Oil and gas companies have seen better days. As a consequence, many investors are leaving the sector in search of safer harbors to park their cash. But if you needed one good reason to hold on to some of your oil and gas stocks, this week’s chart has it...

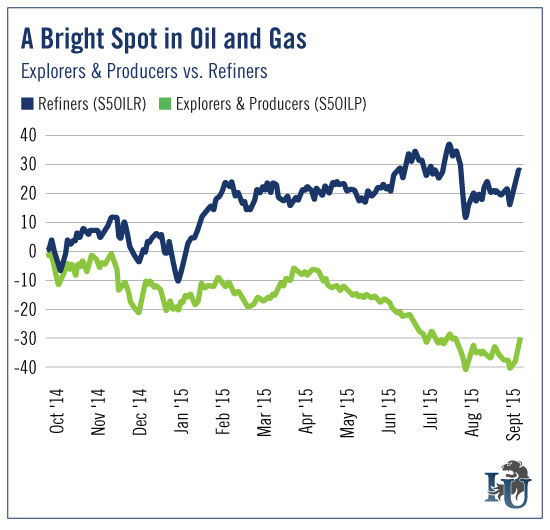

As you can see, we’ve compared the S&P 500 Oil & Gas Exploration & Production Index (S5OILP) and the S&P 500 Oil & Gas Refining & Marketing Index (S5OILR).

Clearly exploration and production (E&P) companies are hurting. As my colleague Ryan covered last week, this is due largely to the severe drop in crude oil prices over the past year.

As prices drop, revenues shrink. Eventually, producers have to shut down wells to bring prices back to a tolerable level. This is the cycle we’ve seen. Thus, the cumulative total return over the past year, which includes dividends, is -30.2% for the industry.

It certainly mirrors the 40% decline in oil prices during the same period.

Meanwhile, in huge contrast, the refining and marketing industry has had a positive return of 27.5%. Here are a few specific examples...

- Western Refining Inc (NYSE:WNR) is up 24%, year to date.

- Shares of PBF Energy Inc (NYSE:PBF) have climbed 21.9%.

- Alon USA Partners LP (NYSE:ALDW) has risen a remarkable 97%. (It’s also worth noting that this company sports a juicy 16.4% dividend yield.)

Why the stark difference in performance? It’s simple...

Oil refiners have lower costs than E&Ps, as they are buying crude oil at cheaper prices. But they still have control over what’s called the “crack spread.” This is the difference between the price of crude oil and the price at which refined products are sold. It means they can set prices in a way that keeps them profitable but also competitive.

So should energy investors dump E&Ps from their portfolio and only hold on to the refiners? Not exactly. As Energy and Infrastructure Strategist David Fessler noted in his latest article, “All the signs point to a continued drop in U.S. unconventional crude production. This can’t help but lead to higher crude prices and, more importantly, higher share prices for those with the patience to wait.”

That means long-term investors should be on the hunt for strong companies - E&Ps, refiners and master limited partnerships - that have been battered by volatility. With an oil price rebound in the pipeline (pun intended), these firms should reward shareholders handsomely.

Bottom line: Don’t throw the baby out with the bathwater. The oil and gas industry is doing well at present - despite what you see in the media. You’ll want to get into the best stocks while they’re still trading at a discount.