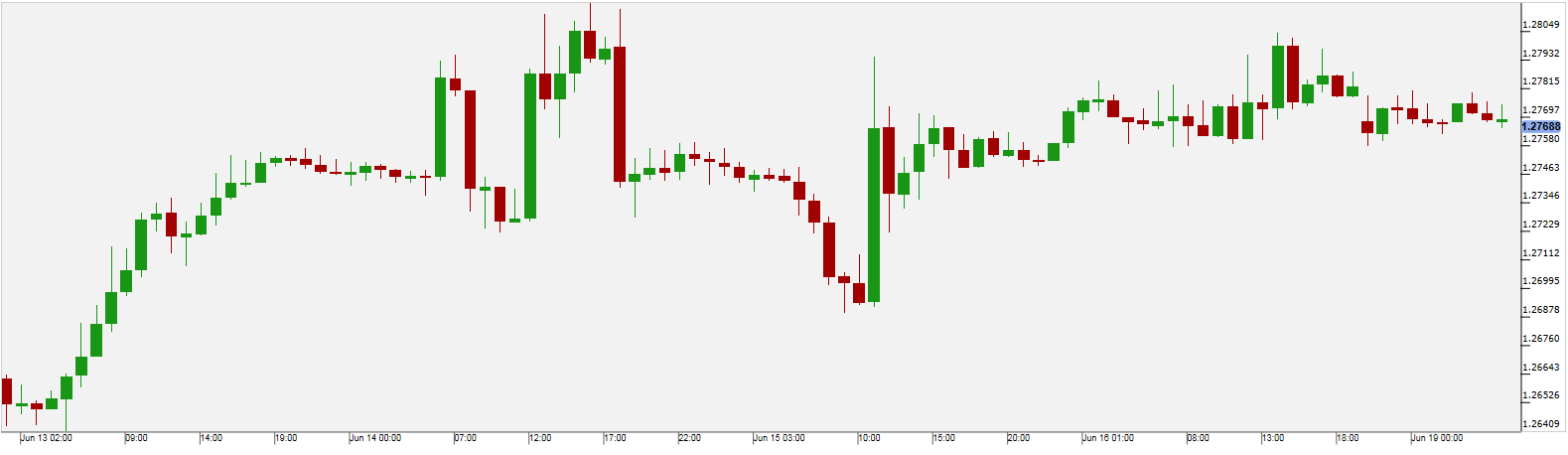

Sterling was unchanged on Monday ahead of the start of Brexit negotiations, with investors also awaiting comments from a top Federal Reserve official to see whether the U.S. dollar's recent gains can be sustained.

Investors are focusing on the UK government's stance in the talks, after the setback and uncertainty brought by this month's election.

For today, Brexit minister David Davis and the European Union's chief negotiator Michel Barnier are due to start negotiations over Britain's departure from the bloc in Brussels.

In the U.S. New York Fed President William Dudley and Chicago Fed President Charles Evans are due to make public appearances.

The British pound was little changed, trading around $1.2777 early on Monday ahead of the Brexit negotiations.

Sterling has been through a turbulent month, sinking to a near two-month low of $1.2636 on June 9 on the British election shock, but rallying last week as the Bank of England came close to hiking rates after a split vote in its monetary policy committee.

It is expected to remain vulnerable in coming months as negotiations proceed on Britain's departure from European Union.

Pivot: 1.273

Support: 1.273 1.268 1.2635

Resistance: 1.2815 1.287 1.2905

Scenario 1: long positions above 1.2730 with targets at 1.2815 & 1.2870 in extension.

Scenario 2: below 1.2730 look for further downside with 1.2680 & 1.2635 as targets.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Gold

Gold prices recovered slightly on Friday, following the weak housing and manufacturing data from the U.S, however, the precious metal remained close to three week lows, trading around the $1253 area and posting its second straight weekly loss.

U.S. homebuilding fell for a third straight month in May to the lowest level in eight months, data showed on Friday, suggesting that subdued housing activity could dent economic growth in the second quarter.

In a separate report the University of Michigan said its consumer sentiment gauged fell to 94.5 in early June from 91.1 in May. Analysts had expected a reading of 97.1.

For today, the focus is shifted towards Brexit negotiations and speeches from several Fed members.

Pivot: 1261

Support: 1247.5 1241 1237.5

Resistance: 1261 1266 1271

Scenario 1: short positions below 1261.00 with targets at 1247.50 & 1241.00 in extension.

Scenario 2: above 1261.00 look for further upside with 1266.00 & 1271.00 as targets.

Comment: the RSI is bearish and calls for further decline.

WTI Oil

Oil futures settled a bit higher on Friday, but prices still suffered their fourth straight weekly loss as the market weighed rising U.S. drilling against ongoing efforts by major producers to cut output to reduce a global glut.

The U.S. West Texas Intermediate crude July contract gained almost 0.6%, to end at $44.74 a barrel on Friday. It touched its lowest since May 5 at $44.22 on Thursday.

Data from energy services company Baker Hughes showed on Friday that U.S. drillers last week added rigs for the 22nd week in a row.

The U.S. rig count rose by six to 747, extending a year-long drilling recovery to the highest level since April 2015.

Pivot: 44.42

Support: 44.42 44.15 43.75

Resistance: 44.95 45.2 45.5

Scenario 1: long positions above 44.42 with targets at 44.95 & 45.20 in extension.

Scenario 2: below 44.42 look for further downside with 44.15 & 43.75 as targets.

Comment: the RSI is mixed to bullish.

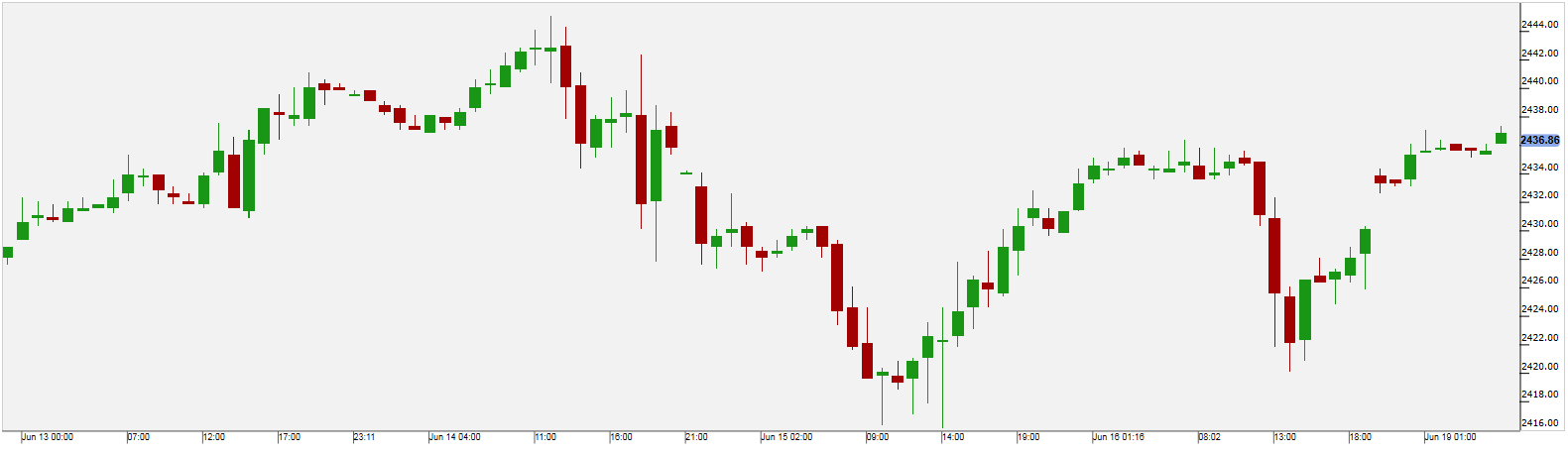

US 500

The main U.S. indices were mixed on Friday, as Amazon’s $13.7 billion deal to buy Whole Foods weighed on retail and grocery companies.

Shares of Whole Foods surged 30% after Amazon (NASDAQ:AMZN) announced a deal to buy the retailer for $13.7 billion. The deal sparked concerns among investors as to what impact an Amazon-owned Whole Foods would have on other retailers and grocery companies.

Walmart (NYSE:WMT) closed nearly 5% lower, as analysts signalled the deal presents a serious threat for traditional retailers such as Wall-Mart.

The Dow Jones and the S&P 500 closed the day almost unchanged while the Nasdaq fell to 6,151.76, down 0.22%.

Pivot: 2426

Support: 2426 2420 2416.5

Resistance: 2439 2441 2443

Scenario 1: long positions above 2426.00 with targets at 2439.00 & 2441.00 in extension.

Scenario 2: below 2426.00 look for further downside with 2420.00 & 2416.50 as targets.

Comment: the RSI is mixed with a bullish bias.