Squeezed for cash and sweating...

That is the state of oil and gas exploration and production (E&P) companies as they enter October.

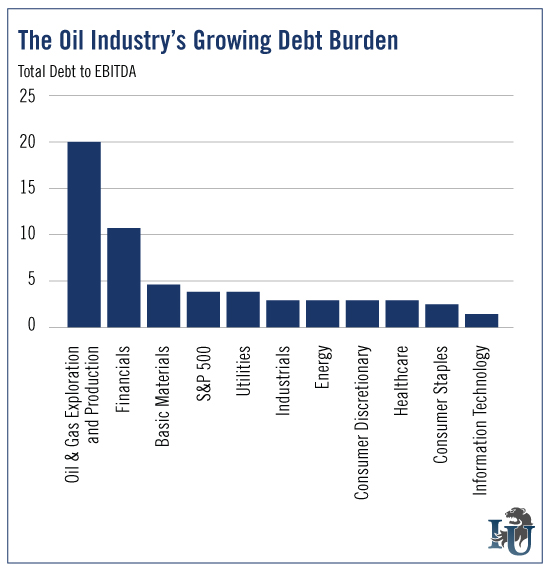

Our chart above shows just how overleveraged the industry has become in relation to other sectors. On average, E&Ps have 20 times as much debt compared to earnings before interest, taxes, depreciation and amortization (EBITDA) brought in over the last 12 months.

And things could get worse from here.

Because this October, in particular, has the potential to send certain companies scrambling for help. And it all has to do with one word: redetermination.

This is when a lender reevaluates a company’s credit line.

For lenders, this is a common and crucial practice. When companies borrow money against their assets, it is important to reevaluate things from time to time. Especially if their asset value is shrinking.

So what does the oil industry borrow against? Its balance sheet’s most prized possession - its estimated natural gas and oil reserves. And with oil trading at its lowest level in six years, reserve values are shrinking faster than Hillary Clinton’s approval rating.

Cash-strapped E&Ps are about to get a rude awakening from lenders.

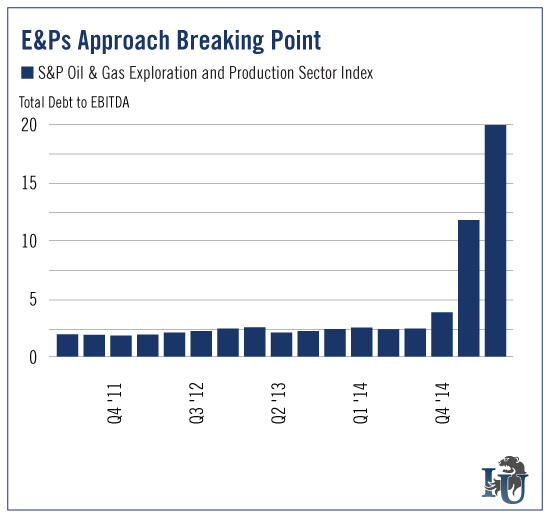

This next chart shows just how fast the situation has developed...

Today, the oil and gas industry’s total debt-to-EBITDA ratio sits at a whopping 19.96. This time last year it was at 2.38. So we have a 738% increase in 12 months. And it doesn’t look like it will stop anytime soon.

This fall’s redetermination season will have already cash-strapped E&Ps begging for more loans at whatever rate they can get. It has become a situation of survive today, pay for it tomorrow.

So what should you do as an investor? Two things...

One, protect your portfolio from overleveraged oil plays. Two, profit from the situation.

Using total debt to EBITDA - coupled with other key metrics - Dave has identified 17 companies on the verge of total collapse. (Editor’s Note: We actually just updated the report title from 19 to 17 because two of the companies Dave originally singled out have already croaked!)

One specific stock on the list has a debt load over 2,000 times its earnings. If you currently hold any of these stocks, you need to act now and get out.

Next is the opportunity to profit.

As troubled E&Ps frantically search for buyout deals, M&A partners or just more cash, they will seek help from investment banks. We are going to see a flood of activity in this market. Many E&Ps have only three to six months of solvency remaining. It will be now or never.

My favorite play for the coming deal-making boom is Evercore Partners (NYSE:EVR).

It’s a top energy industry advisor. The company has a strong and seasoned management team, with decades of experience in the oil industry.

Big deals it helped broker in the past included major spin-offs with Occidental Petroleum (NYSE:OXY)... plus Kinder Morgan's (NYSE:KMI) $38 billion buyout of El Paso Pipeline Partners. Today it is working on deals with Antero Midstream (NYSE:AM), Niska Gas Storage Partners (NYSE:NKA) and Midstates Petroleum (NYSE:MPO).

Last year alone, energy sector deals made up more than a quarter of its $821 million investment banking revenue. In the last four quarters, it has seen double-digit sales growth, year-over-year. And with the help of more oil industry deals coming down the pipe, it’s projecting a 41% increase in earnings and 27% sales growth for 2015.

Any E&P looking for a lifeline will turn to a company like Evercore for help. If not, they should start preparing for judgement day.