Equity indexes around the globe rallied Tuesday, with the Dow ending the session at another record close. The S&P 500 posted a modest gain of 0.34%, just a tad off its intraday high and a mere 0.05% from its latest record close on November 25th. But from an international perspective, Tuesday's big winner was the Italy's FTSE MIB, up 4.15%. Of course, the MIB is still down 17.09% year-to-date.

The yield on the 10-year note closed at 2.39%, unchanged from its previous close.

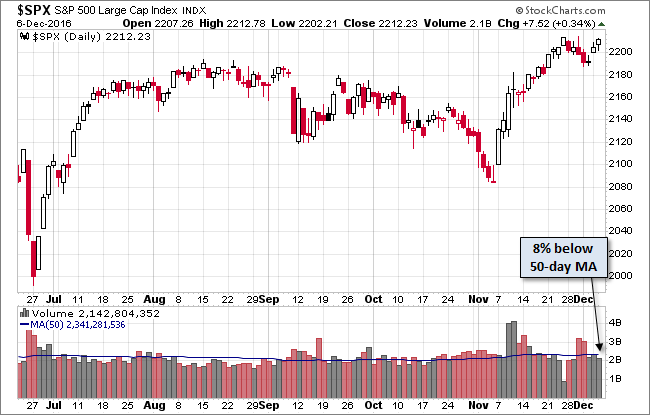

Here's a daily chart of the index. Trading volume was a bit on the light side.

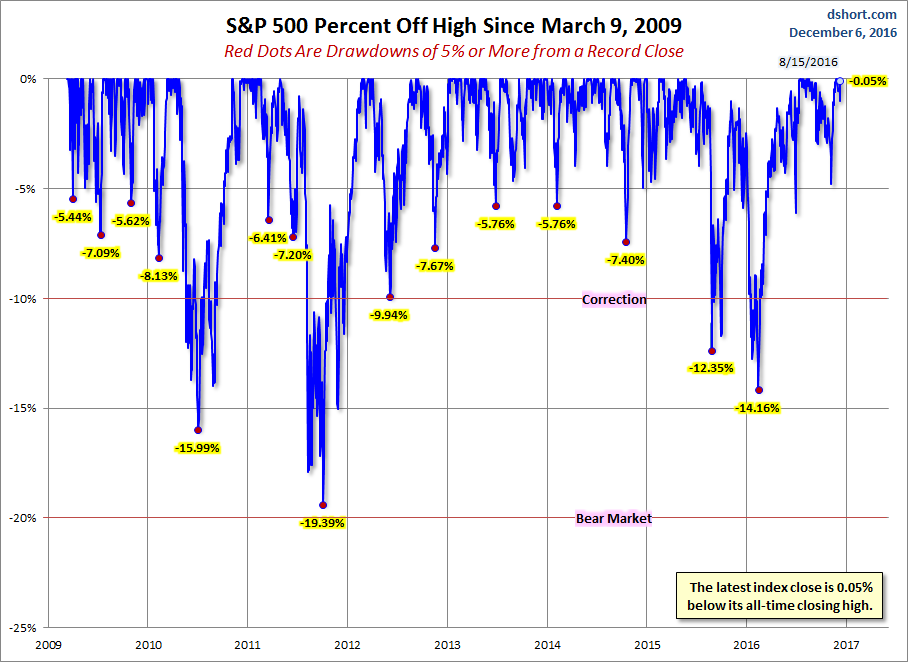

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

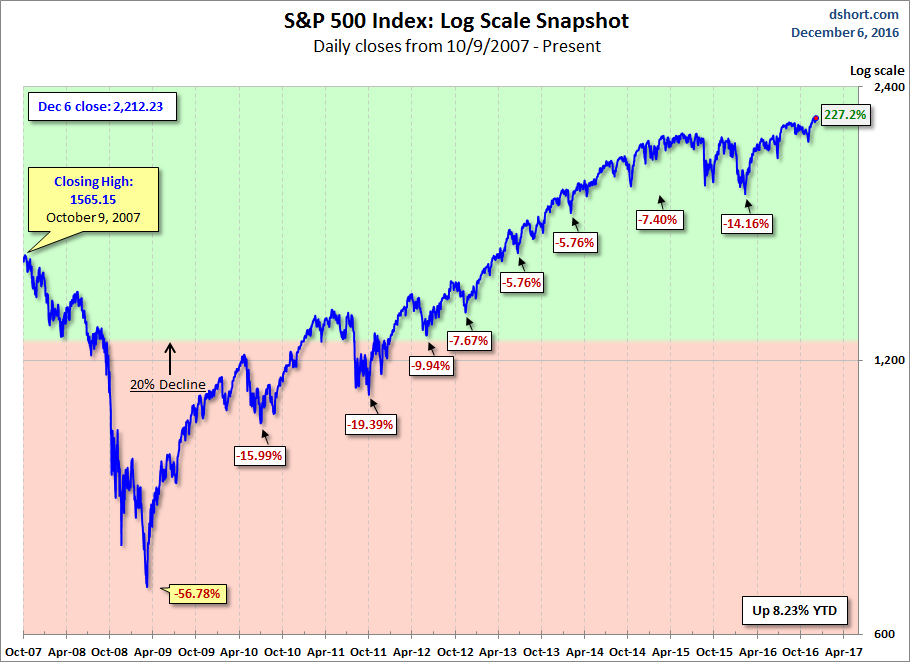

Here is a more conventional log-scale chart with drawdowns highlighted.

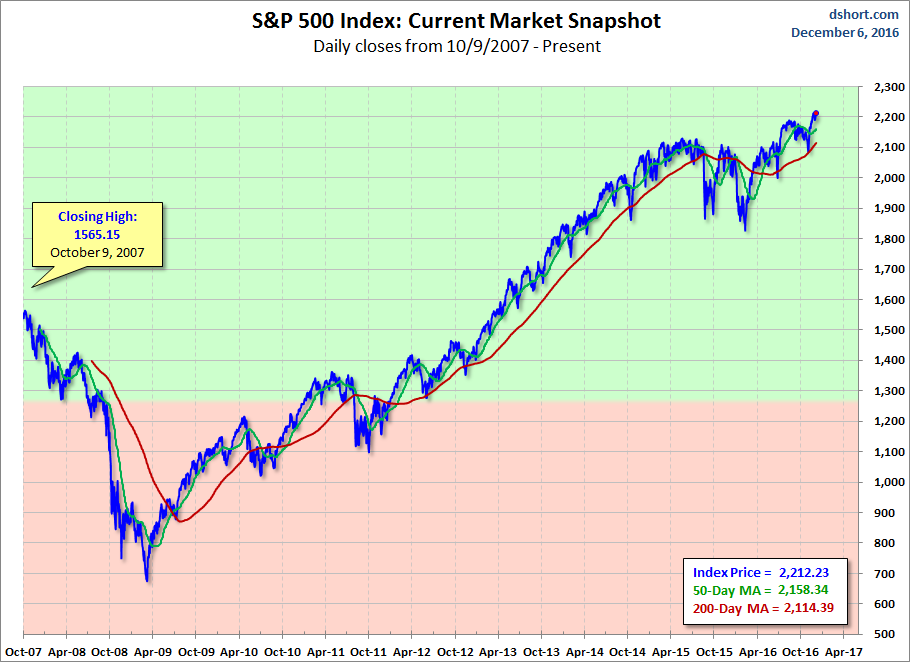

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

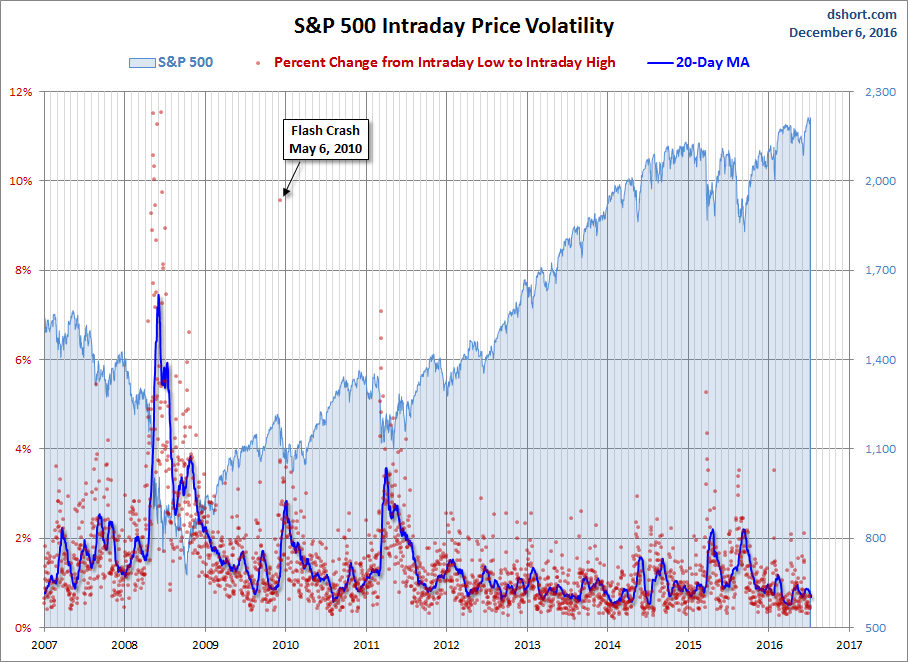

A Perspective On Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.