5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Ashland Inc (NYSE:ASH)

Ashland, ASH, rose from a low in February to a peak in July. It pulled back from there and made another higher top in September before starting a move lower through its 200 day SMA. That found a bottom in November and bounced. The price then started to bounce and making a higher high before falling back again. Coming into the week the bottom may be in again as it printed a strong candle Friday. The RSI is turning back up but with the MACD falling. Look for a continuation Tuesday to participate to the upside…..

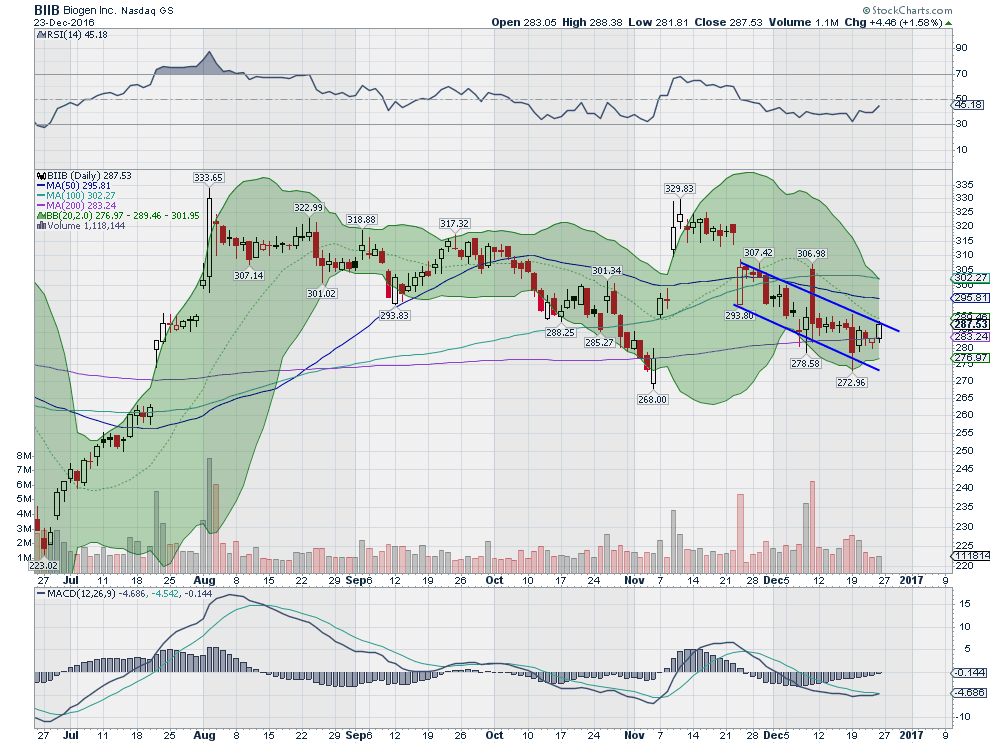

Biogen (NASDAQ:BIIB)

Biogen, BIIB, broke up out of a falling channel in November and settled into a plateau. But it quickly fell out of that and started a new falling channel, leaving an Island Top behind. But Friday saw a strong move higher to the top of that channel. The RSI is turning up and the MACD about to cross up. Look for a push over the top of the channel to participate in the upside…..

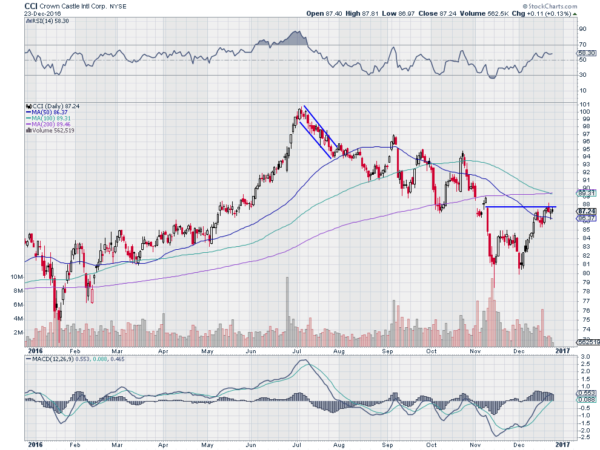

Crown Castle International (NYSE:CCI)

Crown Castle, CCI, moved higher starting in March and accelerating in June to a climax high. It pulled back from there, in a tight channel at first to the 50 day SMA. Then in a more choppy fashion to a low at in November. A small bounce and retest of the low followed before a move up, establishing a double bottom. Now it is at resistance with a RSI holding just under the bullish zone and a MACD rising. Look for a push higher to participate…..

Monster Beverage (NASDAQ:MNST)

Monster Beverage, MNST, fell from a top in August in 2 steps, finding support in November almost 25% lower. The stock bounced from there and rose to the gap area on the second down leg before falling back. This was to a higher low and then it reversed back up again. Now it is at the resistance level again. The RSI is rising and on the edge of a move into the bullish zone while the MACD is rising and bullish…..

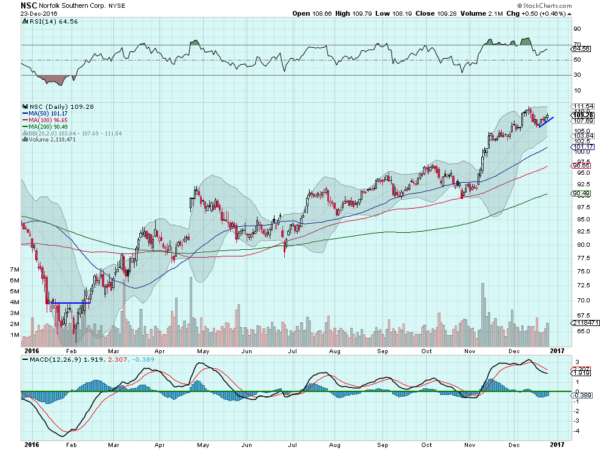

Norfolk Southern (NYSE:NSC)

Norfolk Southern, NSC, had a great 10 month run in 2016, coming into the week up 60% from the February low. After the election it moved higher rapidly for a 2 weeks and has settled and slowed since. Last week saw a resumption of the move higher. The RSI is bullish and rising after working off an overbought signal, while the MACD is stopping its fall. Look for continued upside to participate higher…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the holiday shortened last week of the year sees the equity markets looking strong longer term and consolidative in the short term.

Elsewhere look for Gold to continue lower while Crude Oil consolidates with an upward bias. The US Dollar Index is strong and looks to move higher while US Treasuries continue to be biased lower. The Shanghai Composite and Emerging Markets are biased to the downside with the Chinese market looking more like a digestive move rather than the breakdown in Emerging Markets.

Volatility looks to remain subdued and at very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all suggest further short term consolidation or even minor pullbacks may occur but within longer term strength. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.