S&P 500

Stocks are on a path higher, with the S&P 500 rising to close at a record high this week at 3,169. The patterns in the chart suggest the market continues to climb this week, heading towards 3,200.

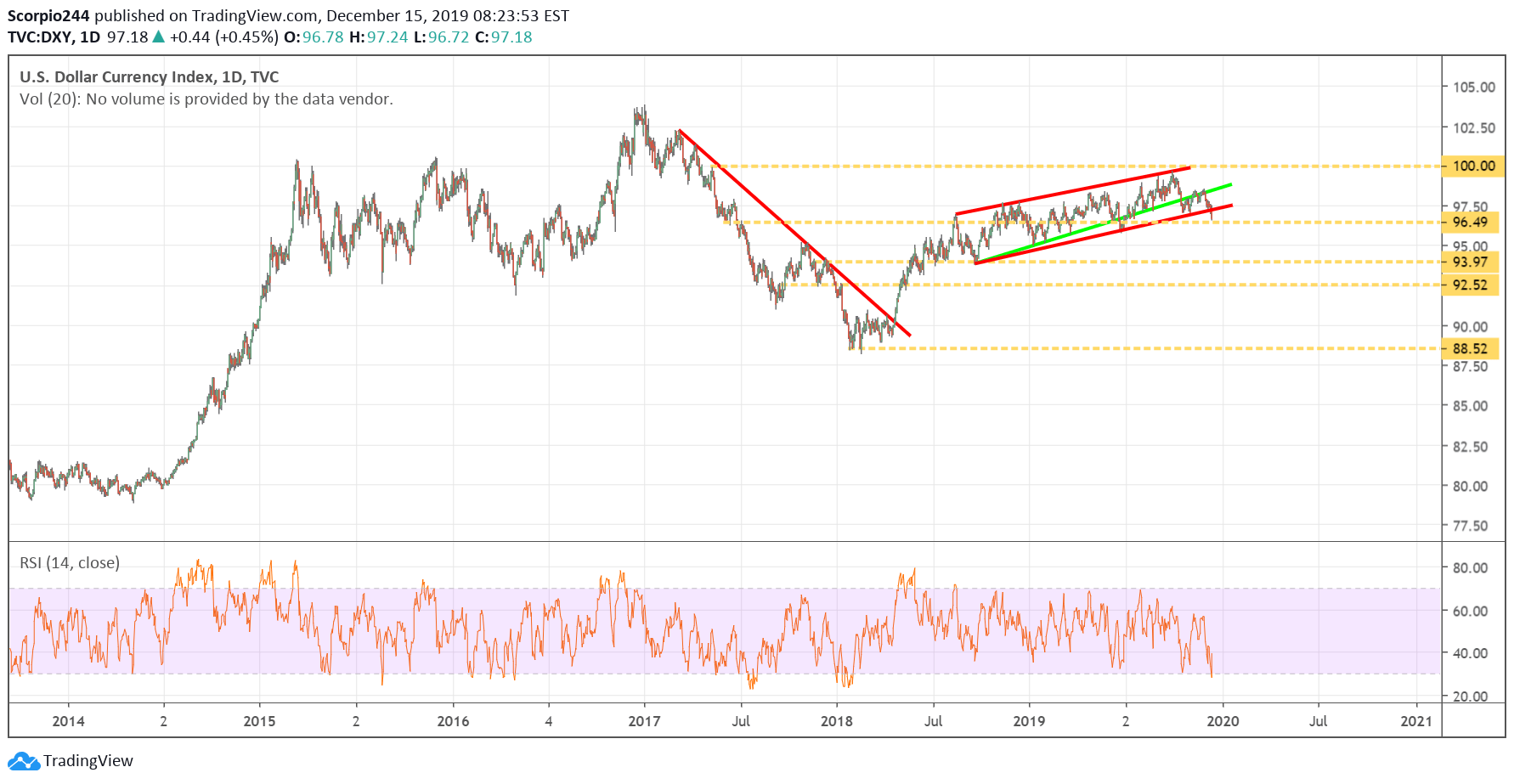

Dollar Index

The dollar index should be on everyone’s watch list this week. The index fell below uptrend and is testing support 96.50. A drop below 96.50 can really get the dollar moving lower towards 94. One should not underestimate the power the dollar has to move commodity prices and to stock inflationary forces. I talk a lot more about the dollar in this video segment from Friday.

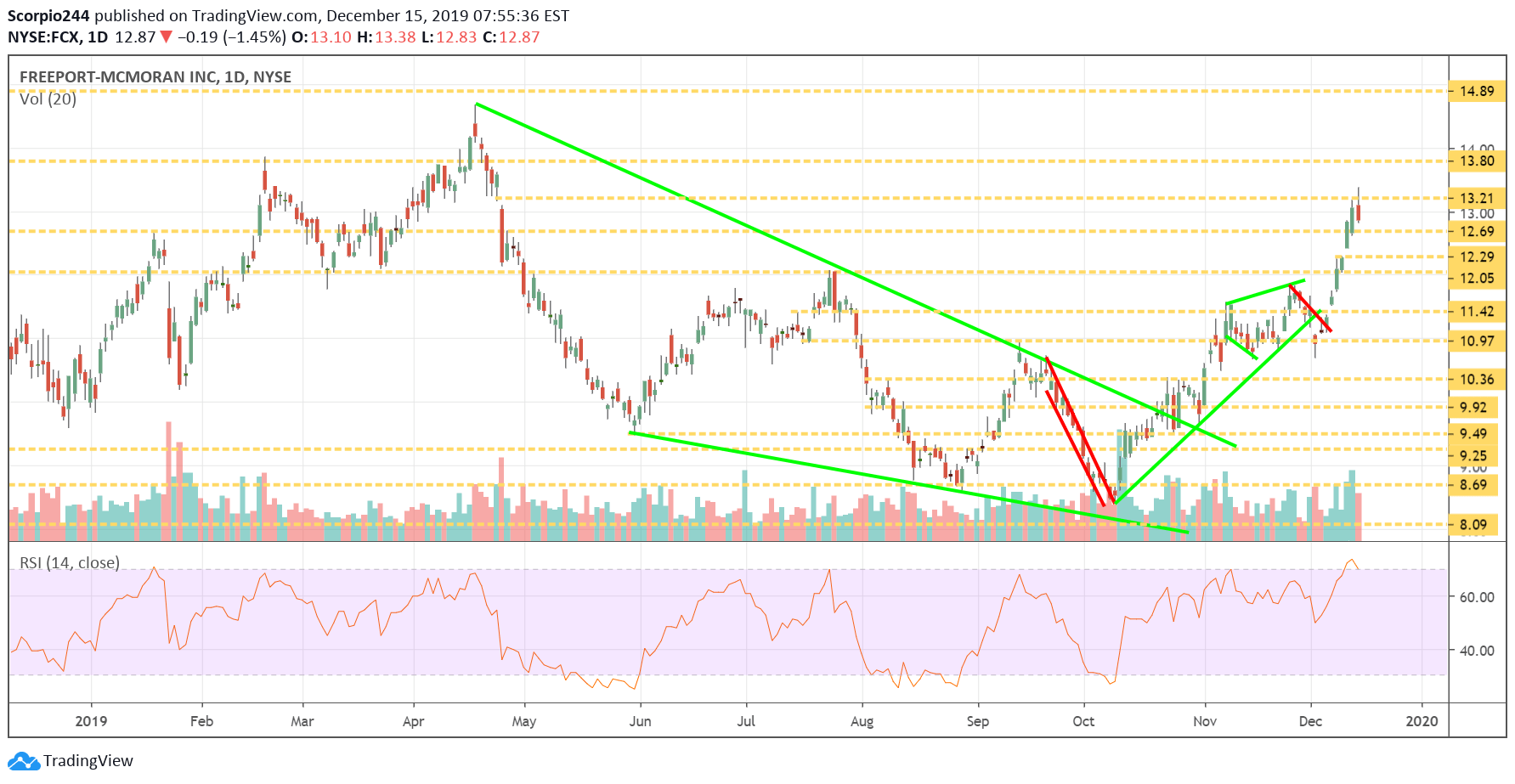

Freeport (FCX)

Freeport (NYSE:FCX) is one stock to keep on your radar if the dollar weakens this week. The stock is testing resistance at $13.20 and could be on its way to $13.80. I was seeing bullish betting in the stock earlier this week, but that was around $12.80. Then again, I have been seeing bullish betting in the stock since September 6, when the stock was only $9.50.

Netflix (NFLX)

Netflix (NASDAQ:NFLX) has a bullish uptrend that has formed, and I have recently seen some bullish options betting that suggests the stock rises to around $316.

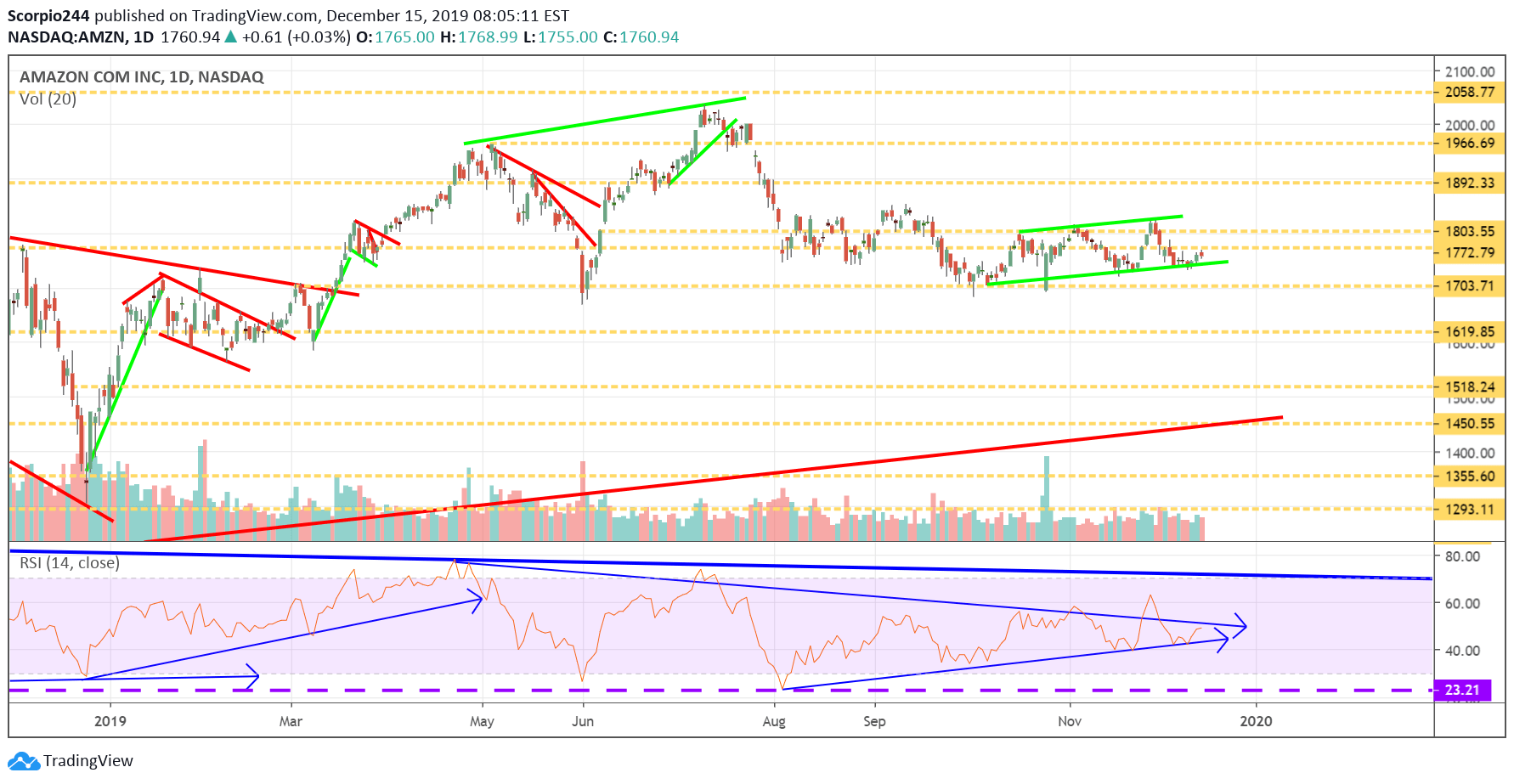

Amazon (AMZN)

Amazon (NASDAQ:AMZN) also appears to be showing some bullish trends as well, along with bullish options betting. It suggests the stock finally push up to around $1840 for starters.

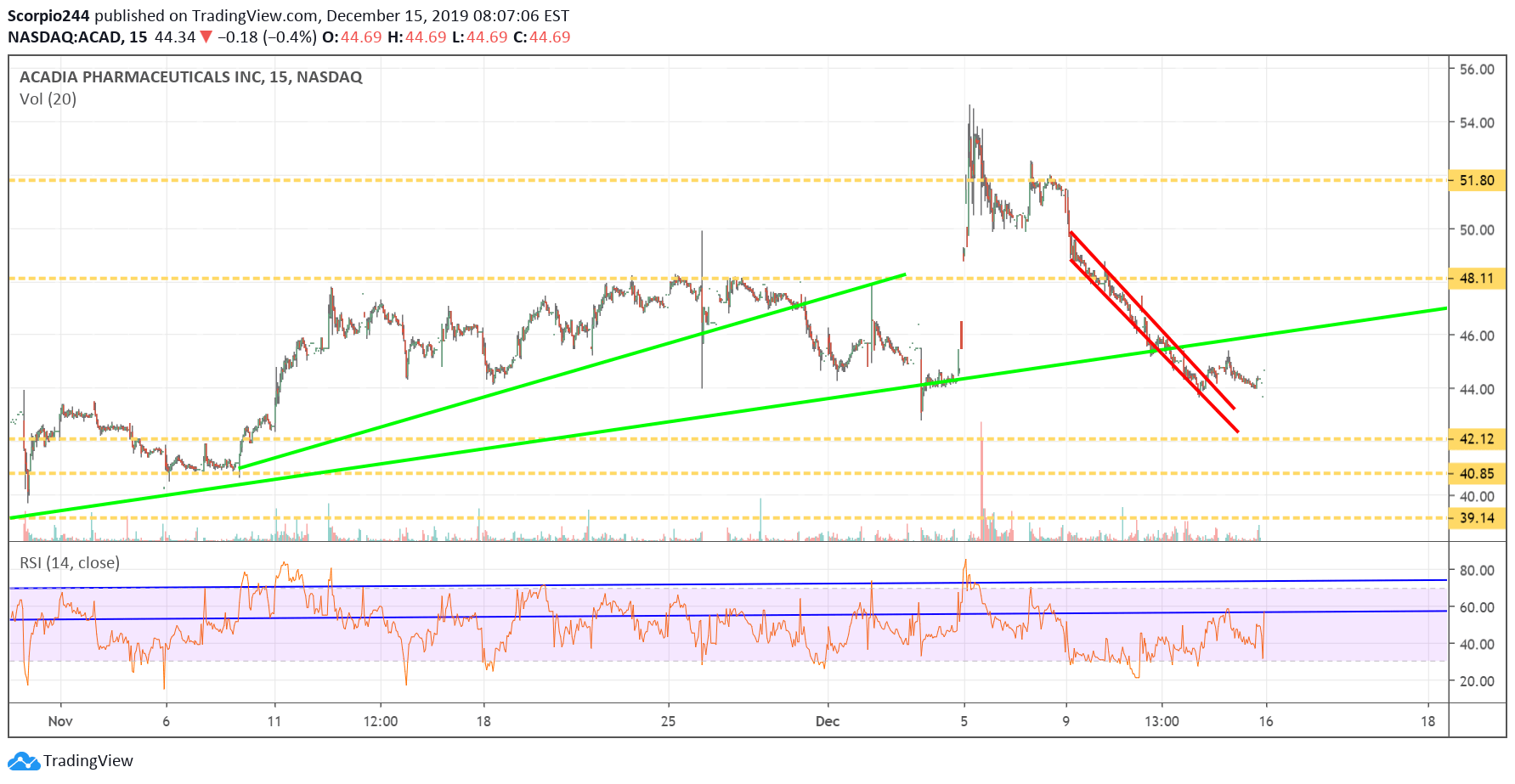

ACADIA (ACAD)

It looks like the lazy trader or the “set it and forget it” Algo, have been cleaned up in ACADIA (NASDAQ:ACAD). Now the stock appears to be forming a double bottom and likely push higher once again towards $48. I love it when people email me to tell me how the CEO sold some stock. Big deal. He acquired 150,000 for $19.65 and sold them around $52, can you blame him? Not to mention, it was part of a 10b5-1 plan that was instituted on August 22. The guy only owned 1.4 million shares in April, when they filed the proxy statement. There have been a whole bunch of insider sales recently, all part of 10b5-1 plans.

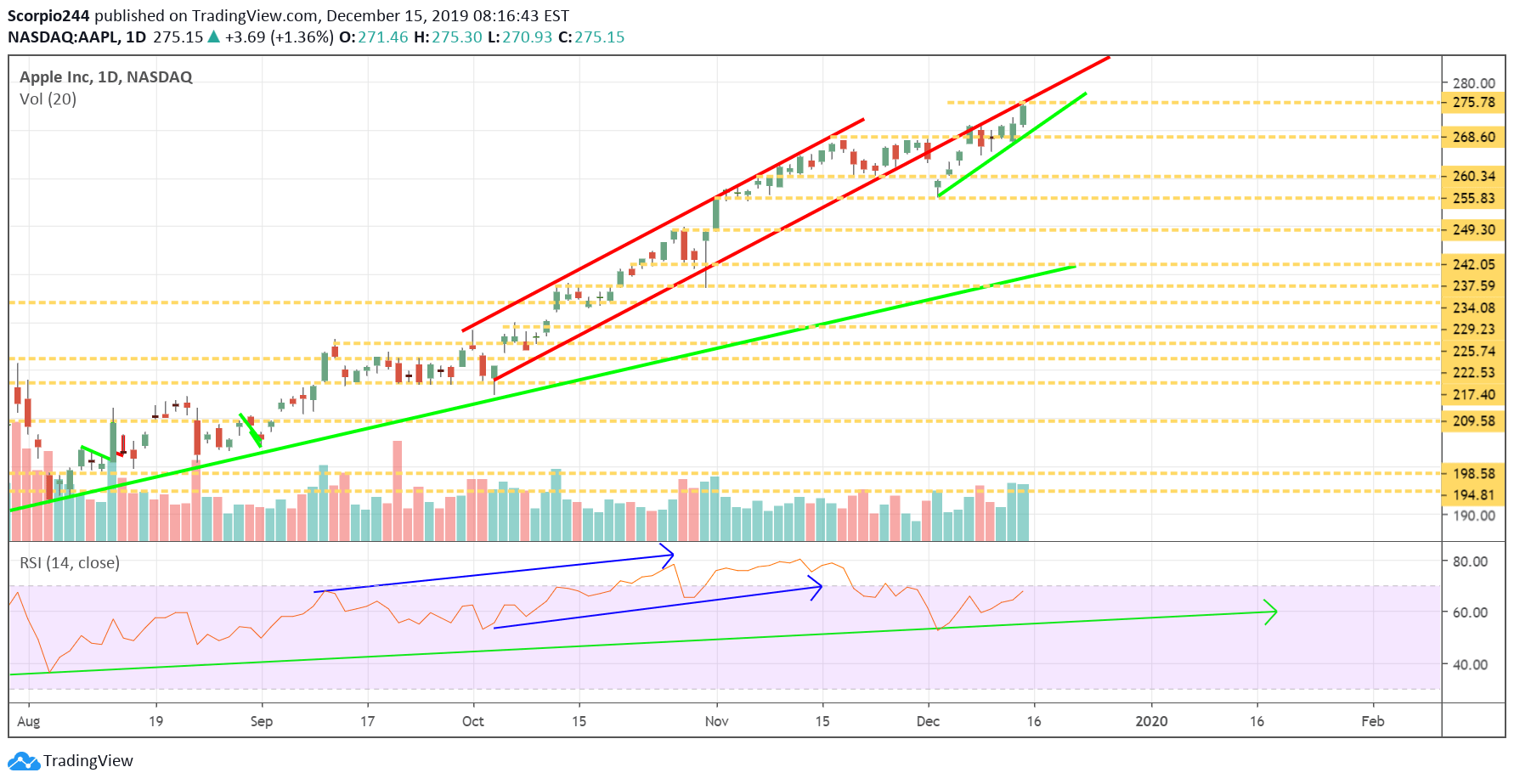

Apple (AAPL)

I think Apple (NASDAQ:AAPL) trades sideways this week or lower towards $268.

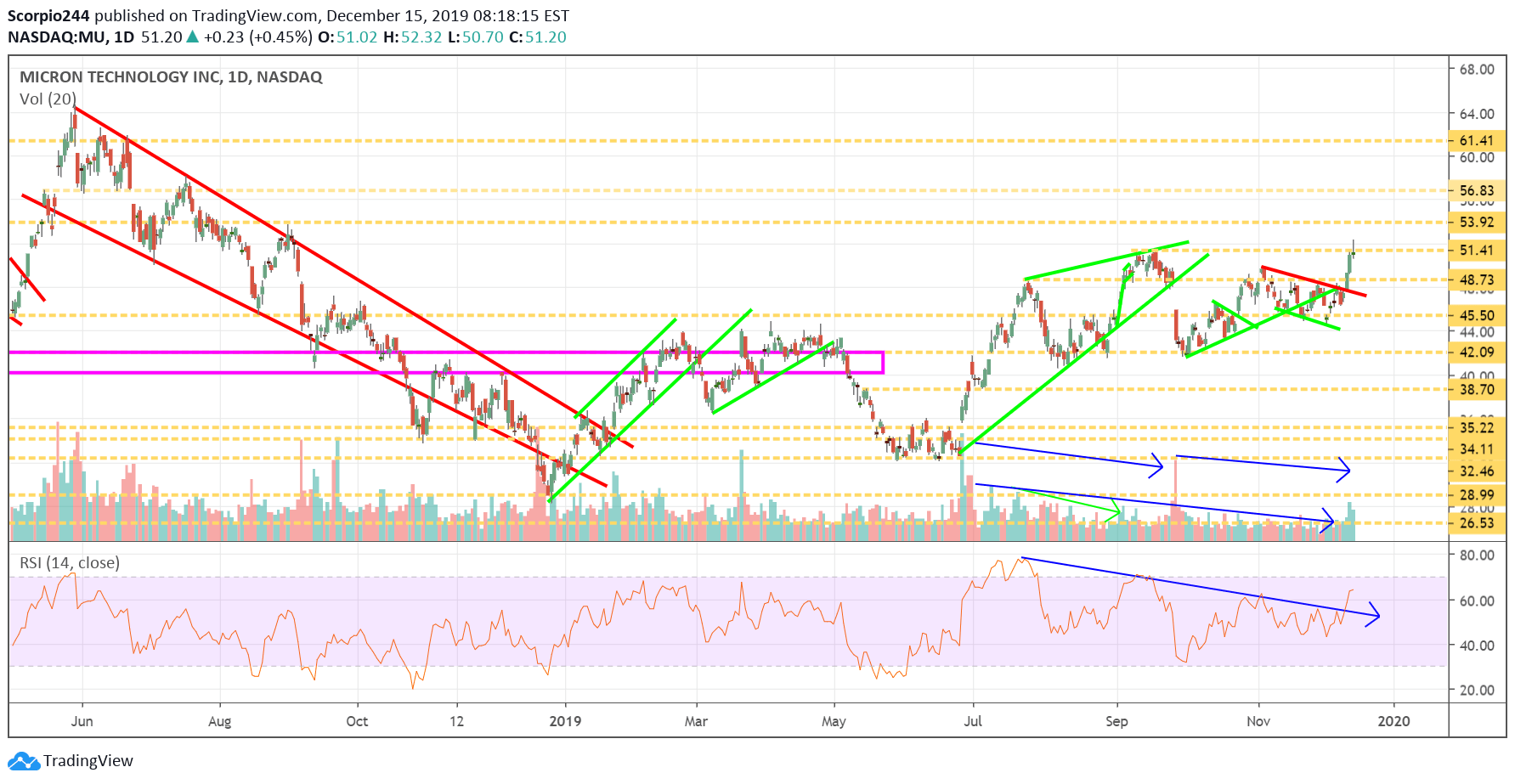

Micron (MU))

Micron (NASDAQ:MU) will report results this week, and I think the stock heads to $54. The trends have changed.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.