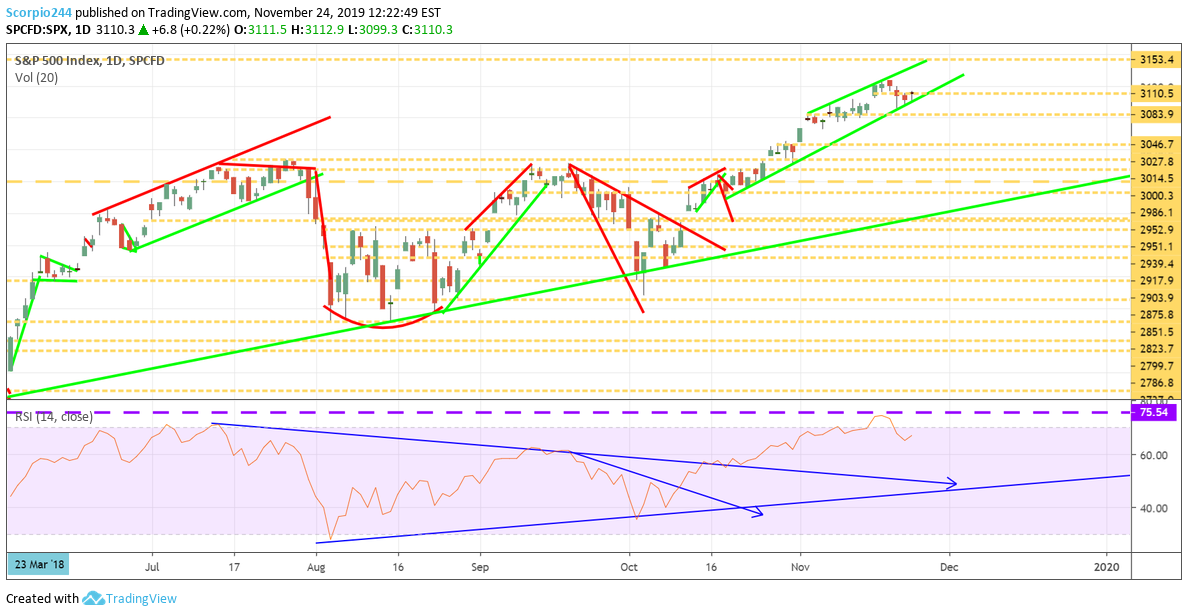

S&P 500 (SPY)

The S&P 500 has been rising in a channel since the beginning of November, and as of now, the channel has remained very strong. As long as the trend remains, the index is likely to continue to advance with 3,150 acting as the next level of resistance.

Apple (AAPL)

Apple (NASDAQ:AAPL) has been rising as well. However, Apple may be showing signs of fatigue as the stock test support at $260. Should the level of support at $260 fail, it could be headed lower to $255.

Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) continues to move higher and is likely to test resistance around $152.

Tesla (TSLA)

There is a good chance that Tesla (NASDAQ:TSLA) bounces sharply and fills the gap back to $360 after the company announced it had almost 150,000 reservations for its cybertruck. Of course, a reservation is just $100, and it makes the hurdle much lower than what we have seen for the X and Y. But still, that is far more than people were opining on Friday, from what I heard.

General Electric (GE)

General Electric (NYSE:GE) looks like it may be forming a pennant pattern, and that means it may be heading to $12.35.

ACADIA (ACAD)

ACADIA Pharmaceuticals (NASDAQ:ACAD) has been challenging resistance around $48.25, and it appears to be forming a bullish rising triangle pattern. A break out sends the stock to $51.80.

Regeneron (REGN)

Regeneron (NASDAQ:REGN) is popping its head up, rising above resistance at $350. It could set up a push to $395.

Illumina (ILMN)

Illumina (NASDAQ:ILMN) is nearing a breakout at $316 that could result in the stock filling a gap up to $360.