As the Fed pivot starts with a 50-basis-point slash, the bond market expects more to come, and gold should benefit. Meanwhile, the risk of a second inflationary wave isn’t dismissed, and the Nasdaq 100 is as highly concentrated as ever. Each week, the Syz investment team takes you through the last seven days in seven charts.

1. The US Federal Reserve Surprises With Not One But Two Rate Cuts

The Federal Reserve has cut interest rates for the first time since March 2020, meaning that the long-awaited “Fed pivot” has officially begun. By starting its monetary policy easing cycle with a 50-basis-point rate cut, it seems the Fed has decided to focus on the labor market dimension of its dual mandate, rather than on inflation.

Here is a summary of last Wednesday's meeting:

- Interest rates cut by 50 basis points for the first time since 2020

- Two further rate cuts are planned between now and the end of 2024

- A Fed governor, Miki Bowman, has come out in favor of a smaller cut (25 basis points). This is the first “dissent” from a governor since 2005.

- The Fed has gained “greater confidence” that inflation is approaching 2%.

- Outlook evolves as “they carefully assess incoming macroeconomic data”

- As far as forecasts are concerned, rate cuts of 100 basis points in 2025 and 50 basis points in 2026 are envisaged.

This is a very clear shift on the part of the Fed, which indicates two things: 1) The US central bank is confident that the disinflationary trend remains in place; 2) It now sees unemployment as its top priority, as the job market is weakening. Their decision almost looks like risk management.

What are the reasons behind the Fed's decision to cut rates by 50 basis points rather than 25? They are as follows:

- Inflation risk is lower than employment and consumption risk;

- The most persistent inflationary component is housing. To alleviate inflationary pressures on the housing market (rents, prices), the supply of housing must increase. To achieve this, mortgage rates need to fall. A sharp reduction in rates should ease borrowing conditions on the housing market;

- US sovereign bond maturities are relatively concentrated at the front end of the curve (short maturities). Short-term rates therefore need to be lowered significantly to ease the interest burden.

Financial markets initially reacted cautiously to the news, before resuming their upward trend on Thursday. The S&P 500, the Dow Jones and even Germany's DAX index hit new all-time highs.

2. The Bond Market Indicates That a Very Large Number of Rate Cuts Are Still to Come

Even after the Fed's 0.50% cut in key interest rates, the difference between short rates and 2-year Treasury yields is the highest it has been for over thirty years.

In other words, the market is expecting further rate cuts, and sooner and further than the Fed is signaling.

Source: Global Markets Investors

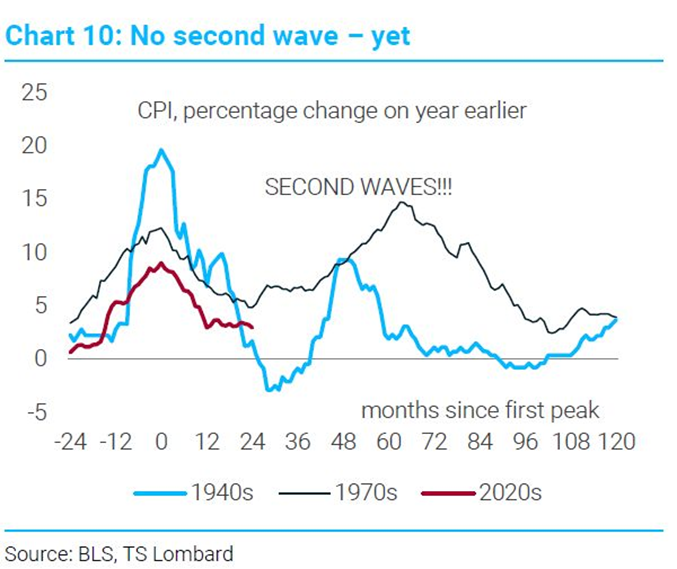

3. The Risk of a “Second Wave”

In the wake of the Fed's surprise 50-basis-point rate cut on Wednesday evening, here's what many economists have in mind: the risk of a second wave of inflation.

Whether in the 1940s or the 1970s, a premature and/or excessive cut in key interest rates set off a backlash of inflationary pressures a few months later. If we extend the historical analysis to all developed countries, the “second wave” hit in 87% of cases...

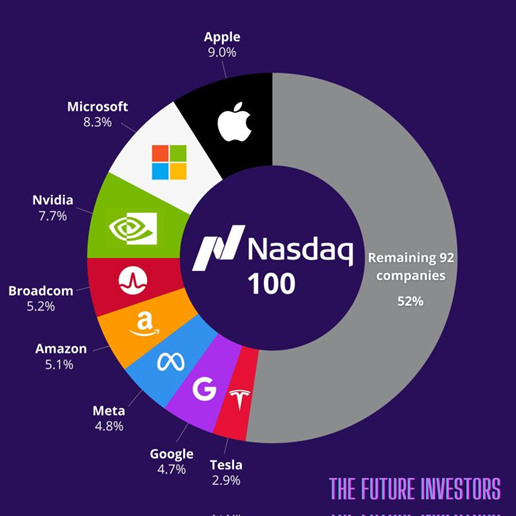

4. A Highly Concentrated Nasdaq 100 Index

Large-cap technology stocks rebounded strongly last week. By the way, here's what you're really buying when you invest $1,000 in an ETF on the Nasdaq 100 (QQQ):

- $90 in Apple (NASDAQ:AAPL)

- $83 in Microsoft (NASDAQ:MSFT)

- $77 in Nvidia (NASDAQ:NVDA)

- $52 in Broadcom (NASDAQ:AVGO)

- $51 in Amazon (NASDAQ:AMZN)

- $48 in Meta (NASDAQ:META)

- $47 in Google (NASDAQ:GOOGL)

- $29 in Tesla (NASDAQ:TSLA)

The remaining $523 is invested in the 92 other stocks...

Source: The Future Investors

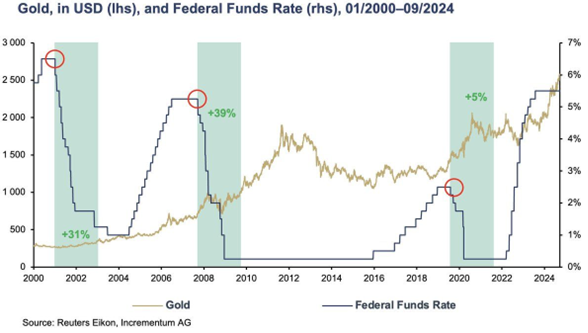

5. Interest Rate Cuts Tend to Benefit Gold

Historically, gold tends to appreciate when interest rates fall. The reason? As real yields (nominal rates minus inflation) on U.S. Treasury bonds fall, the opportunity cost of holding non-performing assets, such as gold, also falls.

Source: Incrementum AG

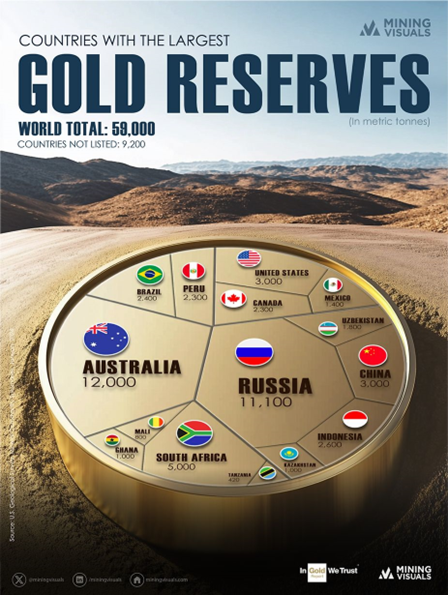

6. World Leaders in Gold Reserves in 2023

According to the US Geological Survey, identified gold reserves currently stand at just 59,000 tonnes worldwide in 2023.

The majority of these reserves are concentrated in three key countries that dominate the global gold landscape: Australia, Russia and South Africa. These countries collectively hold a significant share of the world's gold reserves.

Australia holds some of the world's largest gold reserves, estimated at 12,000 metric tons. These reserves are mainly concentrated in the states of Western Australia and South Australia, where major mines such as Boddington and Super Pit contribute significant gold production.

Russia comes second with 11,100 tonnes of reserves. Its production is largely concentrated in Siberia, where abundant resources have enabled Russia to steadily increase its gold stocks, even in the face of geopolitical challenges.

South Africa remains an important player in terms of gold reserves, although its production has declined due to the increasing difficulty of exploiting deeper deposits. Despite this, it still has significant underground reserves.

Source: Mining Visuals

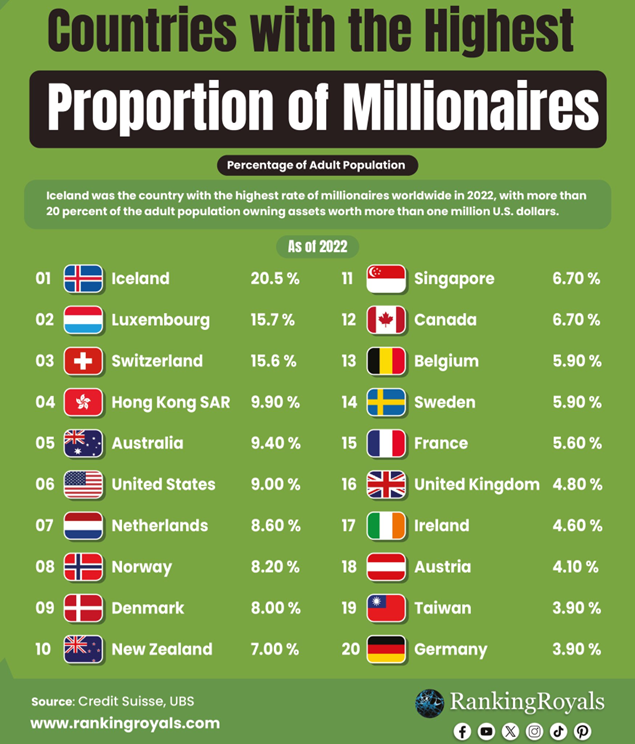

7. Countries With the Highest Proportion of Millionaires

Iceland was the country with the highest proportion of millionaires in the world in 2022, with over 20% of the adult population owning assets worth over one million US dollars.

Luxembourg followed with 15.7% of the population officially identified as millionaires (in dollars), while Switzerland came third (15.7%).

Source: www.rankingroyals.com

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.