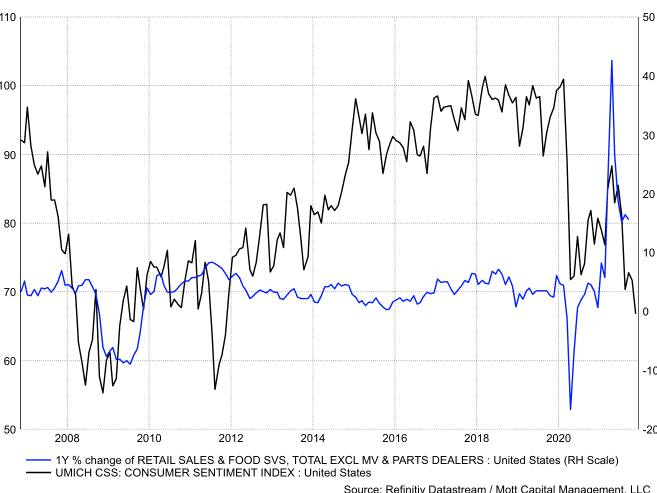

This coming week, this big data point will be retail sales on Tuesday morning and Industrial production on Wednesday. Given the weak University of Michigan report this past Friday, I would be surprised to see a strong retail sales number. The two have had a positive correlation over the years, and the consumer sentiment report was pretty bad.

There will be plenty of talk about positive seasonality trends and the inflow of passive money still pouring into the market. When that isn’t being talked about, the focus will be on inflation. This Friday will also be an options expiration.

1. S&P 500

The S&P 500 was weaker last week, but Friday certainly helped to ease some of the declines. Friday’s rally wasn’t decisive. One decent-sized buy program came through the market around 11 am, which helped get the S&P 500 to pop, resulting in many algo’s chasing the index higher. Otherwise, the action was pretty boring.

The futures managed to climb back to resistance at 4,680 and stalled out there; I think completing a corrective wave B which now leaves the index with a lower wave C, pushing the S&P 500 back to around 4,540. That 4,540 level also roughly lines up with 38.5% retracement for the rally that started in October.

2. Dollar

The dollar had a solid week and is on its march higher; I don’t see that derailing at all and the path higher still in place. Ultimately, I think the dollar can move up to 96.30. The RSI is firmly positive and trending higher, and that tells us that momentum is still firmly bullish.

3. Oil

Meanwhile, oil prices are showing signs of weakness, with a bearish divergence forming due to the price rising and the RSI trending lower. My feeling has been that oil will revert to around $76.

4. Exxon Mobil

This past week, I saw a lot of call contracts closed out for Exxon, which makes me think that others see the price of oil falling. Additionally, a stronger dollar should also weigh on oil prices going forward. Exxon Mobil (NYSE:XOM) has been unable to push above $65 several times over the past few months and has a considerable gap to fill at $57.50, which is likely where the stock is heading in the future.

5. Disney

Walt Disney Company (NYSE:DIS) had a lousy week following disappointing subscriber growth for its streaming business. The stock has a significant level of support, around $156, and is approaching oversold levels. I think it still has some further to fall, but should it find some strong support short-term at $156, it may bounce to $168 after that.

6. Vale

Vale (NYSE:VALE) has fallen due to the plunging prices of iron ore. But the stock has made a lower low and found support around $11.75. Additionally, the RSI is flashing a bullish divergence with a higher low. There is probably a good chance this bounces back to $13.50 in the weeks to come.

7. DraftKings

DraftKings (NASDAQ:DKNG) will need to hold support at $40.75. If that level doesn’t hold, then there is no support until $35.30. I’m not trying to say it will fall; I’m just saying it doesn’t look healthy.

8. Amazon

Amazon.com (NASDAQ:AMZN) has been dead money now since July 2020, and the stock is likely to remain dead money for some time to come. Dead money, in my book, means to underperform the broader S&P 500 massively and, too, basically have no price appreciation. Amazon fits both of those categories.

Now maybe a solid retail sales print gives the stock a boost this week; I’m not sure, but a weak retail sales number could weigh on the shares. Therefore, I think Amazon will remain dead money for some time and likely falls back to support at $3,300 and probably goes lower over time.