Algo’s And ETF’s Drive Trading

The algorithms have gone loco; I think that seems clear. The algo’s and the ETF’s create a recipe that is a freight train heading to disaster. At this point, the price action currently is not all that different from what we saw in December 2018.

The Algo’s push stocks down, then falling stocks push the ETF’s down, then the ETF’s sell the stock held in the basket, then the algo’s chase the stocks down, then the stocks push the ETF’s down, then the ETF’s sells the stocks in the basket, and the algo’s chase the stocks lower. Makes for one big happy family.

Sounds like a vicious cycle? That’s because it is.

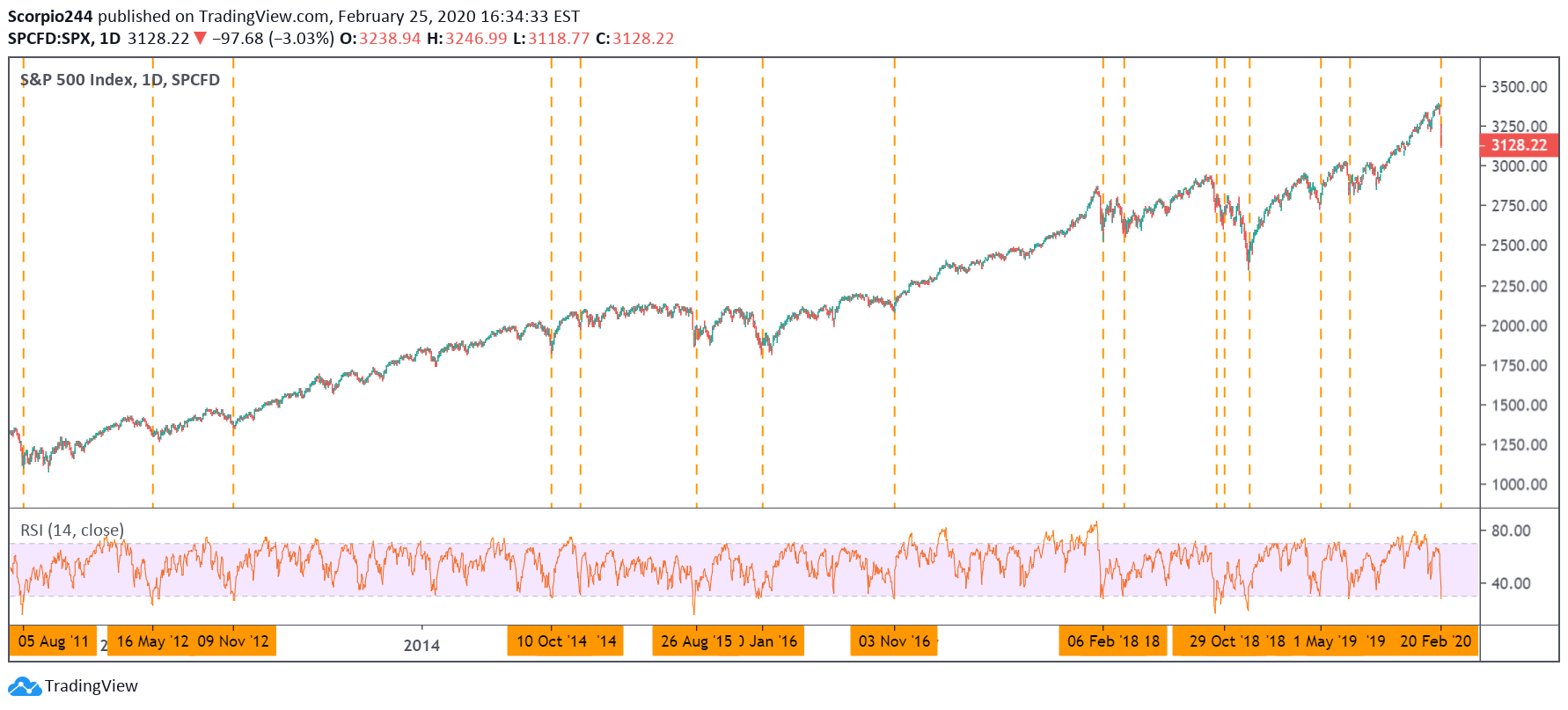

The market is at a one of those points where it is getting oversold.

The RSI is now at 30, and while it hasn’t always led to a change of trend, historically, it has the majority of the time. On the chart below, I count 15 prior times the RSI got to around 30 or 31, and I count 12 of them as being the bottom in the S&P 500.

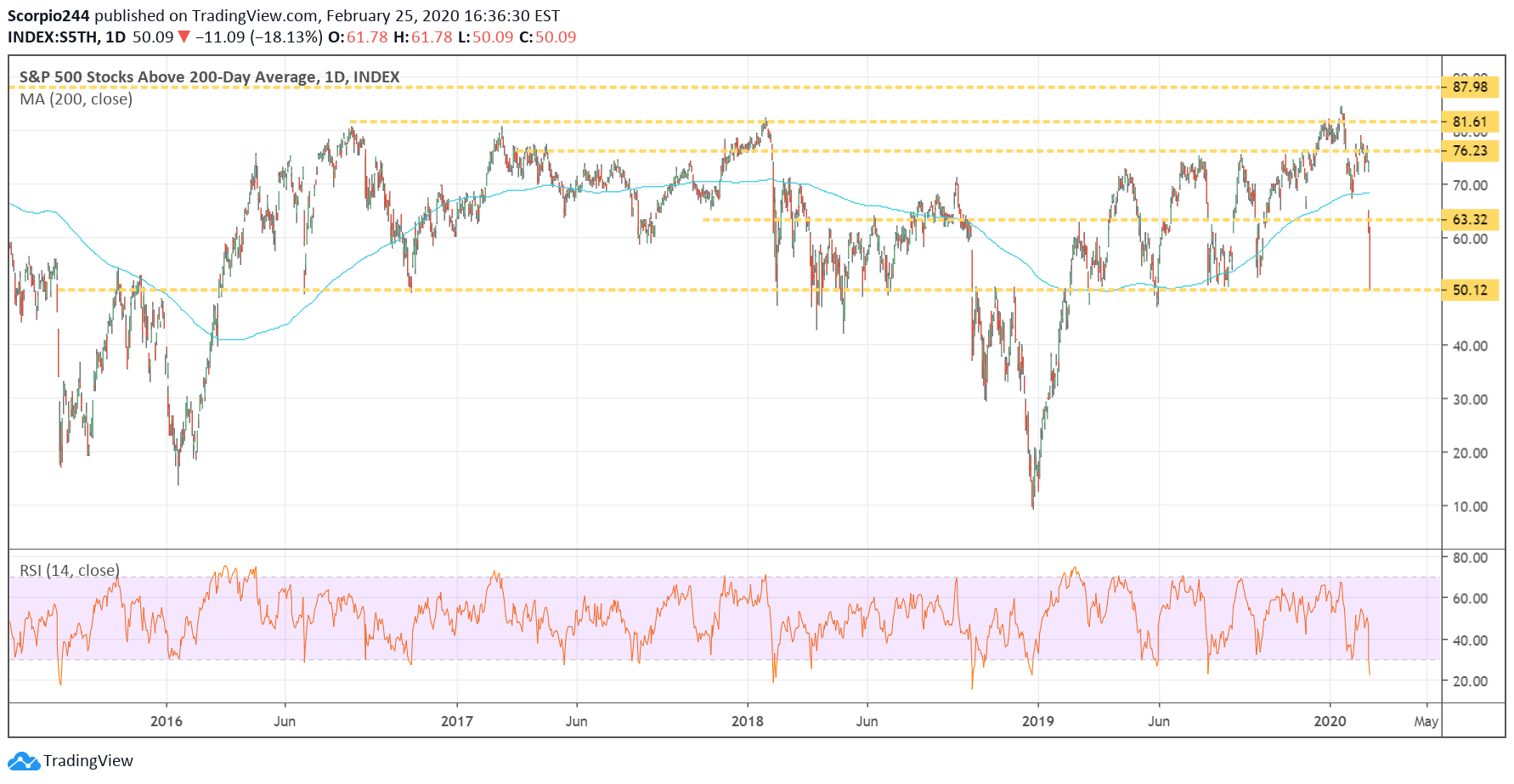

200-Day Moving Average

The number of stocks below their 200-day moving average fell to 50%. Historically that has been the bottom of the range the majority of the time with the expection of December 2018 and end of 2015 into 2016.

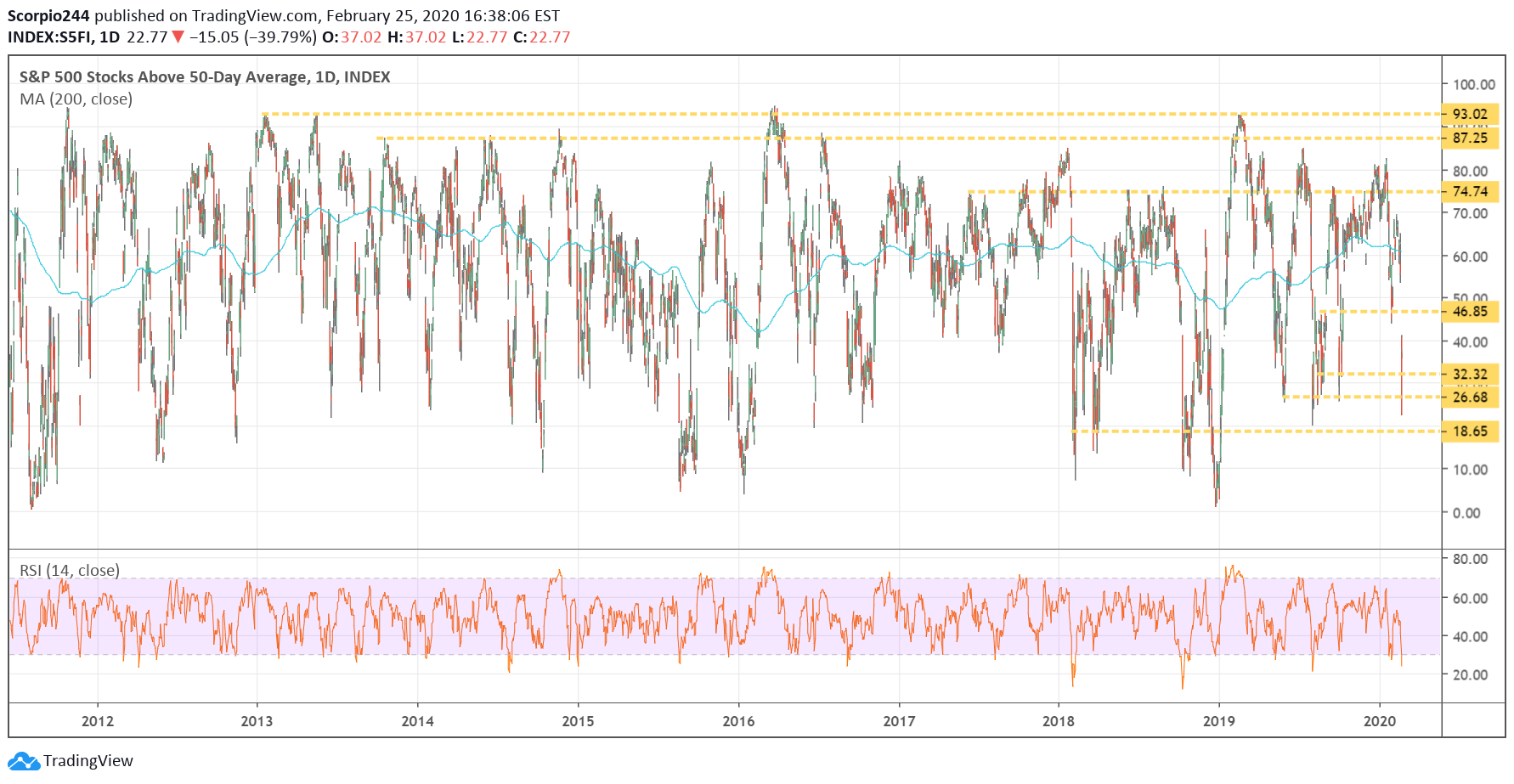

50 Day Move Average

The number of stocks below their 50-day moving average is down to 22.7% and it is now at the very lower bottom of the range.

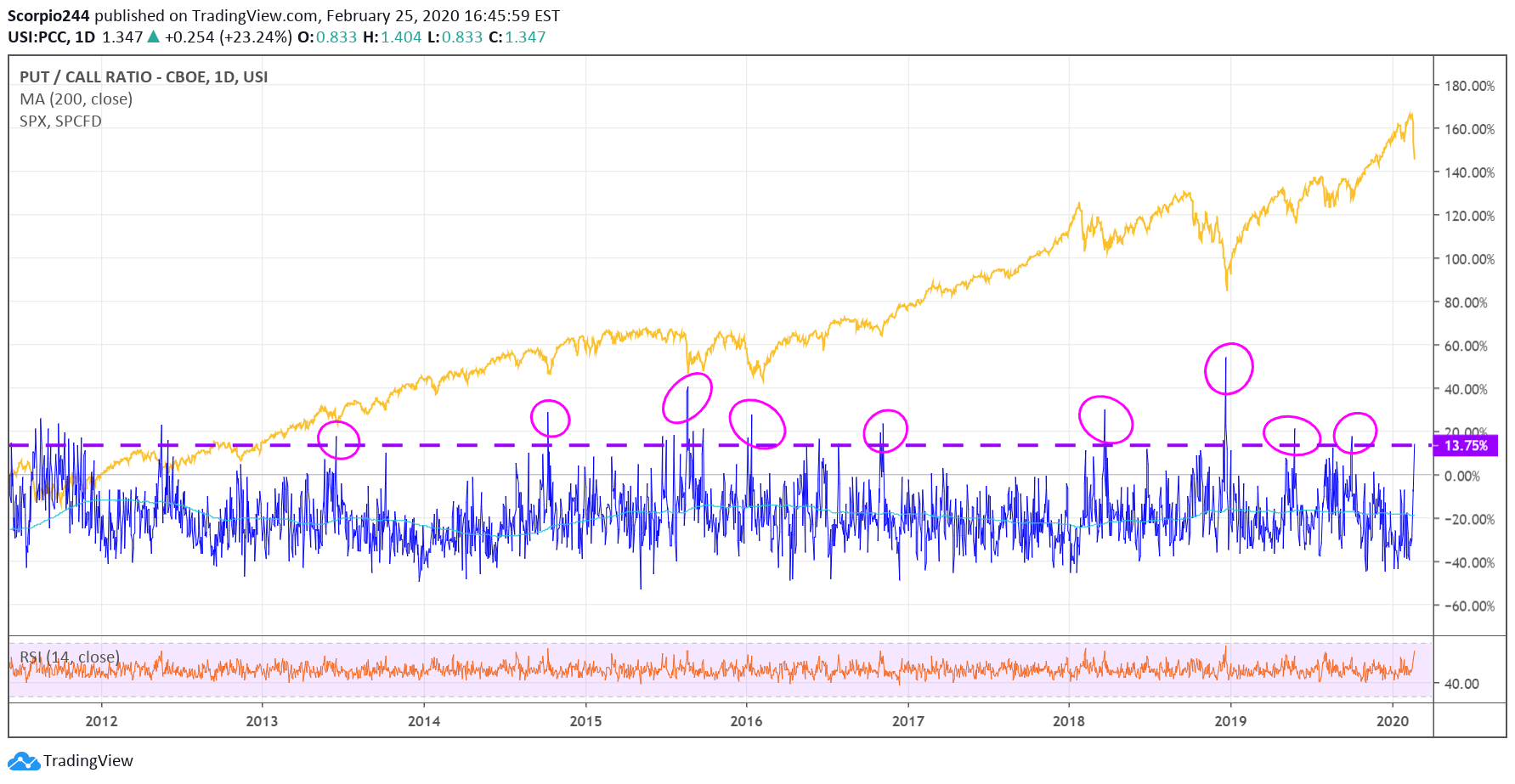

Put To Call Ratio

The put to call ratio reached 1.35 on the CBOE yesterday. There have only been a handful of times that the ratio has hit 1.35 or higher, and each time it was at or near a turning point.

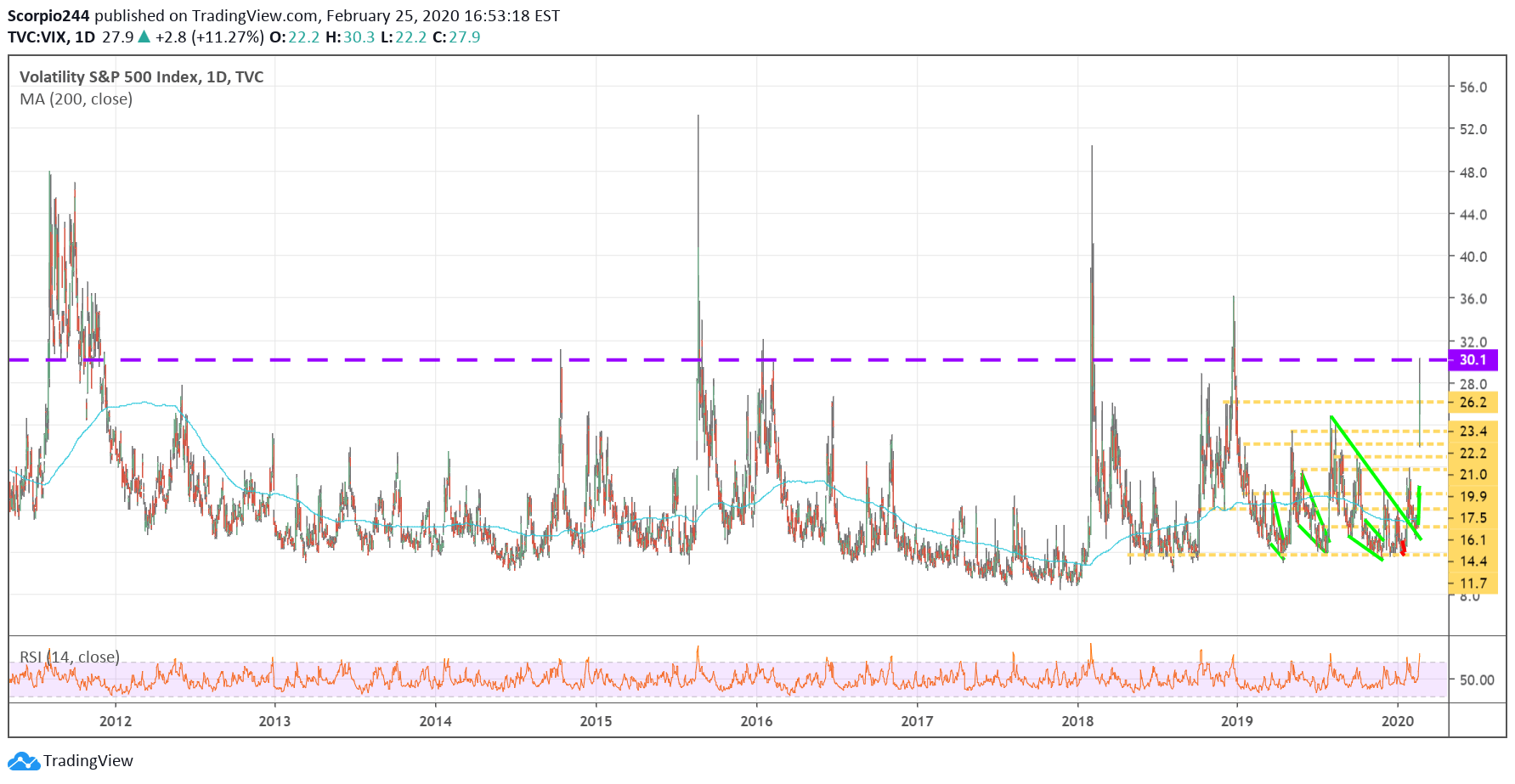

VIX

The VIX also spiked to its highest level since December 2018.

So has the market “bottomed”? It is anyone’s guess. But if it hasn’t, it seems to me we are close, and if I had to guess, yes, I think we are relatively at a bottom, and due for a rebound.

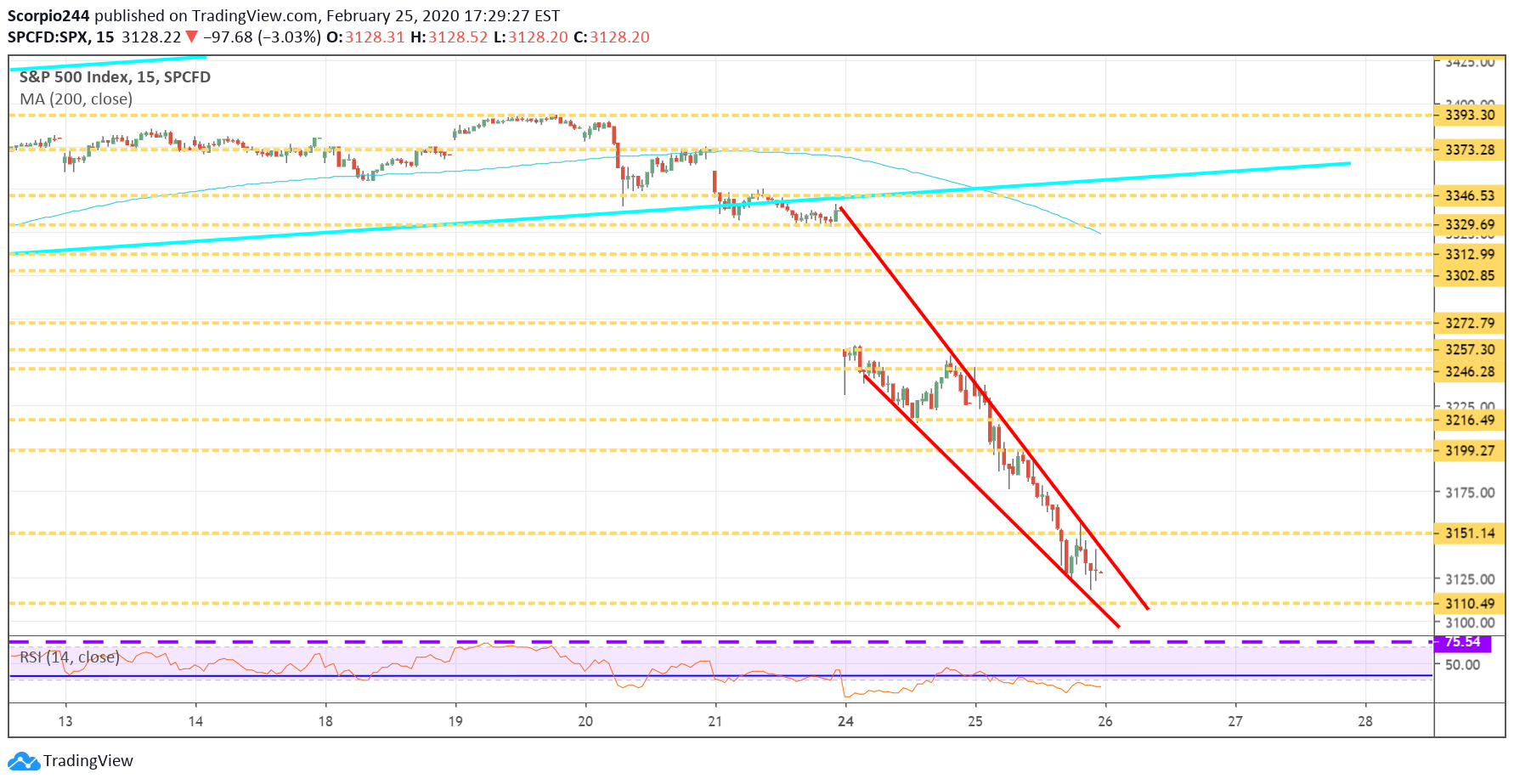

S&P 500 (SPY)

There is a nasty downtrend in the S&P 500 and what appears to be a falling wedge.

If the S&P 500 should rebound today, my expectations are for a rally up to around 3,200.

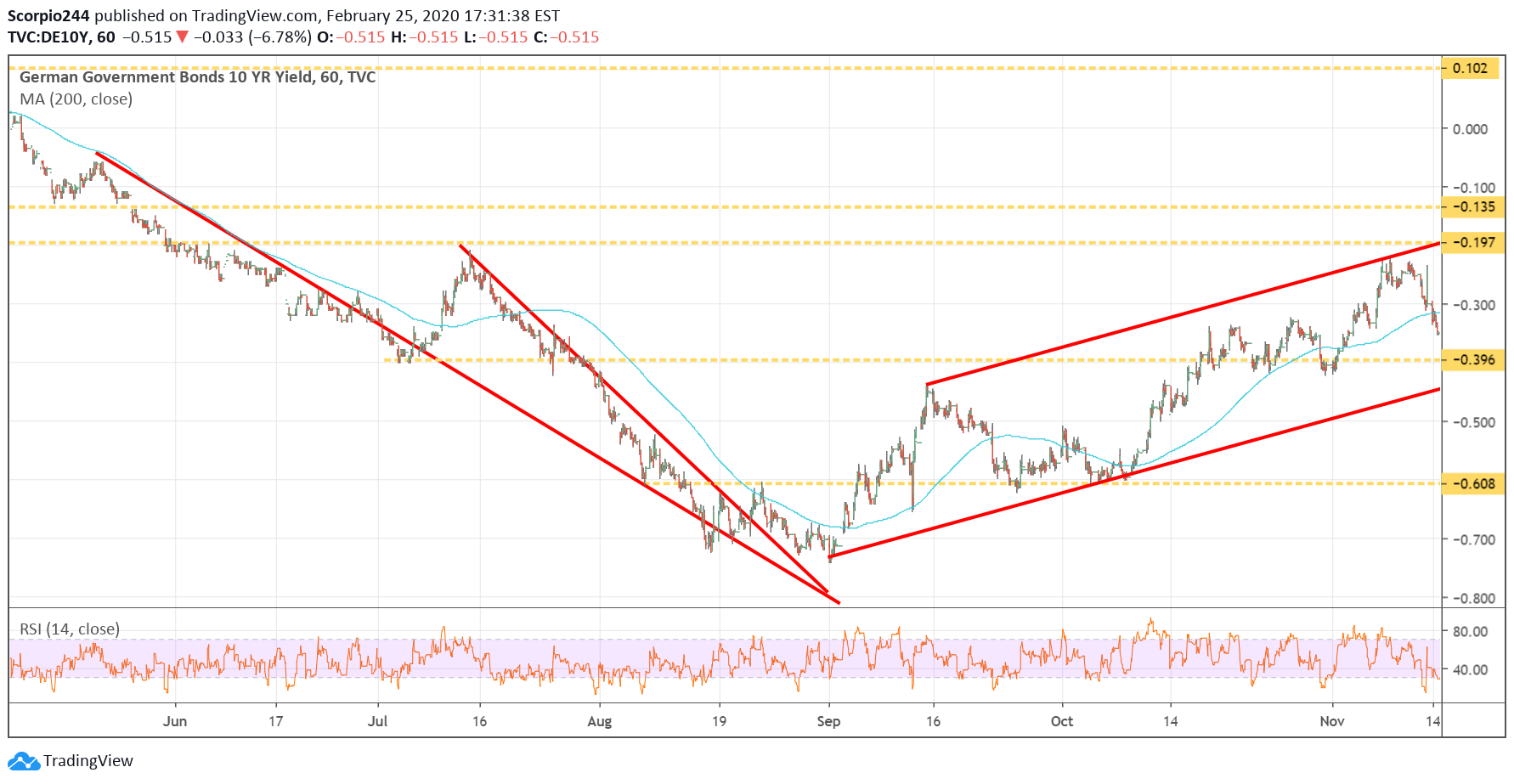

Bunds

It reminds me of this chart for the German Bund from over the summer. It is just on a different time scale.

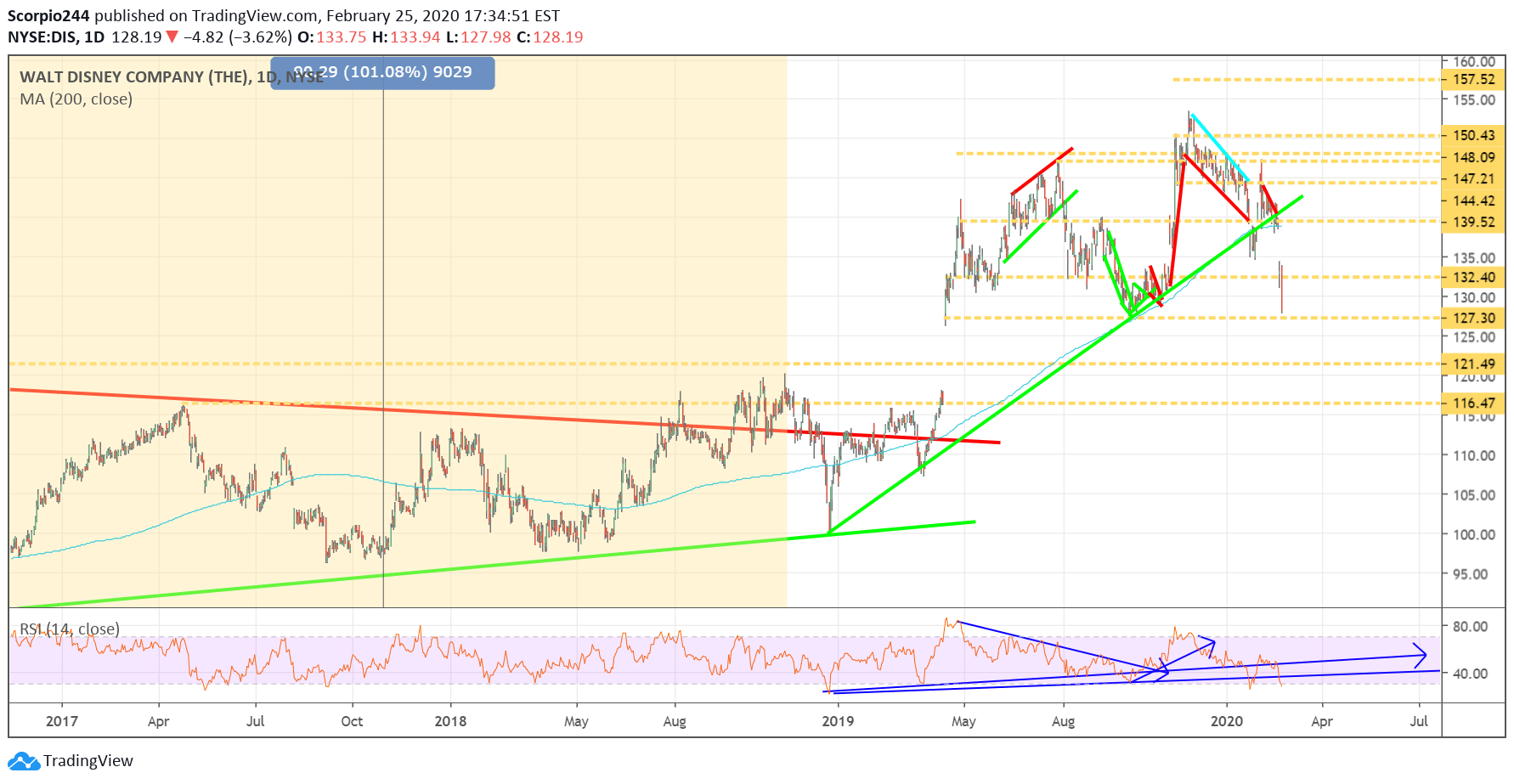

Disney (DIS)

The big news after the close is that Bob Iger is stepping down as CEO of Disney (NYSE:DIS). It was a shock to me, as it was likely to everyone. This idea has been flirted with for some time, and it reminds of when Howard Schultz stepped down from Starbucks (NASDAQ:SBUX). I don’t think much changes here. However, the stock is likely to trade lower and test that gap fill.

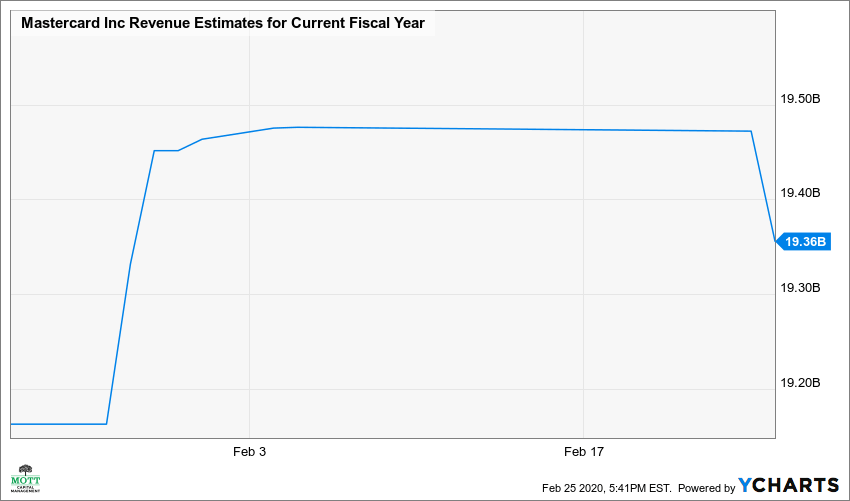

Mastercard (MA)

Mastercard (NYSE:MA) is down about 14% in, oh, about three business days. Pretty amazing. Anyway, on February 20, the stock had a market cap of $346 billion, and now it is $305 billion. Meanwhile, analysts have adjusted their revenue target for 2020, given the guide down. Can you see it on the chart? It goes from an estimate of $19.46 billion to $19.36 billion. So $100 million cut in revenue equals a $40 billion drop in market cap? Makes so much sense.

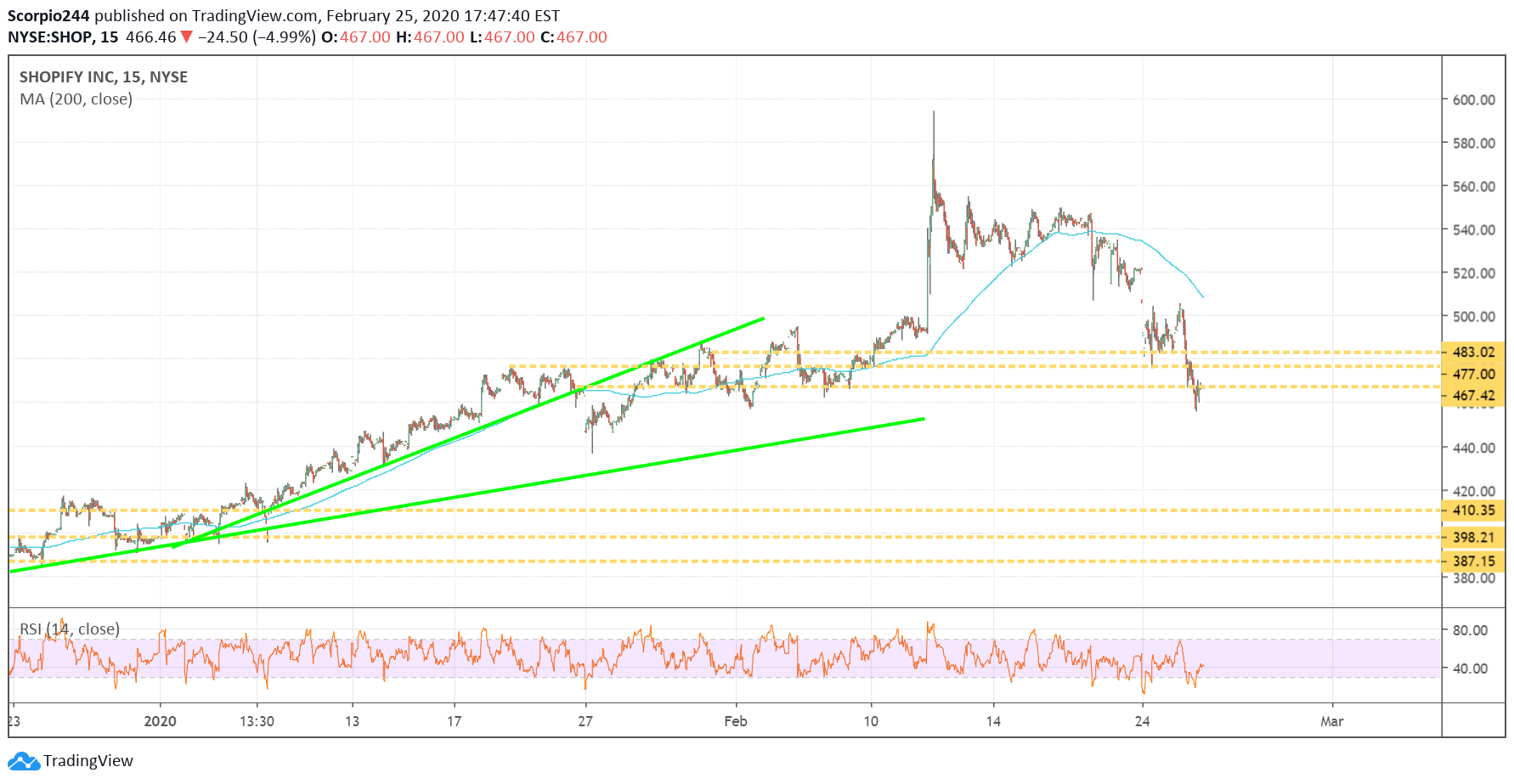

Shopify (SHOP)

Shopify (NYSE:SHOP) is hanging on by a thread at this $465 level. A breach of $465 pushes shares to $445 and perhaps $410.

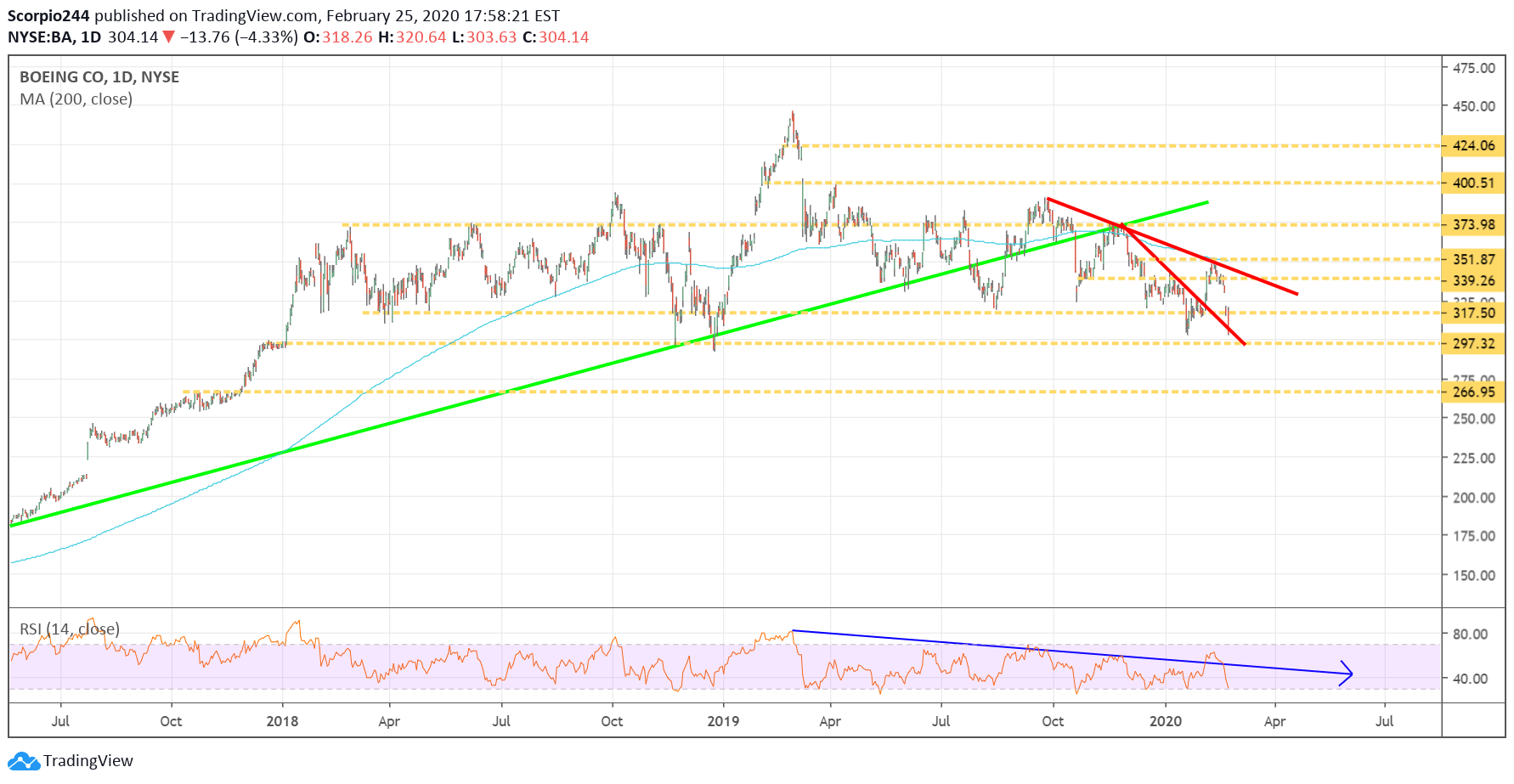

Boeing (BA)

Boeing (NYSE:BA) fell hard yesterday and is now sitting at its recent lows. This region has been pretty firm support with a break below $297, pushing shares much lower. The RSI suggests the stock continues to fall.

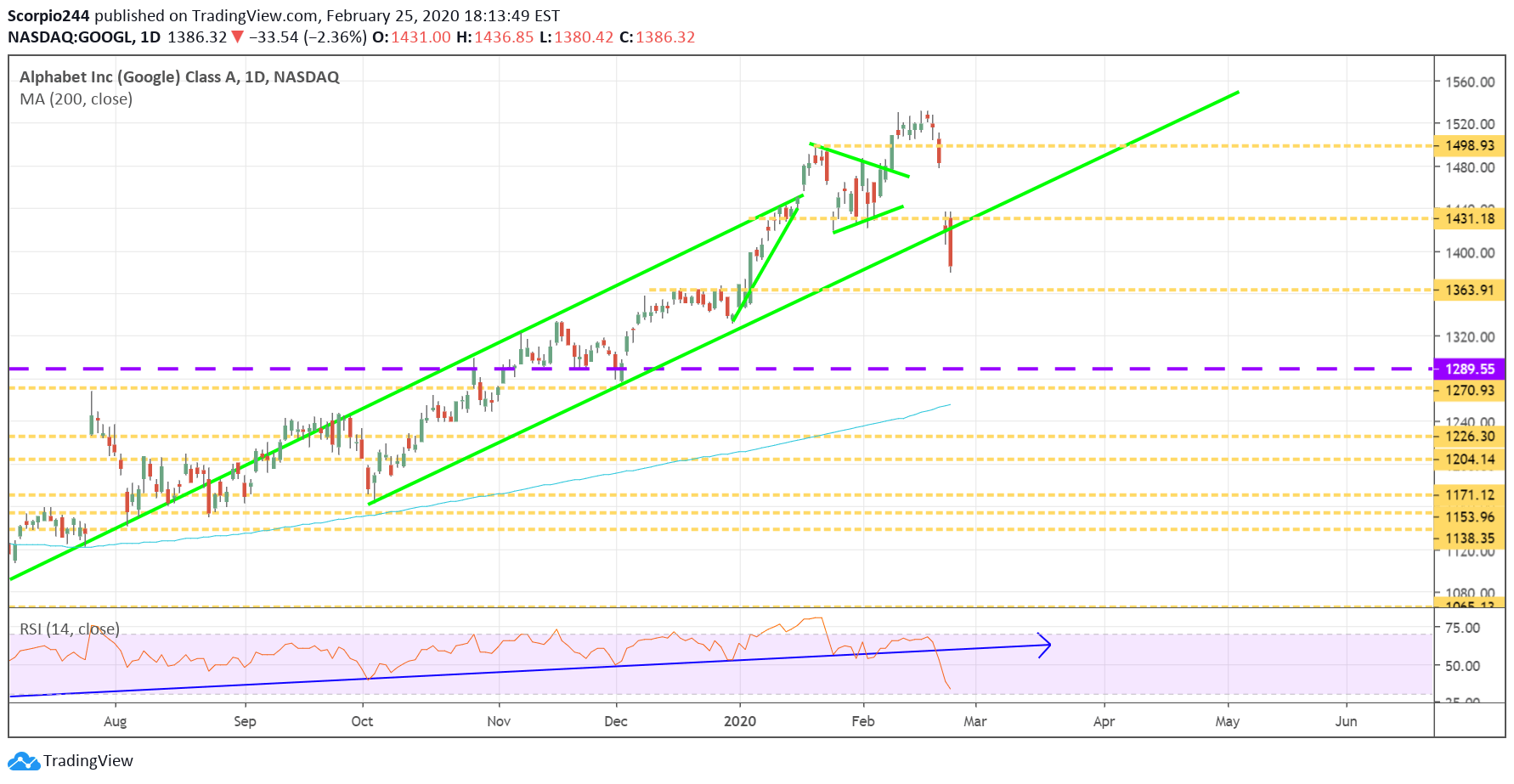

Alphabet (GOOGL)

Alphabet (NASDAQ:GOOGL) broke the uptrend, and that means the stock may fall to around $1360.

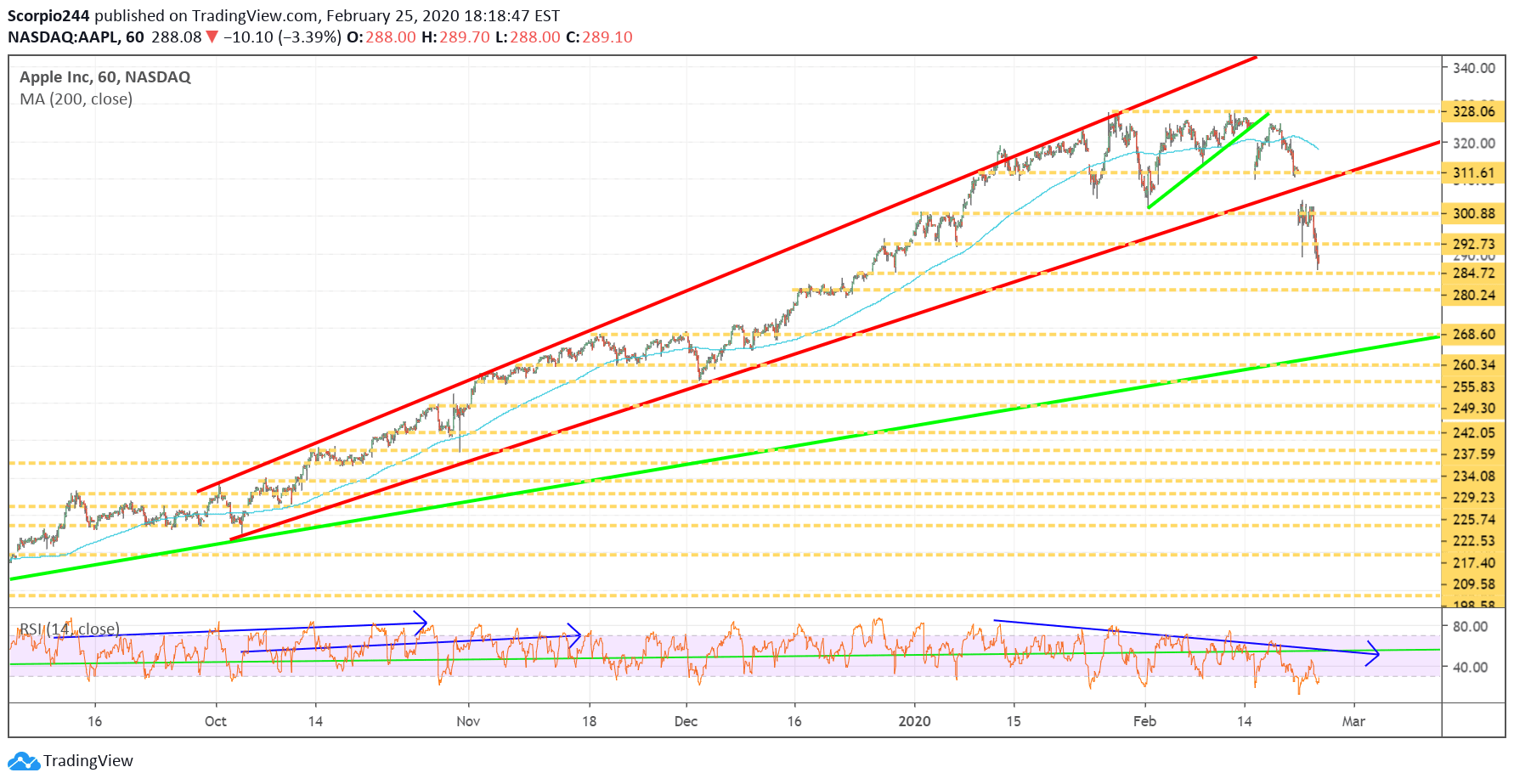

Apple (AAPL)

Apple (NASDAQ:AAPL) managed to find a small region of support around $285. The $290 level is likely to act as resistance for now.

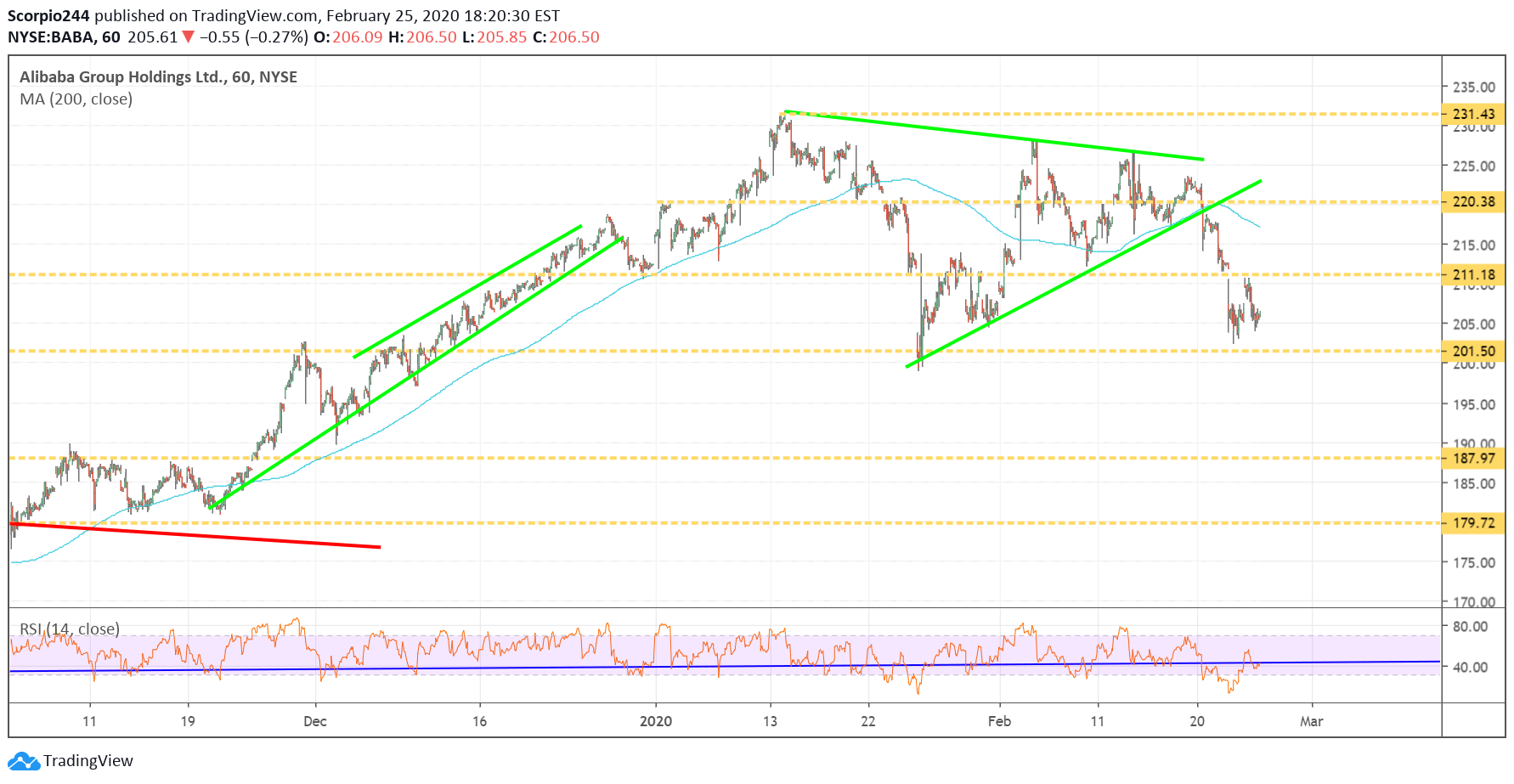

Alibaba (BABA)

Alibaba (NYSE:BABA) appears to be at a healthy level of support just above $201, and I think it rebounds to roughly $211.