Abbott Laboratories (NYSE:ABT)

Abbott Labs, $ABT, started higher off of a bottom in January. It moved higher quickly, reaching the prior top from August by the end of February. Since then it has pulled back to a higher low and has been consolidating. Friday it had a strong move higher to short term resistance. It has a RSI that is rising and into the bullish zone while the MACD is crossed up and rising. Look for a push over resistance to participate higher…..

Baidu Inc (NASDAQ:BIDU)

Baidu, $BIDU, has been in a series of symmetrical triangles, the shortest dating back to early 2016. After a higher low in March the price is back at the top of the triangle heading into the week. The RSI is in the bullish range while the MACD is rising with the Bollinger Bands® turned higher. Look for a break of the triangle to participate higher…..

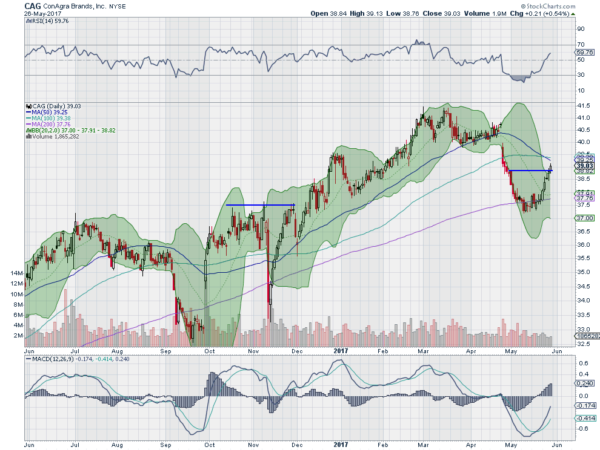

ConAgra Foods Inc (NYSE:CAG)

Conagra, $CAG, rose from a low in September last year, breaking resistance in December. It continued higher to a top in March before a pullback. That found support under the 200 day SMA, a higher low, and reversed higher. It continued up last week as the Bollinger Bands® squeezed in. It enters the week over short term resistance and near a break of the 50 day SMA with the RSI rising and bullish and the MACD moving higher. Look for a push higher to participate to the upside…..

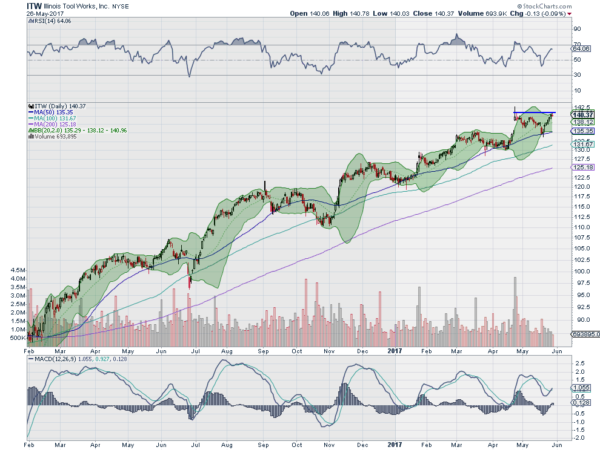

Illinois Tool Works Inc (NYSE:ITW)

Illinois Tool Works, $ITW, has been trending higher since the February 2016 low. It has pulled back to the 100 day SMA a couple of times and recently has been finding support at the 50 day SMA. It gapped higher at the end of April but has been consolidating since then. Two weeks ago it touched that 50 day SMA again and is now back at the top of the consolidation zone. The RSI is in the bullish zone and the MACD crossed and rising. Look for a new high to participate to the upside…..

Packaging Corporation of America (NYSE:PKG)

Packaging Corporation of America, $PKG, has also been trending higher since the February 2016 low. It has made a couple of consolidations along the way, the one ending in late April. That is when it started higher, to the current consolidation zone. Last week it pushed up off of the 20 day SMA and is back near resistance. It has a RSI that is in the bullish zone and rising while the MACD is level after a pullback, and remains positive. Look for a new high to participate higher….

Up Next: Bonus Idea

If you like what you see sign up for more ideas and deeper analysis using the Market Macro picture reviewed Friday which heading into the unofficial beginning of summer sees equities looking strong.

Elsewhere look for Gold to consolidate with a bias higher while Crude Oil consolidates with a bias lower. The US Dollar Index is in a downtrend while US Treasuries consolidate with a bias higher. The Shanghai Composite has stalled the retrenchment and is consolidating while the Emerging Markets continue to move higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). The SPY and QQQ are showing strength on both the daily and weekly timeframes while the small cap IWM is already running out of gas. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.