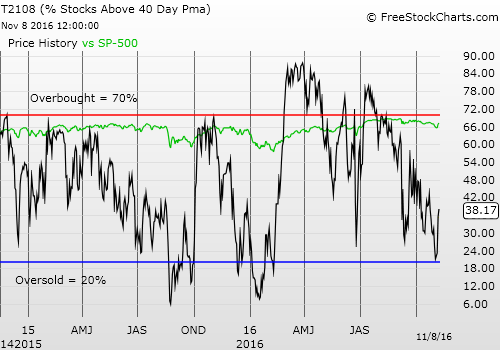

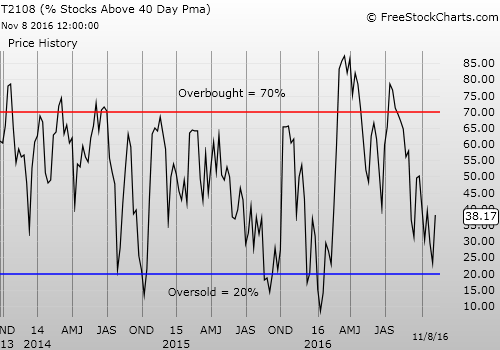

T2108 Status: 38.2%

T2107 Status: 52.9%

VIX Status: 18.7

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #182 over 20%, Day #2 over 30% (overperiod), Day #13 under 40%, Day #30 under 50%, Day #45 under 60%, Day #71 under 70%

Commentary

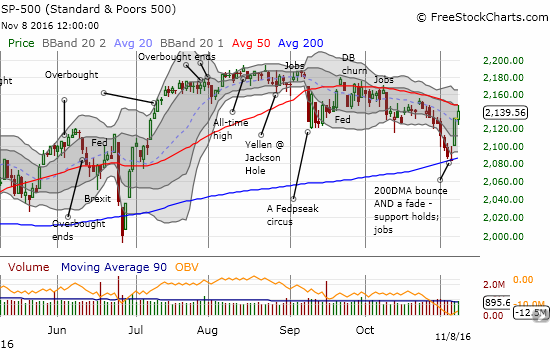

The relief rally continued on Tuesday and once again put on a picture-perfect performance that is hard to make up. Over the last two days, the S&P 500 (via SPDR S&P 500 (NYSE:SPY)) achieved a bracketed rally: the index from a dead stop on Friday at support at its 200-day moving average (DMA) to a dead stop Tuesday at resistance at its 50DMA.

The S&P 500 (SPY) tapped on 50MDA resistance before closing with a 0.4% gain.

The S&P 500 now faces a very critical test. The index has stayed mostly trapped below 50DMA resistance since the big support breakdown in early September.

T2108, the percentage of stocks trading above their respective 40DMAs, did its own dance with 50DMA resistance. Accordingly, a major downtrend in my favorite technical indicator now faces a major test.

T2108 remains stuck in a primary downtrend in place since July (it peaked in February).

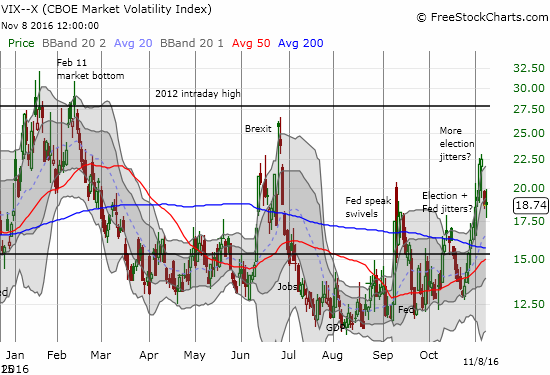

These are ominous tests of resistance given they occurred on the eve of results of the contentious U.S. Presidential election. The volatility index, the VIX, added to the suspense: although the stock market rallied for the day, the VIX stayed exactly flat and well above the 15.35 pivot line. This positioning means the VIX remains poised to soar at the slightest provocation.

The VIX refused to budge at the close after dipping and rallying.

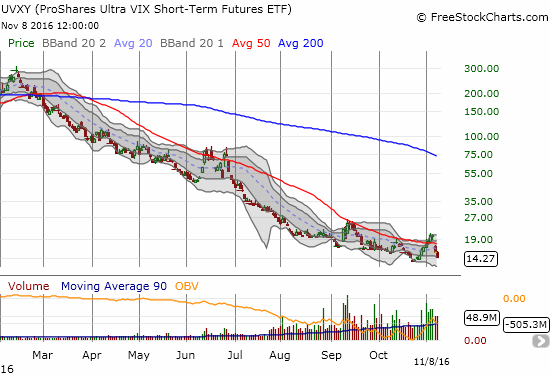

ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) dropped 6.7% although the VIX stayed flat. UVXY looks ready for its regularly scheduled visit with all-time lows.

Despite the ominous set-up, I am leaving the short-term trading call at bullish. I am poised to buy the dips, including any post-election sell-off. Still, I sold a handful of positions that I bought to play the “almost oversold” trading conditions I discussed is earlier posts.

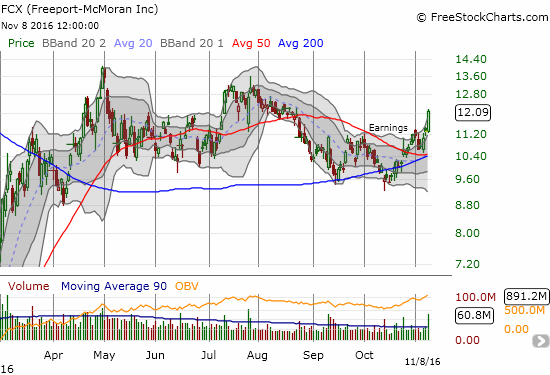

Most importantly, I locked in profits on call options for Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), and Freeport-McMoran Copper & Gold Inc (NYSE:FCX). I kept the call spread on Amazon.com (NASDAQ:AMZN).

Freeport-McMoran (FCX) soared well above its upper-Bollinger Band (BB) on its way to a 7.1% gain.

Copper has been on a tear recently: a 12-day rally and a new 52-week high. This rally was another element of the bullish divergence in recent days that I actually missed. Now, I daresay copper, and FCX in particular, are getting over-extended given the overall global economic environment. Still, FCX is in breakout mode, so I am prepared to buy the dips as long as 50 and 200DMA support hold.

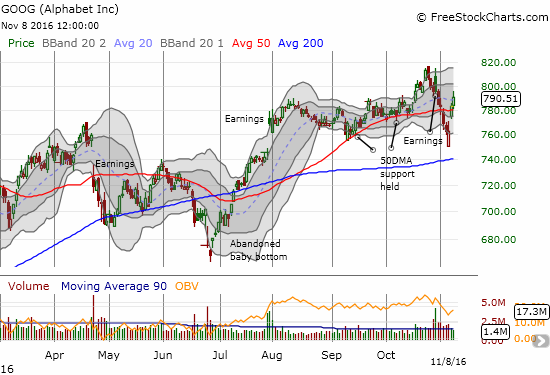

The one market darling I failed to buy ahead of this rally was Alphabet (NASDAQ:GOOG). Ironically, it is the one of the darlings that recovered from a recent breakdown.

Alphabet (NASDAQ:GOOGL) (GOOG) is still down post-earnings, but it has closed two days in a row above 50DMA support.

Now……having said all this, I am typing as early elections results are indicating that, at a minimum, a Hillary Clinton victory for U.S. President will be a LOT closer than anyone with a poll imagined. (At some point, the polling industry will have to be called so much voodoo?).

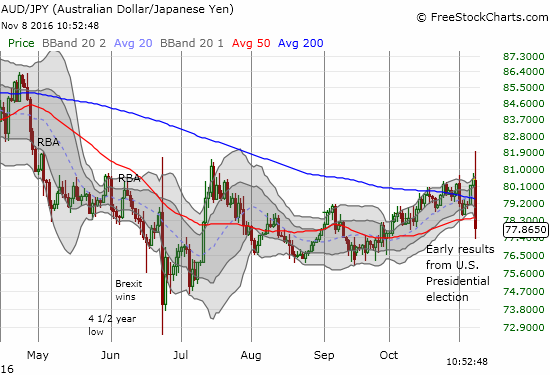

Asian stock markets have sold off heavily, and futures in the U.S. are dumping. My favorite currency indicator of sentiment in financial markets says it all. The Australian dollar (via Guggenheim CurrencyShares Australian Dollar (NYSE:FXA)) is cratering against the Japanese yen (via Guggenheim CurrencyShares Japanese Yen (NYSE:FXY)). Suddenly, the 200DMA for AUD/JPY looks like resistance all over again.

AUD/JPY rallied in support of bullish sentiment earlier in the day. The election ruined THAT with a quickness.

With the market seemingly anticipating a Trump win, and AUD/JPY trading well below its lower-BB, I decided to take profits. These gains are small solace relative to the thumping my long dollar positions are taking!

EUR/USD perked back up and plowed through 200DMA resistance.

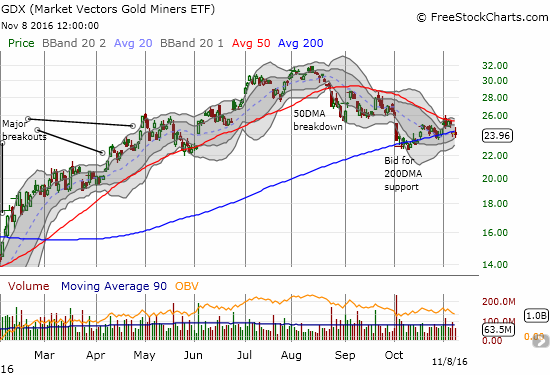

Per my strategy that I have discussed on precious metals, I did start loading up on call options on VanEck Vectors Gold Miners ETF (NYSE:GDX) as it retested 200DMA support on Monday. Maybe that position will at least see gains tomorrow.

As 50DMA resistance bears down on VanEck Vectors Gold Miners ETF (GDX), the uptrending 200DMA continues to provide support. A MAJOR breakout/breakdown is on its way.

As I said in the last T2108 Update, it is time to brace for surprises. Traders should step cautiously and take the action one day, one step at a time.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: long UVXY shares and short UVXY call, long AMZN call spread, long GDX call options, net long the U.S. dollar